In the ever-evolving cryptocurrency industry, complying with taxation requirements becomes daunting. Investing in crypto requires you to report your financial gains and income when filing your yearly income taxes. However, with platforms like Koinly, a simplified process has emerged that provides comprehensive tax solutions for cryptocurrency investors and traders. In this Koinly review, we explore Koinly’s features, pricing structures, user experiences, and more, and how it can assist in streamlining your crypto tax obligations.

Koinly Review: Overview

Founded in 2018 by Robin Singh, Koinly has offices in the UK, US, Sweden, and Germany. Koinly is also available in over 20 countries, which include the UK, Canada, the US, New Zealand, and Australia. The platform allows you to import data through APIs and CSV files and generate reports that are downloadable as PDF files.

The main downloadable files include First In First Out (FIFO) and Last In First Out (LIFO) reports, Form 8949, Schedule D reports, and international tax reports. Koinly also offers its users a comprehensive online crypto tax auditing service that paves the way for them to connect with qualified tax accountants in their locality.

| Based in | London |

| Countries Supported | It is present in the US, UK, Canada, Australia, Sweden, Norway, Ireland, and 20+ countries for specialized tax report generation. For general tax reports, available for 100+ countries |

| Cryptocurrencies Supported | 6,000+ cryptocurrencies |

| Founded in | 2018 |

| Mobile Application | Available for both Android and iOS |

| Pricing | $0-$279 |

| Integration | 350+ exchanges, 50+ wallets |

| Official website | https://koinly.io/ |

What is Koinly?

Koinly mainly constitutes an online crypto tax platform that enables users to monitor all their crypto transactions and actions. Ultimately, it helps them generate regulatory-compliant tax reports.

The software is one way to integrate your wallets and exchanges, and it keeps track of every activity. Such activities may include trading, mining, staking, airdrops, or lending.

Additionally, Koinly simplifies keeping tabs on all the ins and outs, simplifying your recording process. You can also use it to import transactions, monitor all market prices and wallet transfers, and calculate your crypto gains/losses. From these, it then generates crypto tax reports.

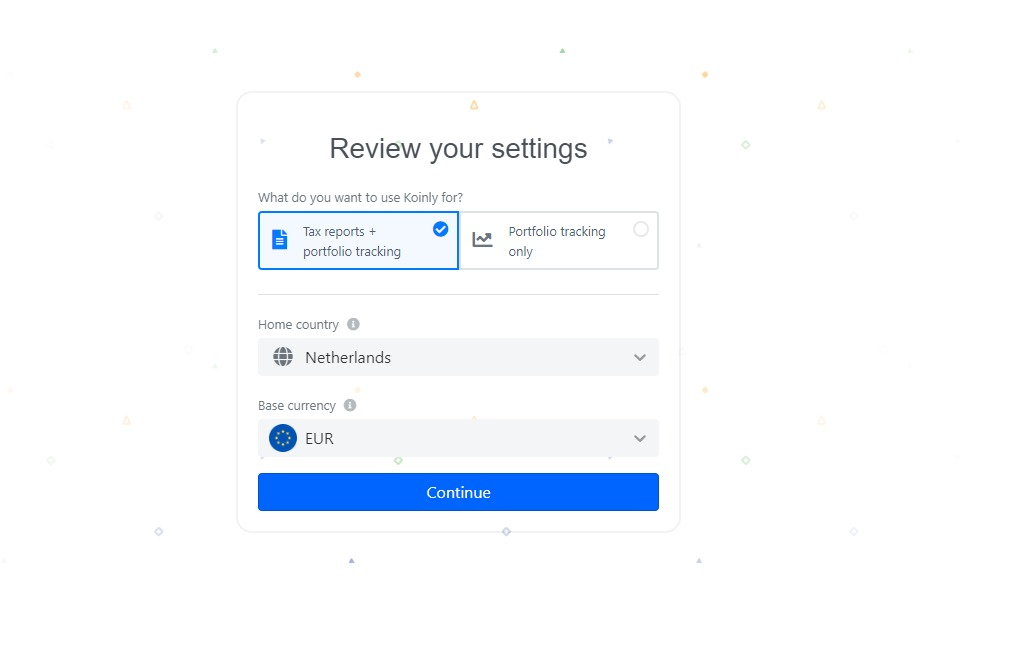

Koinly is currently available in more than 20 countries, allowing users to generate specialized tax reports that are tailored to local regulations and requirements. For users in countries that aren’t currently supported, Koinly is still able to provide general tax reports that are relevant to over 100 other countries.

How Does Koinly Crypto Tax App Work?

The Koinly Crypto Tax app revolutionizes how individuals and businesses handle cryptocurrency taxes by providing a streamlined and efficient solution. The functioning of Koinly is similar to that of an Excel sheet but better. It can calculate your taxes based on the information it gets more quickly and accurately. This is through the crypto software tool’s key feature: its automated data import functionality.

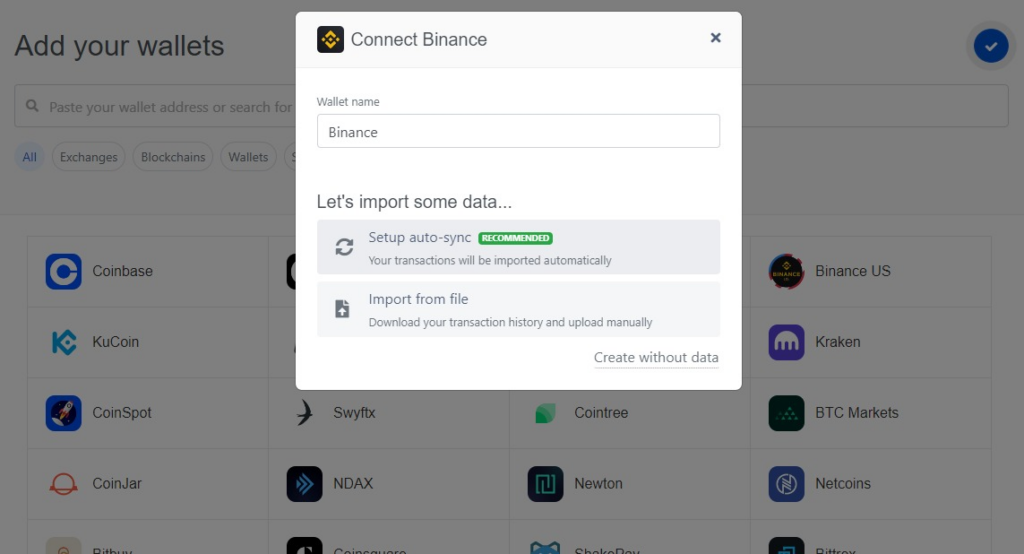

Koinly allows users to connect their cryptocurrency exchange accounts, wallets, and other platforms, which enables them to import transaction data automatically. This can be done by getting your API keys from your wallets or exchanges.

Once the transaction data is imported, Koinly employs sophisticated algorithms to calculate accurate tax obligations. The software takes into account factors such as capital gains, capital losses, cost basis, and holding periods to provide users with precise tax calculations.

Once you’ve completed your transactions, simply check to ensure that everything looks correct and matches the history of each capital gain transaction. This overview is available for everyone, including free plan users. By performing this task, Koinly is able to act as a portfolio tracker, providing valuable insights into the assets held across all of your exchanges and wallets.

During reporting, Koinly offers several tax optimization strategies to help you minimize your tax liabilities, like tax-loss harvesting.

After calculating the taxes, Koinly generates comprehensive tax reports. The reports summarize the user’s crypto transactions, capital gains, and losses.

To file your taxes, you must export complete tax reports generated by Koinly, which requires you to pay for one plan. This can be done manually or through other tax software like TurboTax. Koinly can produce various tax forms, including Form 8949 and Schedule D. If you are a U.S. citizen, Koinly can generate a filled-in IRS tax form.

Koinly Review: Features

The platform brings in some key features that include:

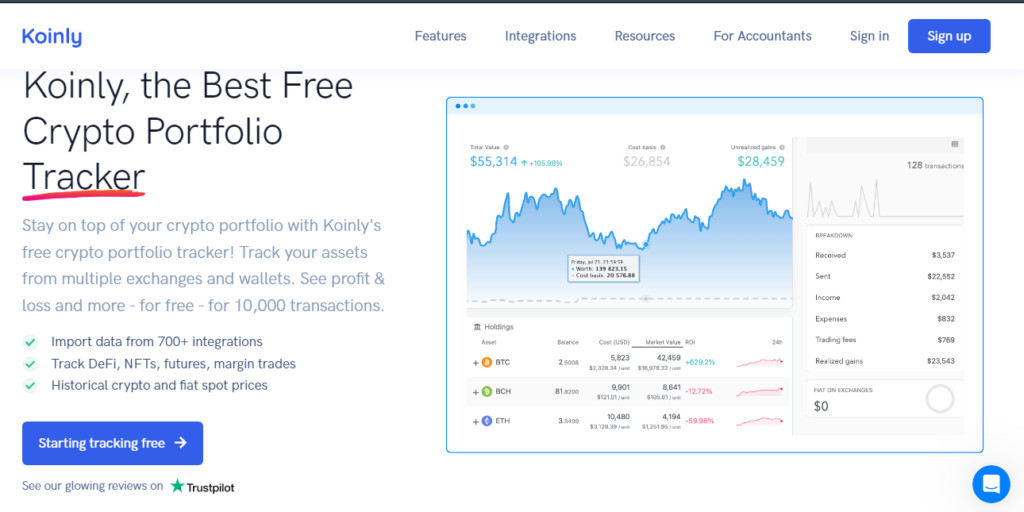

Portfolio Tracking

On your Koinly dashboard, you can see your portfolio value, holdings, performance by holding, and transactions made in a sleek overview. With the portfolio tracking feature, you are able to see your actual return on investment (ROI) and the invested capital. You also get to see your income from mining, staking, lending, and other crypto gains.

With Koinly’s portfolio tracking functionality, you can view your realized and unrealized income.

Compared to other robust portfolio trackers, its dashboard is, in a way, minimal. Even so, having Koinly as a portfolio tracker is still essential, as it can assist you in spotting transaction discrepancies or instances where you are missing particular transactions.

Data Import

With support for over 300 exchanges and wallets, Koinly allows you to effortlessly import your transaction history, saving you valuable time and effort. Imported data may be from

- Margin and Futures Trading: Such trading mainly occurs in exchanges like Binance and Kraken. When you trade in a connected exchange, Koinly can record the transactions, gains, and losses.

- Staking, Lending, and DeFi: These transactions are recorded from crypto lending platforms such as Blockfi, Nexo, Celsius, etc.

Transactions are generated when you link your accounts through the API, adding your BTC wallets using x/y/zpub keys and ETH tokens with your public address. Koinly utilizes AI functionalities to detect transfers within your wallet. As such, it excludes it from tax reports.

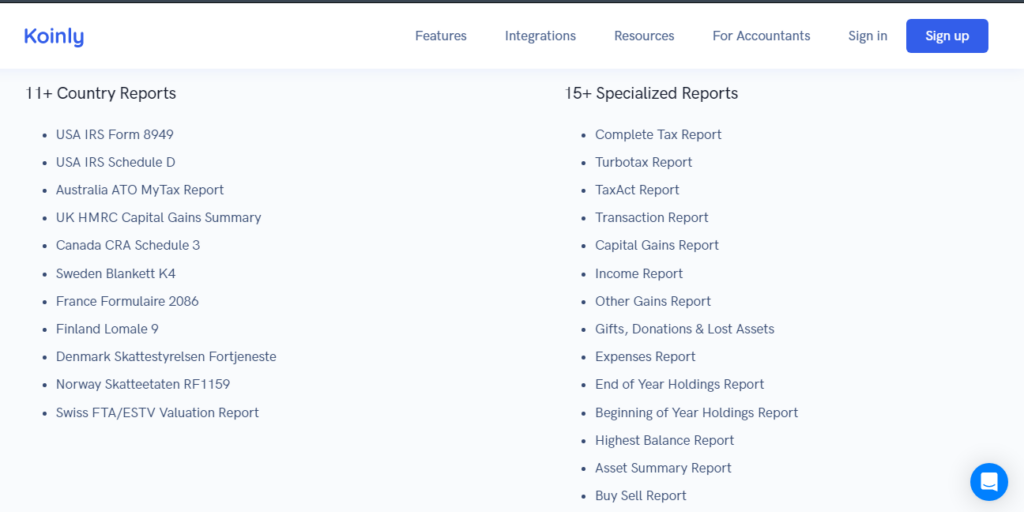

Crypto Tax Reports

Koinly complies with different tax laws in various jurisdictions during tax report generation. You can generate Form 8949 if you are filing in the US. In other countries, you have the choice between the methods and tax forms they produce, including:

- Complete Tax Reports: They bring in your gain summary, margin gains and offset capital gains transactions, asset summary, income, and end-of-year balances. They are downloadable as PDFs.

- Transaction Reports: Are usually reports that comprise all your transactions, downloadable as a CSV.

- Capital Gains Reports: They usually have all your disposals and a CSV.

- Income Report: A CSV having all your income transactions, which include gains from airdrops, forks, interest, and staking rewards.

- Expense Reports: A CSV that has all transactions labeled as a Cost.

- TurboTax Reports: A CSV with transactions easily imported into the TurboTax tax software.

- End of Year Holding Reports: A CSV having your assets at the end of the year.

- Gifts, Donations, Lost Asset Reports: A CSV containing all transactions labeled as a gift, a donation, or a loss.

Error Reconciliation

When importing transaction data from exchanges and wallets, it is common for you to make errors that may lead to inconsistencies in your data. With Koinly’s Error Reconciliation feature, you are able to identify and resolve discrepancies or mistakes in your cryptocurrency transaction data. It ensures the imported data’s accuracy and integrity, providing you with confidence in your financial records.

When Koinly identifies the discrepancies, it provides users with a clear overview of the errors and suggests possible solutions to reconcile the data. Koinly does this through a double-entry ledger system, where any change in your asset balances is backed by an entry, which may make it easy for you to debug issues.

Koinly also highlights errors that may arise due to missing transactions or data that is wrongly imported. The software tool checks the wallets through the API, ensuring that the imported data is correct. It also skips duplicate transactions.

Tax-Loss Harvesting

Tax-loss harvesting mainly occurs when you sell at a loss to balance the amount of capital gains tax owed from selling profitable assets. Crypto tax-loss harvesting is a good investment strategy that reduces your tax bill for a tax year, saving you more money when filing taxes. The process involves selling securities to realize a loss that you then apply against several capital gains in your portfolio. When you sell an asset, you purchase the same asset to maintain your portfolio composition.

You can use the tax-loss harvesting strategy by using Koinly, as it has a tax calculator that assists you in tracking all of your capital gains and losses per asset. With Koinly tax loss harvesting, you can tell which coins you can sell and how much you get in losses.

However, it is essential to note that Koinly is still integrating its independent tax-tool harvesting calculator. In its place, Koinly can show your unrealized capital gains and losses on your dashboard.

Koinly Review: Tax Software Integration

The choice of a crypto tax platform may depend on whether the tax software can import your transactions to the platform of your choice. Koinly can easily integrate with tax software that includes TurboTax and TaxAct.

With Koinly TurboTax, you can prepare and e-file your tax returns virtually, as long as you can access the internet. Also, Koinly’s TaxAct assists you in preparing and filing your tax returns yourself.

Koinly Review: Pricing

Koinly provides a range of plans formulated to care for all crypto investors and traders at different levels. The rate you may pay depends on the number of transactions you aim to accomplish and the services provided. The pricing plans differ as follows:

- Free Plan: You can utilize this plan extensively, allowing you to track your activities, including trades and accounts, and generate a capital gains report and tax preview. With the free program, you can access FIFO and LIFO tax reports. You can also import data from various sources and contact the team through live chat and email.

- The Newbie Account: The plan costs $49 annually, enabling you to generate FIFO and LIFO tax reports. You will also be able to produce international tax reports and comprehensive audit reports. With this plan, you can access Form 8949, and Schedule D reports. It allows you to export data to TurboTax and TaxAct. The downside to this plan is that it only allows up to 100 transactions.

- The Hodler Account: This Koinly pricing plan costs $99 per year, providing a similar range of features as the Hodler account. However, this plan has increased the transaction limit, with the limit running to about 1000. Additionally, with this plan, you have access to priority support.

- The Trader Account: Costs $179 per year for up to 3,000 transactions and $279 for up to 10,000 transactions. This plan provides access to the entire range of features that Koinly offers. Such services include priority support and can produce custom reports.

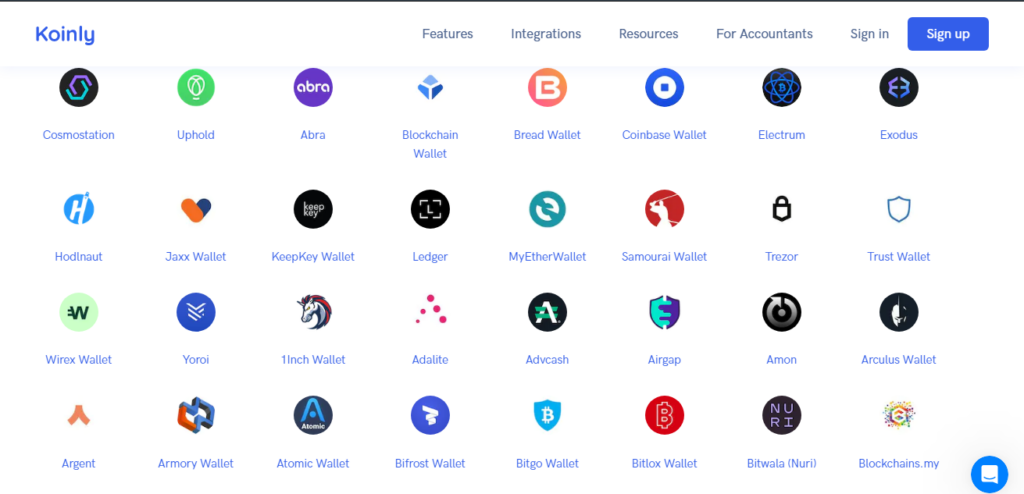

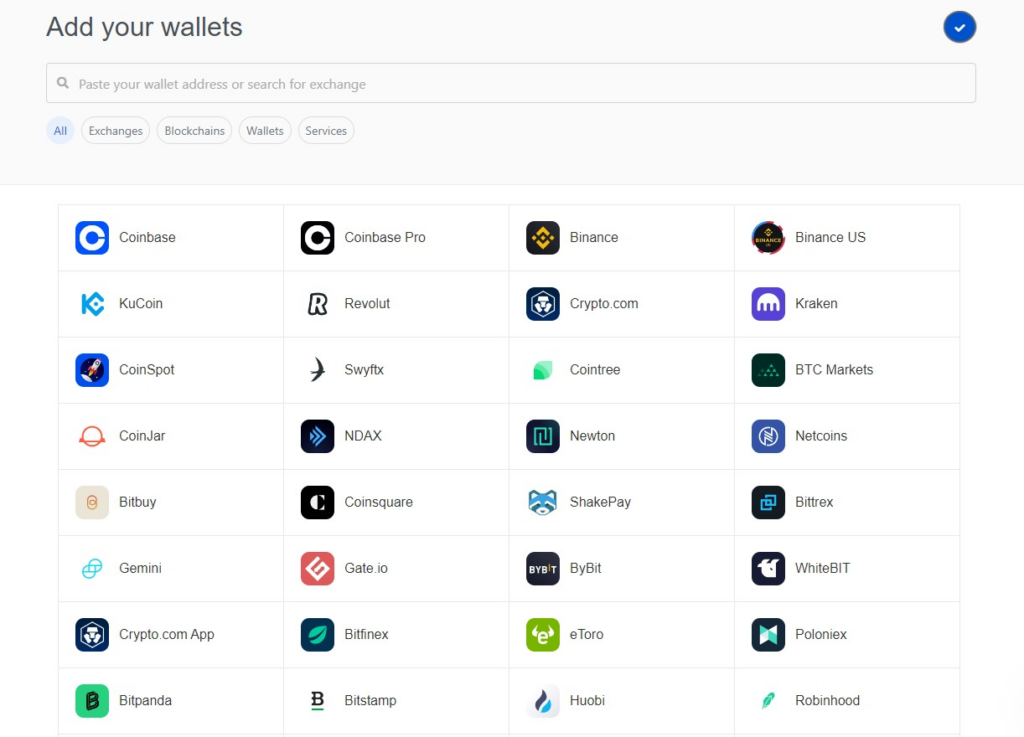

Koinly Review: Exchanges and Wallet Support

Koinly integrates with around 350 crypto exchanges, automatically syncing your transactions to your Koinly dashboard. As such, you can merge all the investing activity into Koinly, helping you start preparing your tax forms.

Koinly also supports the automatic import of various blockchains, including Bitcoin, Ethereum, Litecoin, NEO, and EOS.

Some popular exchanges the platform supports include Coinbase, Crypto.com, Binance, Gemini, Robinhood, Kraken, Kucoin, and Gate.io.

Koinly also supports integration with several wallets, including:

- Trust Wallet

- Trezor

- Ledger

- Exodus

- Uphold

- Electrum

- Abra

It is crucial to note that you provide read-only access when you connect to Koinly. As such, your transaction data can be imported, but you cannot access your holdings.

Koinly crypto tax software can detect the type of income-varying transactions. For instance, the software can see margin and futures trading from connected exchanges. Its fantastic feature can also uncover missing transaction data, duplicating it to ensure you file correctly.

Koinly Review: Supported Blockchains and Cryptocurrencies

Koinly supports most of the cryptocurrencies listed on CoinMarketCap. The tax software platform supports tokens on the ETH, BSC, Polygon, AVX, FTM, Solana, ADA, and more blockchains.

Most of the tokens that Koinly supports also include other EVM blockchains. The platform supports over 6,000 cryptocurrencies, including Bitcoin (BTC), Stellar Lumens (XLM), Polkadot (DOT), Litecoin (LTC), and Ethereum (ETH).

Koinly can import NFTs (ERC-1155 and ERC-721) for EVM-based blockchains, including ETH, BSC, FTM, AVAX, Cronos, etc. You can also add NFTs that Koinly does not support.

After you create a new ETH, BSC, or even a Polygon wallet, the tax software automatically imports all trades and liquidity transactions from Uniswap, Sushiswap, PancakeSwap, Balancer, and other DeFi platforms.

Koinly Review: Countries Supported

Koinly supports a vast number of countries, with this list being added every day. In the Americas, they support countries like the US and Canada. Their extensive support also flows to Europe, with the backing of the UK, Germany, Sweden, Denmark, Finland, Norway, the Netherlands, France, Spain, Italy, Austria, Lichtenstein, Ireland, the Czech Republic, Estonia, and Malta.

Koinly also supports Asian countries, including Japan, South Korea, and Singapore.

There is also support from countries that use other accounting methods, including FIFO, LIFO, Highest Cost, Shared Pool, Lowest Cost, and Average Cost Basis.

Koinly Review: Privacy and Security

Koinly prioritizes your trust and the safety of user data, which makes them employ several security protocols to protect you against exploits or breaches.

Koinly does not require you to provide any private keys or have access to your funds in the exchange accounts. Additionally, Koinly encrypts data in transit and does not store your payment details. As such, these practices ensure that Koinly is a safe and secure crypto tax software.

However, you may want to note that, as the software connects with your accounts through API, it is always good to disable any ability to withdraw and trade when configuring any API connections you may have.

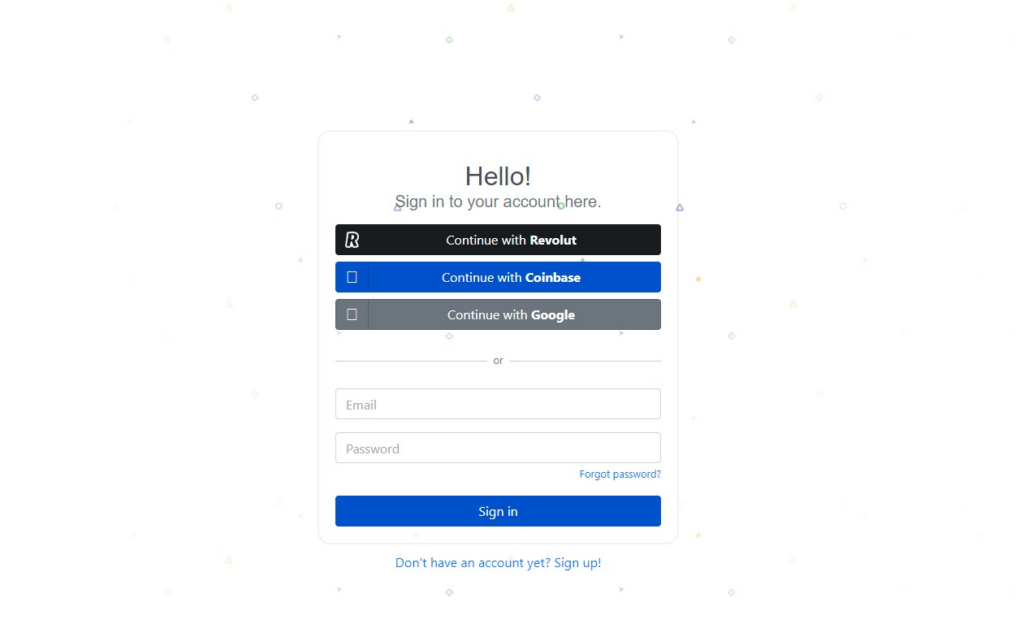

When signing up, Koinly allows you to authenticate through Google/Coinbase, removing the need to store passwords. If you log in through email, your password is stored through bcrypt, which makes it secure.

Koinly Review: Customer Support

If you need assistance with Koinly, there are several ways to contact their customer service team. The simplest option is to use the live chat feature, where you can message a customer support agent. Additionally, every Koinly pricing plan offers direct email support from experts.

Most customers using the platform cite reliable Koinly customer support as a prerequisite to quality customer service.

In addition to their truly quality customer service options, Koinly also offers access to helpful documentation, guides, and FAQs to help you find simple solutions to your queries. Paid plan users can enjoy prioritized support, which means they receive faster responses from the team compared to other users.

Koinly Review: Pros and Cons

Pros

- It allows you to invite your accountant for filing purposes.

- Offers a free version.

- Has an easy-to-use interface.

- Brings together small trades into a single transaction.

- Supports over 6,000 cryptocurrencies and the integration of over 350 exchanges.

- Offers general tax reports for over 100 countries and localized tax reports for over 20 countries.

Cons

- You cannot pay through cryptocurrency.

- IRS-compliant tax reforms are only available for paid plans.

- Expensive for traders to have huge yearly trade volumes,

How Do I Open a Koinly Account?

Step 1: On the website’s page, there is a “Sign up using your Coinbase or Google account” option. However, you can also sign up with your name, email, and password.

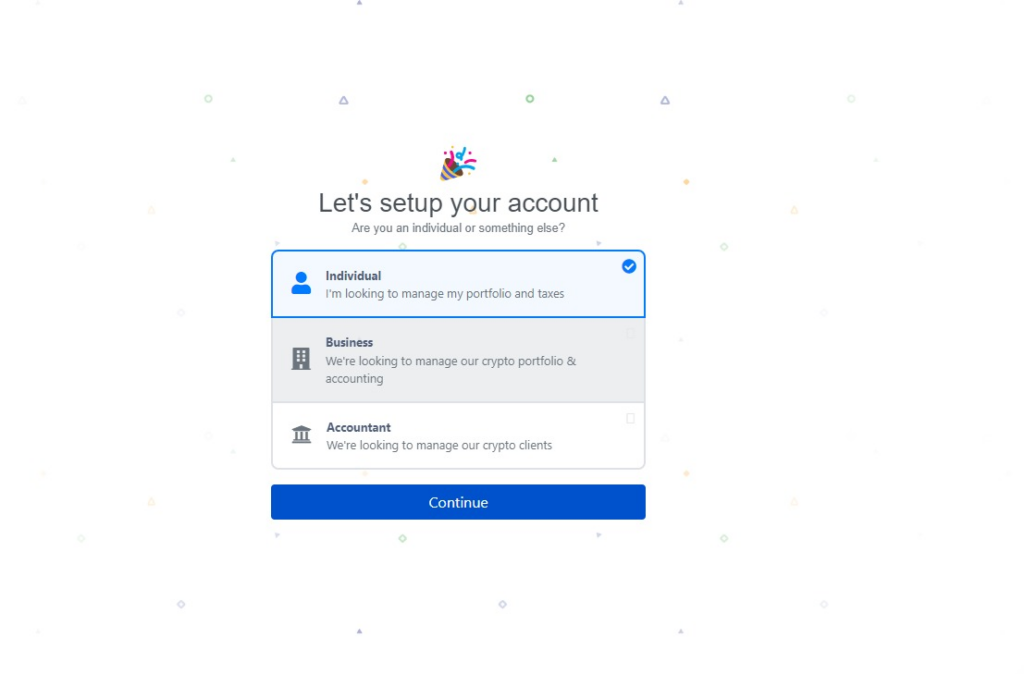

Step 2: Choose whether you are registering the account as an individual or a business.

Step 3: Identify what you are using the account for—either as a tax reporting and portfolio tracker, or a portfolio tracker alone.

Step 4: Once you sign up, add your wallets from the list provided.

Step 5: Import data from your exchanges and wallets.

It is, however, essential to note that Koinly does not follow KYC (Know Your Customer) requirements. As such, you can set up a new account in just a few minutes. Importing transaction data, however, takes around 15 to 20 minutes.

How Does Koinly Compare?

While there is still progress to be made in the development of effective crypto tax software, Koinly stands out as one of the most cost-effective choices for portfolio tracking tools and other crypto software options. The platform offers a free plan, allowing you to try it out before deciding on a paid version.

Koinly vs. ZenLedger

Koinly and ZenLedger are very prominent crypto tax calculators with comparable services. Both crypto tax software programs offer a free plan, allowing you to test them out before making a decision. The two also support a wide range of cryptocurrencies, which makes it useful if you buy and sell digital coins on multiple exchanges.

The main difference between the two is pricing, with Koinly offering cheaper pricing plans and integrations compared to ZenLedger. For instance, ZenLedger has a Platinum plan that allows for limitless transactions, but it comes with an annual cost of $999. While this is expensive, the trader account for Koinly, which goes for $179, can only allow 10,000 transactions. All the same, if you are not a trader who regularly engages with their wallets and exchanges to trade, Koinly may be the best option for you.

ZenLedger also has a tax-loss harvesting tool incorporated into all paid plans, while Koinly has no independent tax-harvesting tool.

Koinly vs. CoinTracker

Koinly and CoinTracker have similar features, such as tax calculators and portfolio tracking. Both platforms also offer free and paid subscription plans.

However, there are some differences in their free plans. With CoinTracker’s free plan, users can only track their portfolio for a limited number of transactions, which is 25. Nevertheless, it still provides tax reports for free. Koinly, on the other hand, does not offer tax reports as part of its free plan but offers portfolio tracking.

The two platforms also integrate with many crypto exchanges and wallets. With Koinly, you can track over 6,000 cryptocurrencies, while with CoinTracker, you can track over 10,000.

When it comes to pricing, Koinly is cheaper, with its paid plan starting at $49 per year, while CoinTracker starts at $59 per year.

Final Thoughts

As a crypto taxing tool, Koinly offers a comprehensive crypto tax solution by simplifying the tedious process of tracking, reporting, and filing taxes on crypto transactions. With its advanced features, user-friendly interface, and extensive integration support, Koinly stands out as a reliable platform and crypto tax calculator. Thus, it is ideal for individuals and businesses navigating cryptotaxation.

Koinly comes in as a strong contender in the cryptocurrency tax software market. Take advantage of this tool by allowing it to handle your crypto tax needs. This will enable you to focus on what truly matters; your crypto investments.

FAQ

Is Koinly safe?

Koinly has the ability to use your API keys to read data from your exchange accounts, but not the ability to trade or withdraw. As such, yes, Koinly is safe.

Is Koinly free?

Yes, Koinly is free. However, you will have to pay if you want a vast user base.

Does Koinly work with the IRS?

Yes, Koinly works with the IRS, as it can generate filled-in IRS forms. The platform also shares data with the IRS.

How much does Koinly cost?

Koinly has differing pricing plans that can cater to every user’s needs. The cost may depend on the number of transactions you wish to perform, additional features, and support options. As such, the price ranges from $0-$279.

Does Koinly have a mobile application?

Yes, Koinly has a mobile app for Android and iOS. However, the iOS version is in beta testing. The Koinly app provides all the features and products; it is smooth and easy to use. Such an interface is an ideal situation for most users.

![LBank Review: What is It? Is This Exchange Legit? ([currentmonth] [currentyear]) 47 Lbank Review Featured Image](https://coinwire.com/wp-content/uploads/2024/05/lbank-review-featured-image-1024x683.jpg)

![OKX vs Coinbase [currentyear]: Full Features and Pricing Review 49 Okx Vs Coinbase](https://coinwire.com/wp-content/uploads/2024/05/okx-vs-coinbase-1024x683.jpg)

![Backpack Exchange Review [currentyear]: Guide to Backpack Airdrop 50 Backpack Exchange Review](https://coinwire.com/wp-content/uploads/2024/05/backpack-exchange-review-1024x683.jpg)

![Justin Sun Net Worth ([currentyear]): Where Does All Money Come From? 51 Justin Sun Net Worth Featured Image](https://coinwire.com/wp-content/uploads/2024/05/justin-sun-net-worth-featured-image-1024x683.jpg)