In a dramatic turn of events impacting the cryptocurrency landscape, Grayscale, the crypto asset manager, has emerged triumphant in its legal clash against the U.S. Securities and Exchange Commission (SEC). This decisive ruling by the U.S. District of Columbia Court of Appeals not only deals a blow to the SEC’s attempts to obstruct Grayscale’s Bitcoin spot ETF aspirations but also sends positive ripples through the market.

Legal Win Nudges Grayscale Closer to Bitcoin ETF

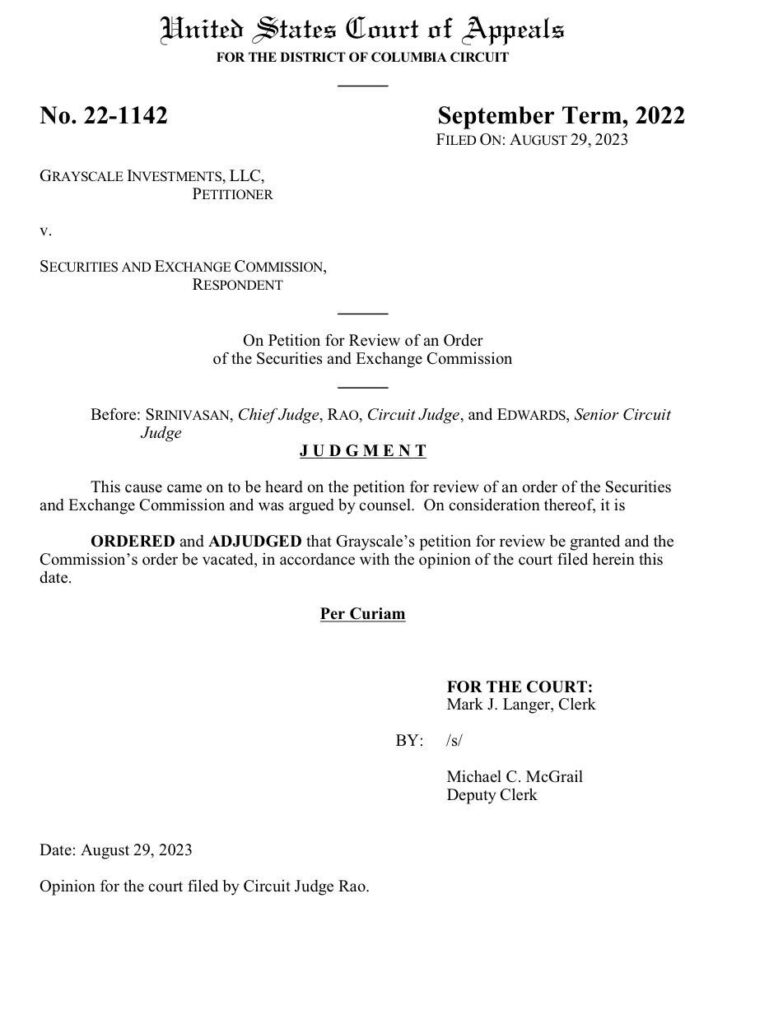

In a legal contest that has captured the attention of the cryptocurrency industry, Grayscale has secured a noteworthy legal victory against the SEC. The U.S. District of Columbia Court of Appeals’ ruling is a game-changer, as it overturns the SEC’s lawsuit, potentially propelling Grayscale toward the coveted status of a Bitcoin spot exchange-traded fund (Bitcoin ETF). While this decision doesn’t instantaneously convert Grayscale’s flagship product, the Grayscale Bitcoin Trust (GBTC), into an ETF, it undeniably marks a pivotal step forward.

Prominent ETF expert James Seyffart from Bloomberg underscores the significance of this legal triumph, highlighting that it nudges Grayscale closer to realizing the sought-after ETF status for Bitcoin. The court’s decision to nullify the SEC’s refusal to greenlight GBTC’s transformation into an ETF serves as an invitation to explore further advancements and discussions in the dynamic cryptocurrency market.

Bitcoin Rebounds on Grayscale’s Legal Victory

The repercussions of the legal win resonate powerfully throughout the cryptocurrency market. Bitcoin, the market leader, experienced an immediate surge of over 4% in response to the legal breakthrough, currently trading at $27,534 and marginally exceeding its 200-day Moving Average (MA). Initial concerns about the MA impeding Bitcoin’s recovery seem quelled as the recent legal developments invigorate the cryptocurrency, propelling it beyond the $27,000 threshold to briefly touch $27,877.

For Bitcoin to sustain its rebound, maintaining the $27,000 level and avoiding a dip below the moving average is critical. Establishing the MA as a reliable support level offers a buffer against short-term price fluctuations and potentially positions Bitcoin for another assault on the formidable $28,000 resistance.

Conclusion

Grayscale’s victory against the SEC reverberates as a resounding win for both the company and the broader cryptocurrency market. In a climate marked by regulatory crackdowns, this legal triumph represents a much-needed boost of confidence. The ruling sets a positive precedent that has the potential to rekindle faith in the market and reverse the recent trend of liquidity outflows. As Grayscale inches closer to an ETF designation, the entire industry watches intently, anticipating the continued impact of this legal milestone on the trajectory of Bitcoin and beyond.

![Best Crypto Exchanges for Day Trading [currentyear] - Top 6 Platforms 11 Best Crypto Exchanges For Day Trading](https://coinwire.com/wp-content/uploads/2023/10/best-crypto-exchanges-for-day-trading-1024x683.jpg)

![Best Free Crypto Sign Up Bonus Offers & Promotions in [currentyear] 12 Best Free Crypto Sign Up Bonus And Promotion](https://coinwire.com/wp-content/uploads/2023/08/free-crypto-sign-up-bonus-1024x683.jpg)