In a shocking turn of events, the $400 million hack that rocked cryptocurrency exchange FTX in the hours following its bankruptcy filing in 2022 has now been linked to a SIM swap attack. Three individuals – Robert Powell, Carter Rohn, and Emily Hernandez – face charges from U.S. federal prosecutors for orchestrating a series of SIM swap attacks, manipulating telecom providers, and allegedly stealing the identities of 50 victims.

The SIM Swap Scheme Unveiled

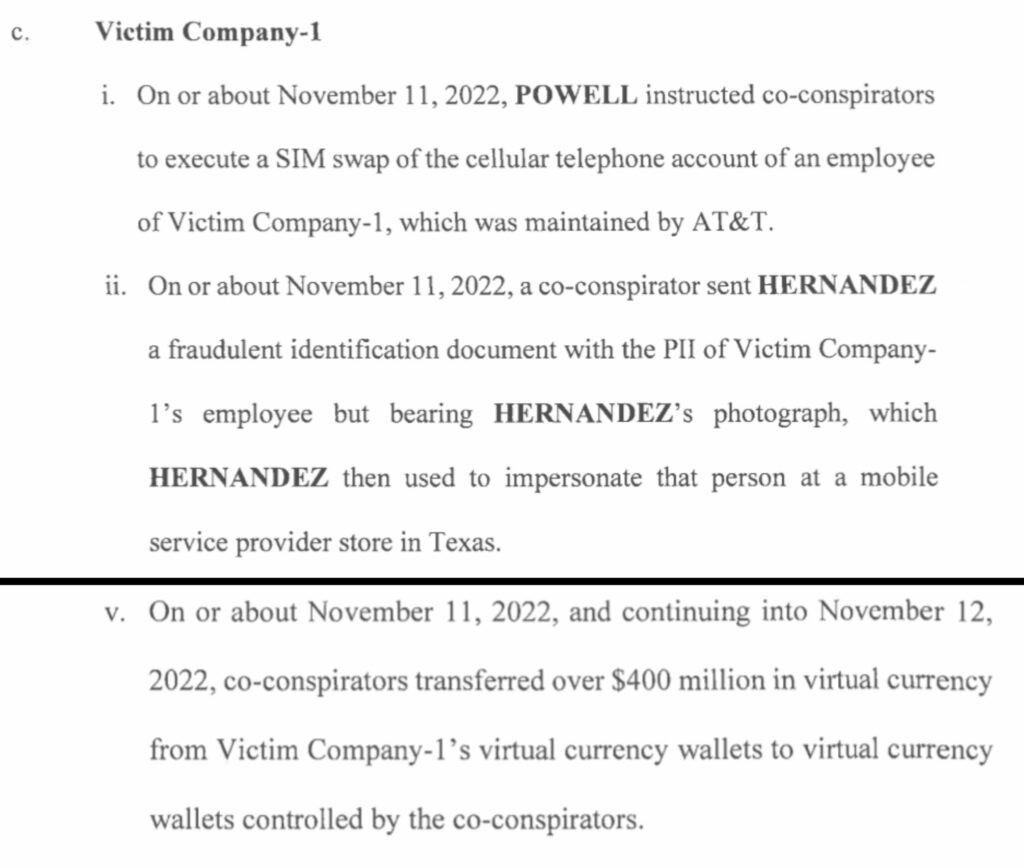

According to a January 24 filing in a Washington, D.C. District Court, prosecutors outlined how Powell, Rohn, and Hernandez executed SIM swap attacks by convincing telecom providers to port victims’ numbers to the trio’s phones. The indictment mentions an attack on “Victim Company-1,” which, as per a February 1 blog post from blockchain security firm Elliptic, is believed to be FTX. During this incident, Hernandez allegedly impersonated an employee, enabling Powell to access the company’s AT&T account and transfer over $400 million in virtual currency out of crypto wallets.

Initially raising suspicions of an inside job, the $400 million hack occurred just hours after FTX filed for bankruptcy. The incident left many in the cryptocurrency community baffled, but the recent charges shed light on the sophisticated SIM swap attack orchestrated by Powell, Rohn, and Hernandez.

Read more: FTX Founder Sam Bankman-Fried Found Guilty On All 7 Charges: 115 Years In Prison

FTX’s Post-Hack Challenges

FTX CEO and restructuring chief John J. Ray III revealed the challenges faced by the exchange in the aftermath of the hack. He cited poor security and a lack of proper systems as major hurdles when taking over post-bankruptcy. This vulnerability likely made FTX an attractive target for the alleged SIM-swapping trio. The funds moved through various bridges and blockchains in an attempt to launder the stolen crypto, which also involved transactions with the crypto exchange Kraken.

After successfully siphoning off the funds, the attackers utilized different bridges and blockchains to move the pilfered crypto, attempting to cover their tracks. The elaborate laundering process added a layer of complexity to the investigation, highlighting the challenges faced by authorities in tracing and recovering stolen cryptocurrency.

Read more: Binance Faces Class-Action Lawsuit Over Alleged Role in FTX Collapse

Conclusion

The FTX $400 million hack, initially shrouded in mystery, now unravels as a result of federal charges connecting the incident to a SIM swap attack. The case underscores the growing threat of such cybercrimes within the cryptocurrency space and emphasizes the need for robust security measures to safeguard digital assets. As the legal proceedings against Powell, Rohn, and Hernandez unfold, the aftermath of the FTX hack serves as a stark reminder of the ongoing challenges faced by the crypto industry in combating sophisticated cyber threats.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 8 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 9 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)

![Cardano vs Solana ([currentyear]): Is Cardano or Solana better? 10 Cardano Vs Solana Featured Image](https://coinwire.com/wp-content/uploads/2023/06/cardano-vs-solana-featured-image-1024x683.jpg)

![Paybis Review ([currentmonth] [currentyear]): Is It Safe and Legit? 11 Paybis Review Featured Image](https://coinwire.com/wp-content/uploads/2024/05/paybis-review-featured-image-1024x683.jpg)