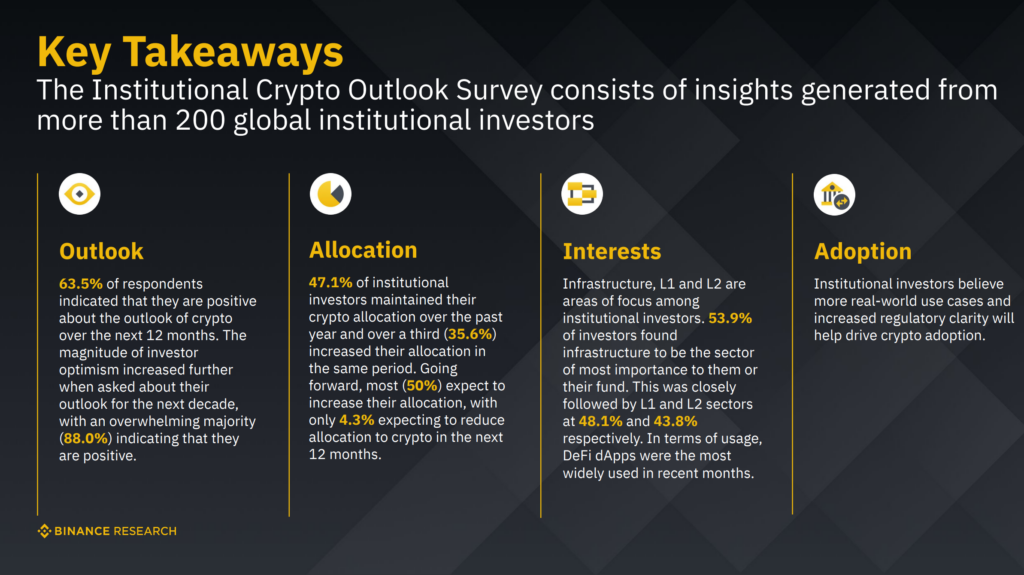

Institutional Crypto Outlook Survey – A recent survey conducted by Binance Research, involving over 200 global institutional investors, provides valuable insights into their perspectives on the cryptocurrency market. The results reveal a prevailing optimism among institutional investors regarding the future of crypto, as well as their investment strategies, interests, and concerns. This article summarizes the key findings of the survey and highlights the growing bullish sentiment among these influential market participants.

Positive Outlook for Crypto

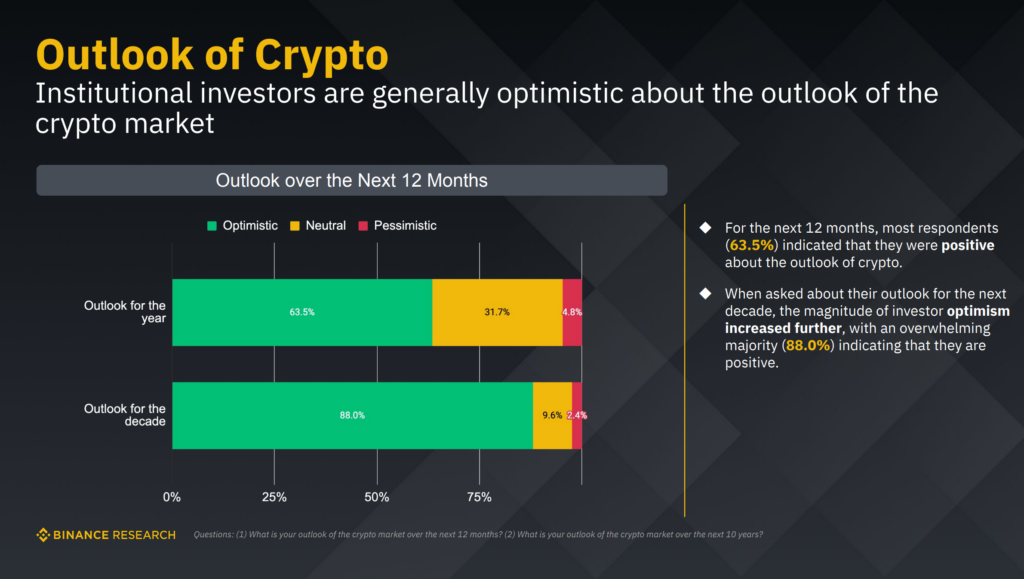

The survey indicates that a significant majority of institutional investors (63.5%) are positive about the outlook of cryptocurrencies over the next 12 months. This optimism intensifies when considering the next decade, with an overwhelming 88% indicating a positive long-term outlook. The findings suggest that institutional investors see immense potential in the crypto market and are confident in its sustained growth.

Allocation and Investment Strategies

Almost half of the respondents (47.1%) maintained their crypto allocation over the past year, while over a third (35.6%) increased their allocation during the same period. Looking ahead, the majority (50%) of institutional investors plan to increase their crypto allocation in the next 12 months, demonstrating a continued belief in the market’s potential. Remarkably, only a small fraction (4.3%) expects to reduce their crypto allocation.

Areas of Interest

Infrastructure emerged as the sector of greatest importance to institutional investors, with 53.9% considering it a top priority. Layer 1 (L1) and Layer 2 (L2) solutions followed closely, with 48.1% and 43.8% respectively.

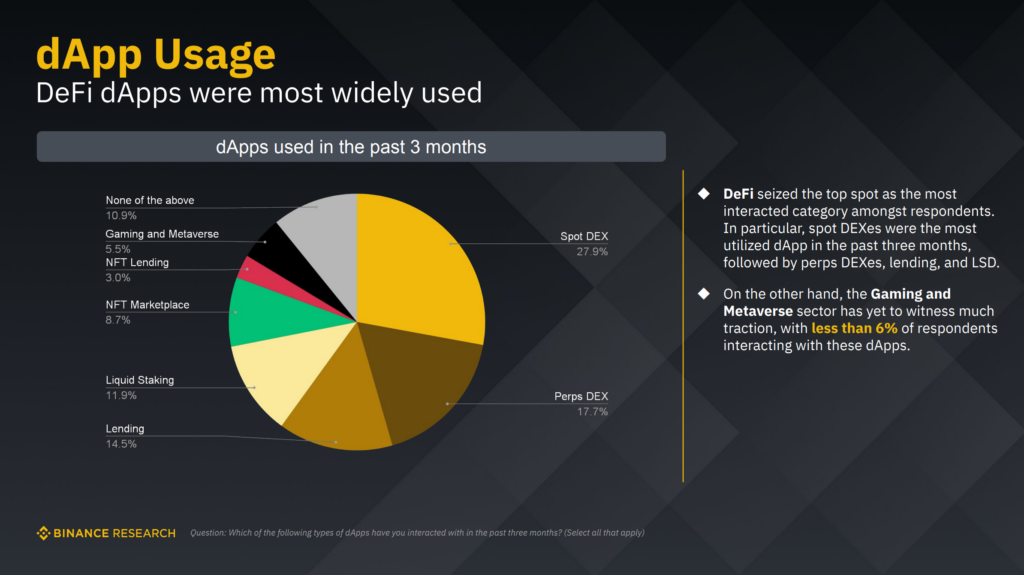

Additionally, decentralized finance (DeFi) decentralized applications (dApps) were the most widely used among institutional investors in recent months. These findings indicate that investors are focused on the technological foundations and innovations that support the growth and functionality of the crypto ecosystem.

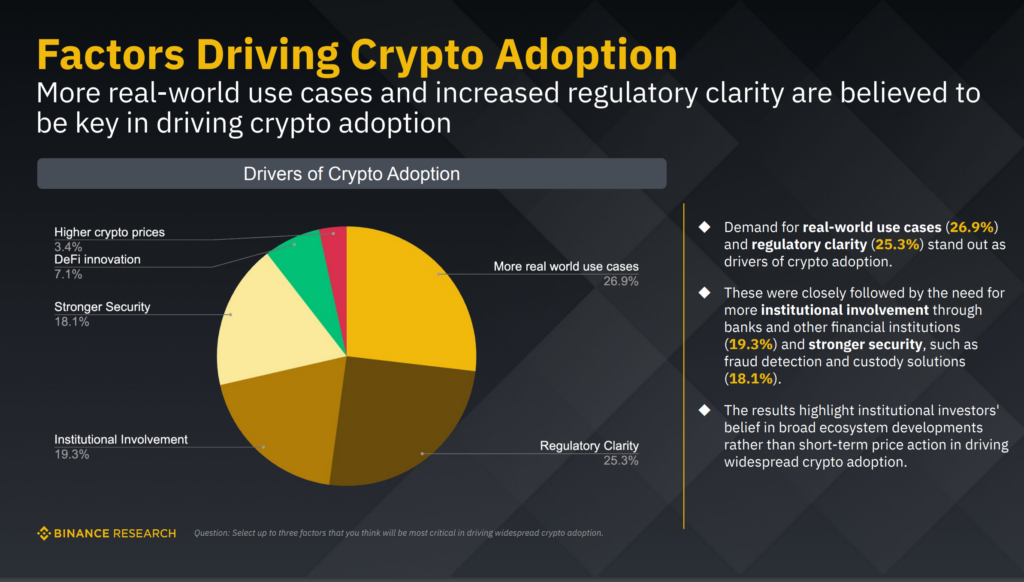

Driving Factors for Adoption

Institutional investors believe that real-world use cases and increased regulatory clarity are crucial for driving the widespread adoption of cryptocurrencies. According to the survey, 26.9% of respondents identified the demand for real-world use cases as a key driver, while 25.3% emphasized the importance of regulatory clarity.

The survey also highlighted the need for more institutional involvement through banks and financial institutions (19.3%) and stronger security measures (18.1%) as factors that would contribute to wider adoption.

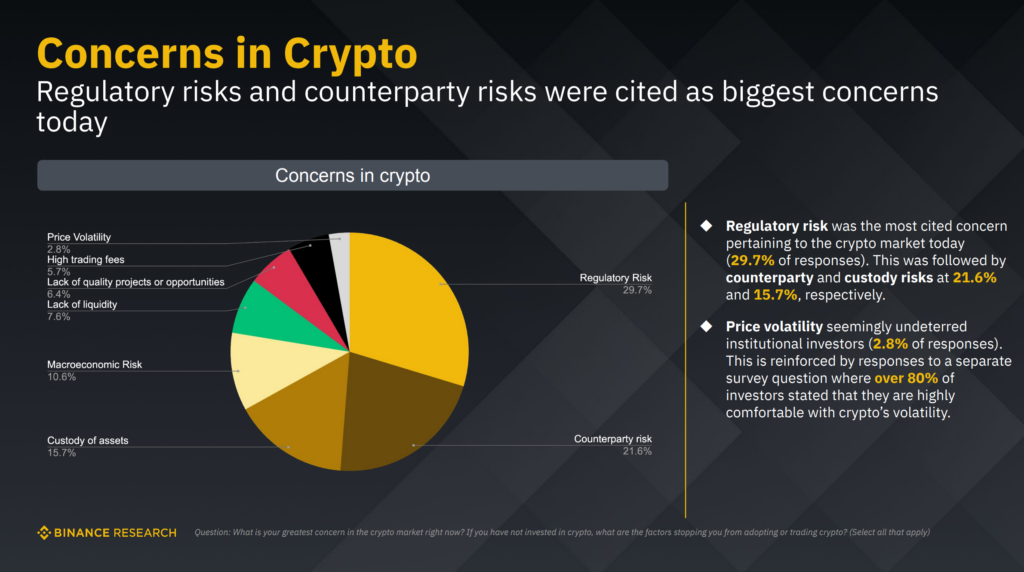

Concerns and Trading Preferences

Regulatory risks were cited as the greatest concern in the crypto market by 29.7% of respondents, followed by counterparty and custody risks (21.6% and 15.7% respectively). Interestingly, price volatility appeared to be less of a concern for institutional investors. The survey also revealed that centralized exchanges are the preferred trading venues for the majority (90.5%) of institutional investors, with decentralized exchanges and over-the-counter desks being less commonly used.

Positive Outlook for Crypto in the Short and Long Term

According to the Institutional Crypto Outlook Survey, a significant portion of institutional investors holds a positive outlook for the cryptocurrency market. The survey reveals that 63.5% of respondents indicated optimism about the prospects of crypto over the next 12 months. This indicates a favorable sentiment among institutional investors, suggesting that they expect the crypto market to perform well in the near future.

Furthermore, when asked about their outlook for the next decade, an overwhelming majority of 88.0% of institutional investors expressed positivity. This indicates that institutional investors have a long-term bullish view of the crypto market, expecting continued growth and development over the coming years.

Read more: Binance Embraces Bitcoin Lightning Network: A Solution to Scalability Challenges

These findings suggest that institutional investors have confidence in the potential of cryptocurrencies and believe that they can offer attractive opportunities for investment and growth. The positive outlook reflects the increasing acceptance and adoption of cryptocurrencies by traditional financial institutions and signals a growing belief in the long-term viability and value of digital assets.

For the full details of the survey, click here.

Conclusion

The survey results underscore the growing optimism among institutional investors regarding the future of cryptocurrencies. With a majority expressing positivity for both the short and long term, institutional investors are expected to increase their crypto allocations and remain focused on areas such as infrastructure, Layer 1, and Layer 2 solutions. Real-world use cases and regulatory advancements are considered pivotal for widespread adoption. While concerns regarding regulatory risks persist, institutional investors remain committed to the crypto market, emphasizing its potential for significant returns and exposure to emerging technologies.

![Best Crypto Copy Trading Platforms in [currentyear] (Free & Profitable) 27 Best Crypto Copy Trading Platforms](https://coinwire.com/wp-content/uploads/2023/06/best-crypto-copy-trading-platform-1024x683.jpg)

![BingX vs KuCoin [currentyear]: Features, Fees, and Security 30 Bingx Vs Kucoin](https://coinwire.com/wp-content/uploads/2024/05/bingx-vs-kucoin-1024x683.jpg)