JPMorgan Chase & Co., the largest U.S. bank, is exploring the development of a new digital currency aimed at streamlining international payments and settlements. The bank is contemplating the use of a blockchain-based deposit token, representing deposit claims, to achieve this goal. While much of the necessary infrastructure is in place, JPMorgan will proceed with the token’s creation pending approval from U.S. regulators. This expansion into blockchain builds upon JPMorgan’s existing system, JPM Coin, which has processed around $300 billion in transactions since its 2019 launch.

JPMorgan Blockchain-Powered Deposit Token for Instant Transactions

This new deposit token is poised to revolutionize cross-border payments by harnessing the power of blockchain technology, a decentralized ledger system that records and verifies transactions without the need for intermediaries like counterpart banks and clearinghouses. One of the key advantages of this technology is the potential for instant transactions, greatly reducing the time it takes for funds to move across borders. Furthermore, blockchain transactions have the potential to significantly cut transaction costs, as they eliminate the fees associated with traditional intermediaries. As a result, JPMorgan’s endeavor holds the promise of making international transactions more efficient and cost-effective for businesses and consumers alike.

Market Impact and Potential for Institutional Adoption

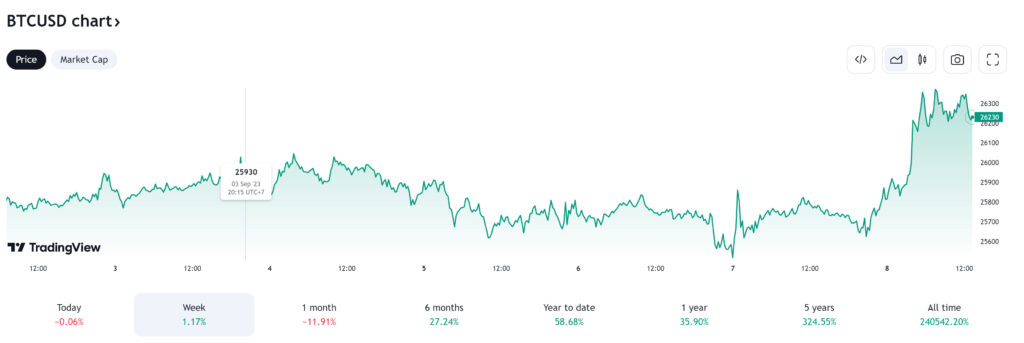

The news of JPMorgan‘s blockchain-based deposit token comes at a time when the cryptocurrency market is experiencing notable fluctuations. Bitcoin, the leading cryptocurrency, recently saw a 1.62% increase in its value within 24 hours, reaching above $26,000. This development has ignited optimism for increased institutional adoption of blockchain technology, as JPMorgan, a major player in the financial industry, takes steps toward blockchain-based payment and settlement systems.

While JPMorgan’s initiative is certainly promising, the crypto market is also eagerly awaiting a decision from the U.S. Securities and Exchange Commission (SEC) regarding another financial giant, BlackRock. BlackRock applied for approval to launch a spot Bitcoin exchange-traded fund (ETF) on June 15, and a favorable decision could have a significant impact on the market. If Bitcoin regains momentum, it could drive a rally that pushes prices back above the $30,000 threshold.

Read more: BlackRock Insiders: Bitcoin ETF Approval Could be Within 6 Months

Conclusion

JPMorgan’s exploration of a blockchain-based deposit token represents a noteworthy advancement in the financial sector’s adoption of blockchain technology. The potential for faster, more cost-effective international payments and settlements is an exciting prospect for businesses and individuals alike. As this project progresses, it underscores the growing significance of blockchain in modern finance, positioning itself as a key player in shaping the future of cross-border transactions. Additionally, the broader crypto market is on the lookout for regulatory decisions, which could further impact the trajectory of cryptocurrencies and blockchain adoption in the financial landscape.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 8 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 9 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)

![Cardano vs Solana ([currentyear]): Is Cardano or Solana better? 10 Cardano Vs Solana Featured Image](https://coinwire.com/wp-content/uploads/2023/06/cardano-vs-solana-featured-image-1024x683.jpg)

![Paybis Review ([currentmonth] [currentyear]): Is It Safe and Legit? 11 Paybis Review Featured Image](https://coinwire.com/wp-content/uploads/2024/05/paybis-review-featured-image-1024x683.jpg)