Franklin Templeton’s digital assets division recently delved into the realm of Bitcoin-based NFTs, shedding light on the potential of Ordinals in propelling innovation within the Bitcoin ecosystem. While recognizing the positive momentum Ordinals bring, the asset manager also emphasized associated risks, cautioning investors against potential losses.

Bitcoin Ordinals Fuel Innovation in Bitcoin Space

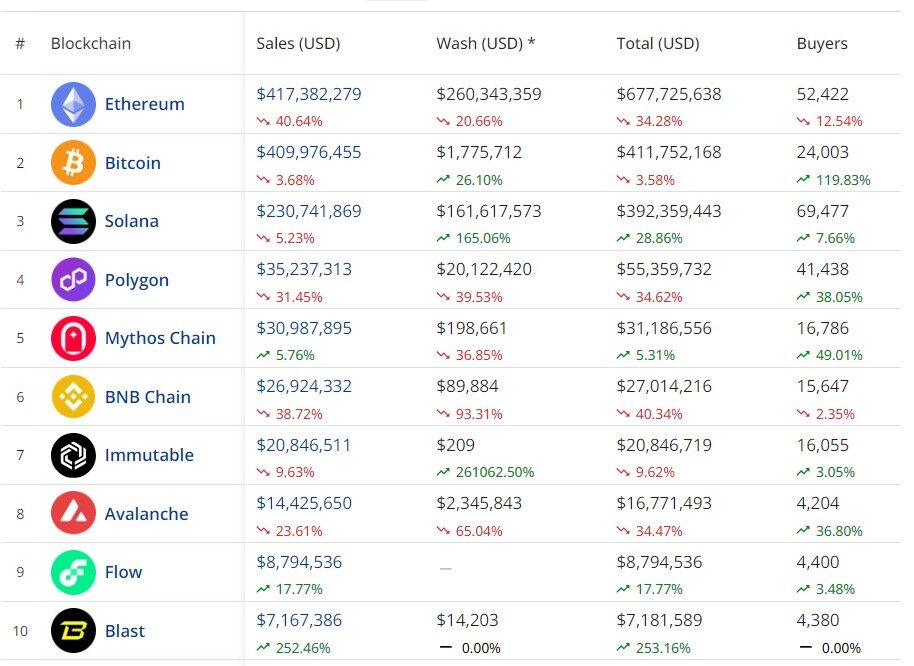

Franklin Templeton Digital Assets highlighted the significant role of the Bitcoin Ordinals protocol in sparking a renaissance of activity within the Bitcoin market over the past year. This surge in innovation is attributed to various factors, including the emergence of new fungible token standards like BRC-20 and Runes, the development of Bitcoin-based layer-2 networks, and the rise of Bitcoin decentralized finance (DeFi) primitives. Notably, the company underscored the accelerating pace of activities within the Bitcoin NFT space, with Ordinals witnessing a surge in trading volume. Collections such as NodeMonkes, Runestone, Bitcoin Puppets, Ordinal Maxi Biz, and Bitmap were cited as examples dominating the NFT ecosystem in terms of trading volume and market capitalization.

Read more: Bitcoin Poised for Record High as GBTC Outflows Decline to $170M

Mitigating Risks in Bitcoin Ordinals Investment

Despite the optimism surrounding Ordinals, Franklin Templeton cautioned investors about associated risks. The asset manager emphasized that Ordinals, like any investment, could lose value and are not insured by institutions such as the Federal Deposit Insurance Corporation. Moreover, the firm reminded investors of the inherent risks in digital assets due to their immature and rapidly evolving nature, as well as the vulnerabilities inherent in their technology. Franklin Templeton reiterated its commitment to informing investors about potential risks associated with digital assets, underscoring the importance of thorough risk assessment before investment decisions.

Conclusion

As Franklin Templeton continues to explore various niches within the crypto space, its recent focus on Bitcoin Ordinals underscores the growing significance of innovation within the Bitcoin ecosystem. While recognizing the potential for positive momentum, the firm remains vigilant in highlighting associated risks, emphasizing the need for investors to exercise caution and conduct thorough risk assessments. In a rapidly evolving landscape, understanding both the potential rewards and risks is essential for informed investment decisions in the digital asset space.

![Best Crypto Exchanges for Day Trading [currentyear] - Top 6 Platforms 11 Best Crypto Exchanges For Day Trading](https://coinwire.com/wp-content/uploads/2023/10/best-crypto-exchanges-for-day-trading-1024x683.jpg)

![Best Free Crypto Sign Up Bonus Offers & Promotions in [currentyear] 12 Best Free Crypto Sign Up Bonus And Promotion](https://coinwire.com/wp-content/uploads/2023/08/free-crypto-sign-up-bonus-1024x683.jpg)