FTX, the once-prominent exchange that faced bankruptcy and legal challenges, has unveiled its reorganization plan to settle a complex array of claims. The proposed plan aims to categorize claimants into specific classes and sets the stage for the collapsed exchange to potentially operate as an offshore entity. The plan outlines various pools for recovery and addresses the contentious issues surrounding assets, including FTT Token holders’ compensation.

FTX’s Reorganization Plan and Claim Categorization

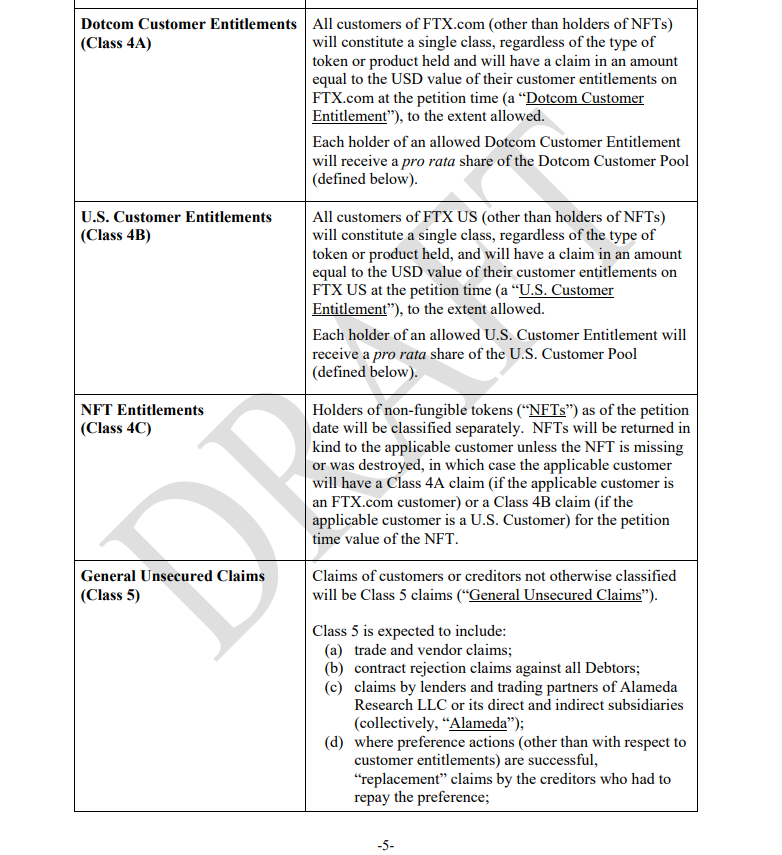

Their recently filed documents detail a draft plan of reorganization to address the extensive collection of claims from various parties. The plan includes 13 different classes of claims, including FTX.com customer entitlement claims, U.S. customer claims, non-fungible token (NFT) customer claims, and more. The proposed global settlement involves evaluating claims in U.S. dollars through a methodology prepared by FTX, pending approval by the bankruptcy court. Disputes over assets held on FTX.com and its US exchanges are also under consideration.

Read more: FTX Subpoenaed by Terraform Labs in Terra/Luna Short-Selling Legal Battle

Compensation and the Path to Resurrection

As part of the reorganization plan, the exchange aims to identify three primary recovery pools associated with FTX.com customers, its US customers, and assets not attributable to the defunct exchange arms. Notably, NFT holders will have their separate classification, with a provision for their returns unless the NFTs were lost or destroyed. In such cases, their claims would be adjusted accordingly. Additionally, the exchange acknowledges “shortfall” claims by the exchange organizations against a pool of general assets to compensate for unauthorized borrowing and misappropriation of assets by former CEO Sam Bankman-Fried and associates.

Conclusion

FTX’s proposed reorganization plan marks a pivotal step in the exchange’s journey toward potential resurrection. By categorizing claims and outlining recovery pools, they aim to address the complexities surrounding bankruptcy and legal challenges. The plan’s mention of a potential offshore exchange hints at new possibilities for specific creditors, and the liquidation of the exchange’s estates signals a commitment to payout distributions to customers and creditors. As the collapsed exchange navigates its path to restructuring, the crypto community awaits the resolution of this high-profile case.

![Best Crypto Copy Trading Platforms in [currentyear] (Free & Profitable) 9 Best Crypto Copy Trading Platforms](https://coinwire.com/wp-content/uploads/2023/06/best-crypto-copy-trading-platform-1024x683.jpg)

![BingX vs KuCoin [currentyear]: Features, Fees, and Security 12 Bingx Vs Kucoin](https://coinwire.com/wp-content/uploads/2024/05/bingx-vs-kucoin-1024x683.jpg)