Cryptocurrencies have taken the financial world by storm, offering exciting investment opportunities for people worldwide. But when it comes to buying and trading digital assets, which platform should you choose: KuCoin vs Coinbase?

We’ll break down the differences between these two popular cryptocurrency exchanges and compare fees, ease of use, security, and the range of coins available.

Key Takeaways:

- Kucoin is a platform for advanced traders who want to trade a large variety of cryptocurrencies (more than 700) and access different types of markets, such as spot, margin, futures, trading bots, staking, and crypto lending.

- Coinbase is a platform for beginners and those who prefer simplicity, security, and a limited selection of cryptocurrencies (more than 250) with an easy-to-use interface and allows users to buy and sell crypto with fiat currencies, such as USD.

- Kucoin is not licensed to operate in the US, whereas Coinbase is a public company with high regulatory standards and accepts fiat deposits via bank transfer (SEPA), PayPal, credit card, debit card, Apple Pay, and SWIFT.

Kucoin vs Coinbase: Key Differences

| Features | Coinbase | Kucoin |

|---|---|---|

| Headquarters | San Francisco | Seychelles |

| Launched | 2012 | 2017 |

| License | Yes (New York State Department of Financial Services) | None |

| Supported Coins | 250+ | 700+ |

| Trading Fees | Maker: 0.4%Taker: 0.6% | 0.1% maker/taker |

| Security | Very High | High |

| KYC Mandatory | Yes | Yes |

| US Supported | Yes | No |

| Funding Methods | ACH, Wire transfer, Google Pay, SEPA, PayPal | Prepaid cards, Wise, Paypal, Zelle, Skrill, etc. |

| Futures Trading | Yes (only selected accounts) | Yes |

| Copy trading | No | Yes |

| Mobile App | Available for iOS and Android users | Available for iOS and Android users |

| Customer support | Live chat available | 24/7 support email |

| Reviews | Coinbase Pro review | Kucoin review |

Kucoin Overview

Kucoin is one of the leading day trading crypto exchanges in the world. It was established in 2017 by Michael Gan and Eric Don. It is registered in Seychelles, with offices in Hong Kong and Singapore. It has over 30 million users worldwide and supports nearly 700 cryptocurrencies for buying, selling, and trading. The exchange is available in more than 200 countries with a staggering $1.7 billion trading volume per day.

The platform provides various features and services to its users, such as futures trading, leveraged tokens, margin trading, P2P exchange, card purchases, instant buy/sell, and the Kucoin ecosystem. You can benefit from the Kucoin token (KCS), which is the native currency of the platform. KCS holders can enjoy discounts on trading fees, dividends from the platform’s revenue, exclusive promotions, and access to new projects.

In 2019, Kucoin launched its own blockchain, KuChain, and its own decentralized exchange, KuSwap, which are based on the Cosmos network and support cross-chain transactions.

Join Kucoin today using our referral code “QBSTYFKL” and receive a generous welcome gift pack worth up to 700 USDT.

Kucoin Pros

- Earn Interest: It allows users to earn passive income from their crypto by participating in staking or lending programs for certain coins.

- Many supported coins: KuCoin has a large variety of crypto assets, with more than 700 different coins available for trading. This includes many low-cap altcoins and shitcoins.

- Low trading cost: It charges low fees for trading, from 0.005% to 0.10% per transaction, and gives a 20% discount when users pay with its native token, KuCoin Token (KCS).

- Mobile App: KuCoin has an app for both Android and iOS that enables users to access the exchange from anywhere.

- Extra rewards: Users get exclusive perks for trading and holding KCS, such as giving extra bonuses, reducing withdrawal fees, and offering exclusive services such as interest-free borrowing and high lending rates.

Kucoin Cons

- Geographical Restrictions: It does not have a license in the U.S., so users from the U.S. should look for other exchanges like Coinbase and Binance.us.

- Hack: KuCoin was hacked in the past, losing more than $275 million worth of crypto in 2020 (Read more about Kucoin hack here).

Coinbase Overview

Coinbase is a leading US-based platform for trading, buying, selling, and storing various digital currencies. It was founded in 2012 by Brian Armstrong, a former engineer at Airbnb, and Fred Ehrsam, a former trader at Goldman Sachs. It began as a service that allowed users to buy and sell “BTC only” using bank transfers.

In 2013, it received its first funding from Y Combinator, Union Square Ventures, and Andreessen Horowitz. Coinbase then added other cryptocurrencies, such as Ethereum, Litecoin, and Bitcoin Cash. The platform also launched various products and services for different kinds of customers, such as Coinbase Pro, Coinbase Commerce, Coinbase Wallet, Coinbase Custody, and Coinbase Earn.

Later, it became one of the most popular and trusted platforms for crypto enthusiasts, investors, traders, and institutions. It has over 98 million users and more than $114 billion worth of crypto assets on its platform. It operates in over 100 countries and supports more than 250 tradable cryptocurrencies. It is also known for its high-security standards, regulatory compliance, and user-friendly interface. In 2021, Coinbase became the first major crypto company to go public, listing its shares on the Nasdaq stock exchange under the ticker symbol COIN.

Join Coinbase today using our exclusive referral code “SUCCESS” and unlock a $10 Bitcoin signup bonus and more rewards.

Coinbase Pros

- Multiple Assets: It supports more than 250 digital assets, which provides users with a large variety of choices to buy and sell cryptocurrencies.

- Minimum trading limit: You can trade as low as $1, which makes it suitable for beginners and small investors who want to enter the crypto market.

- DeFi ecosystem: Decentralized application, or dapp, access includes staking tools and NFT marketplaces, which offer users more ways to engage with the crypto ecosystem and earn rewards.

- Non-custodial wallet: It has a Coinbase Wallet for decentralized crypto storage that supports thousands of crypto coins.

- Regulated: It is highly regulated under many financial authorities such as a license from the National Futures Association (NFA), Alaska Money Transmitter License, etc. (check full list)

Coinbase Cons

- Higher Fees: It has higher trading costs than other cryptocurrency exchanges, which can affect the profitability of users’ trades and investments.

- Legal Issues: Facing some legal uncertainty as the SEC accuses it of breaking securities rules, which can impact the reputation and stability of the platform and its users.

- Lack of advanced trading options: It does not have advanced trading tools such as leverage tokens, margin trading, crypto copy trading, automated bots, etc.

Kucoin vs Coinbase: Trading Fees Comparison

Kucoin Fees

KuCoin has different fees for different types of transactions, such as trading fees, deposit fees, and withdrawal fees. It also offers various promotions and rewards for its users, such as zero-fee trading for certain trading pairs, referral fee rebates, and more.

Kucoin Trading Fees

These are the fees that KuCoin collects for enabling the trades on its platform. KuCoin has a tier-based maker/taker fee structure, which means that the fees vary depending on the user’s trading volume and VIP level. A maker is someone who creates liquidity in the order book by placing a limit order, while a taker is someone who removes liquidity from the order book by executing a market order or matching a limit order.

The base fee for both makers and takers is 0.1%, which is relatively low compared to other major exchanges. However, users can lower their trading fees by becoming a VIP member, which requires holding a certain amount of KuCoin Tokens (KCS) or having a certain trading volume in the last 30 days.

The higher the VIP level, the lower the trading fees. For example, a VIP 10 user pays only 0.005% for both maker and taker fees. Users can also get a 20% discount on trading fees by paying with KCS tokens.

For futures trading, the base fee for both makers and takers is 0.02% and 0.06%, respectively, for both USDT-Margined Contracts and COIN-Margined Contracts.

Deposit fees

KuCoin does not apply any fees for depositing funds, regardless of the cryptocurrency or the amount. This makes KuCoin a good option for users who want to transfer their funds from other platforms or wallets without paying any extra costs.

Withdrawal fees

The withdrawal fee and minimum withdrawal amount depend on the cryptocurrency and the network that the user chooses. KuCoin updates the withdrawal fees regularly according to market conditions and network congestion.

The withdrawal fees are usually lower than the average market fees, and KuCoin also subsidizes some of the withdrawal fees for certain cryptocurrencies. For example, the withdrawal fee for Bitcoin (BTC) is 0.0008 BTC and 0.01 ETH (ERC20) for Ethereum.

Here is the full Kucoin fee structure.

Coinbase Fees

Coinbase Trading Fees

This is the fee that Coinbase charges for processing transactions. It depends on the payment method, the order size, and the user’s location. For example, in the US, Coinbase charges a flat fee of $0.99 for orders below $10, $1.49 for orders between $10 and $25, and so on.

Coinbase charges a variable percentage fee of 1.49% for orders above $200 or for orders paid with a bank account or Coinbase USD wallet. For orders paid with a debit card or PayPal, Coinbase charges a variable percentage fee of 3.99%. These fees are different for other regions, such as Europe, the UK, Canada, Australia, and Singapore.

Coinbase Pro Exchange has a maker-taker fee structure, similar to Kucoin. It charges a 0.4% maker and 0.6% taker fee. High-volume traders can get discounts.

| Tier | Taker Fee | Maker Fee |

| $0K-$10K | 60bps | 40bps |

| $10K-$50K | 40bps | 25bps |

| $50K-$100K | 25bps | 15bps |

| $100K-$1M | 20bps | 10bps |

| $1M-$15M | 18bps | 8bps |

| $15M-$75M | 16bps | 6bps |

| $75M-$250M | 12bps | 3bps |

| $250M-$400M | 8bps | 0bps |

Instant Conversion Fee

The fee that Coinbase charges for converting one crypto to another. It is based on the exchange rate and the transaction fee. Coinbase says it charges up to 2% for this service.

Deposit and Withdrawal Fees

This is the fee that Coinbase charges for depositing and withdrawing funds on the platform. It depends on the payment method and the user’s location. For example, in the US, Coinbase charges zero fees for ACH transfers and up to $25 for wire transfers. In Europe, Coinbase charges a fee of 0.15 EUR for SEPA transfers and 1 GBP for SWIFT transfers. Here is the full price structure:

| Transaction Type | Deposit Fee | Withdrawal Fee |

| ACH (USD) | Free | Free |

| Wire (USD) | $10 USD | $25 USD |

| SEPA (EUR) | €0.15 EUR | Free |

| Swift (GBP) | Free | £1 GBP |

Winner: Kucoin is the clear winner compared to Coinbase due to its very low crypto trading and withdrawal fees.

Join Kucoin today using our referral code “QBSTYFKL” and receive a generous welcome gift pack worth up to 700 USDT.

Kucoin vs Coinbase: Supported Coins

Kucoin supports more than 700 crypto assets including many new projects, altcoins, and some shitcoins. The exchange is also popular for launching IEOs and listing their tokens for early investors.

On the other hand, Coinbase supports only 250 coins which are industry established. It focuses more on high market cap assets instead of new projects. Therefore, if you want to invest in new altcoins, Kucoin is the best choice.

Winner: Kucoin supports more coins and tokens than the Coinbase crypto exchange.

Kucoins vs Coinbase: Security Measures

Is Kucoin Safe?

Kucoin is one of the safest crypto exchanges in the industry. Here are some of its security measures:

- Multi-factor authentication: KuCoin supports three kinds of two-factor authentication (2FA): phone binding, email binding, and Google Authentication. 2FA is one of the best ways to protect your account and crypto-assets because it asks you to enter a code that changes every time you log in, withdraw, create an API, or do other actions.

- Trading Password: It also asks users to set up a trading password, which is a 6-digit password that you need for important actions such as trading, withdrawing, and creating an API. Having a trading password makes your account more secure along with your regular login password and 2FA.

- IP restrictions: When you turn on the IP restriction, KuCoin will start the account protection mechanism, which will send you an email message and verification code whenever someone tries to log in from a different IP address than yours.

- Cold storage: It keeps most of the crypto assets in cold wallets. This makes it harder for hackers, thieves, or accidents to take or lose your money.

Kucoin Hack 2020: Even with these security measures, KuCoin was hacked by North Korean hackers who took $275 million of crypto in 2020. However, the platform paid back the users who were affected.

Is Coinbase Safe?

Coinbase is also a highly secure exchange with all accounts having two-step verification by default. Users can also use security keys for more security. Here are some other safety measures:

- Safe storage: It stores 98% of customer money offline in safe places around the world. This way, hackers cannot access most of the crypto assets.

- Insurance: Coinbase covers the remaining 2% of customer money that is online with an insurance policy. This policy protects against theft and cyberattacks. It is provided by a group of leading insurers and brokers.

- Encryption: It encrypts sensitive data, such as wallets and keys, with AES-256 encryption. It also hashes passwords and uses SQL injection filters to prevent database attacks.

- Transparency: Coinbase (COIN) is a public company that follows financial rules and laws. It publishes its financial reports every quarter and is audited every year by an independent party.

Winner: Both exchanges are highly secure, however, Coinbase has a slight edge due to its public listing and past track records.

Kucoin vs Coinbase: Deposit Methods

Kucoin supports more than 10 payment methods depending on your country. Here are some popular deposit methods:

- Visa and Mastercard

- Wise

- Paypal

- Zelle

- Skrill

- UPI (Only P2P)

- Google Pay and Apple Pay (Only P2P)

Coinbase also supports many funding methods such as:

- Bank Account (ACH)

- Debit Cards

- Wire Transfer

- PayPal

- Apple Pay and Google Pay

- SEPA Transfer

- SWIFT

Winner: Coinbase supports more deposit methods than Kucoin exchange, especially in the US and European countries.

Kucoin Standout Features

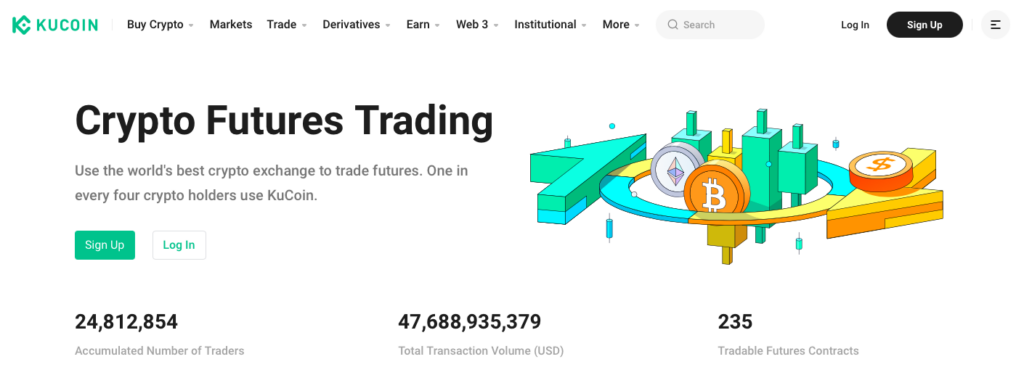

Derivatives Trading

Crypto futures are a kind of derivative that lets you bet on the future price of a cryptocurrency, whether it will rise or fall. You can trade crypto futures (235 tradable assets) with leverage, which means you can increase your potential profits or losses by borrowing money from the platform.

KuCoin has different types of crypto futures contracts, such as USDT-Margined Futures, Coin-Margined Futures, and Leveraged Tokens.

- USDT-Margined Futures are paid in USDT, a stablecoin that is linked to the US dollar, and allow up to 100x leverage.

- Coin-Margined Futures are paid in the crypto asset itself, such as BTC or ETH, and allow up to 125x leverage.

- Leveraged Tokens are ERC-20 tokens that represent a group of futures contracts with a fixed leverage ratio, such as 3x long or 3x short. You can buy and sell leveraged tokens like any other token on KuCoin, without having to worry about margin, liquidation, or funding rates.

On the other hand, Coinbase recently got a license for a futures trading platform. Currently, it supports only BTC and ETH in the leverage market. Also, only a few accounts are eligible for futures trading.

Join Kucoin today using our referral code “QBSTYFKL” and receive a generous welcome gift pack worth up to 700 USDT.

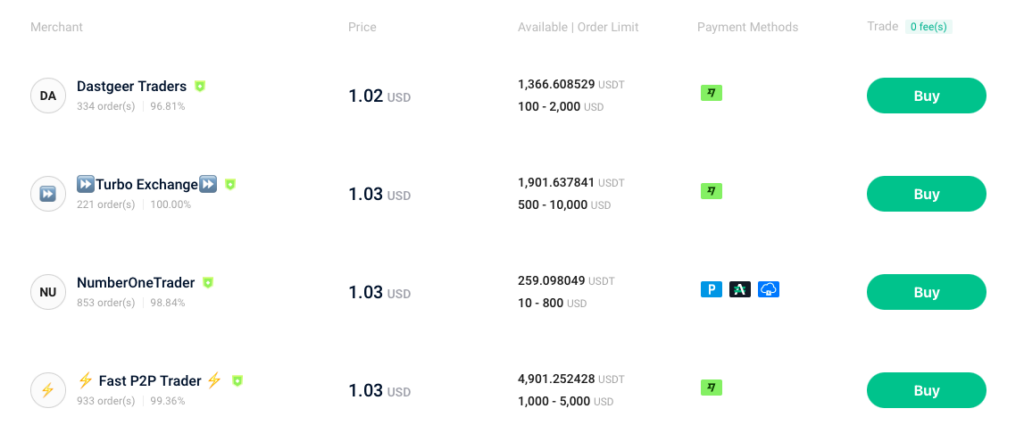

P2P Trading

KuCoin P2P trading allows users to exchange cryptocurrencies with each other, without any middlemen. The platform acts as a trusted third party that holds the crypto until the trade is completed.

Users can choose from different payment methods, such as bank transfer, PayPal, Alipay, and 20 more, to buy crypto with their local currency. Currently, it supports more than 30 fiat currencies, including INR, USD, NGN, MYR, and RUB.

KuCoin P2P also offers zero trading fees and fast transactions, thanks to the professional merchants that are verified by KuCoin. Users can use P2P trading on both the KuCoin app and website, and enjoy the advantages of peer-to-peer trading without paying any transaction charges.

However, the Coinbase exchange does not support P2P trading.

Trading Bots

Kucoin trading bots offer various trading strategies, such as spot grid, futures grid, martingale, smart rebalance, infinity grid, and dollar-cost averaging (DCA).

- Spot Grid: This bot places buy and sell orders within a price range. It sells at high prices and buys at low prices, creating a grid of orders that can generate income regardless of market direction.

- Futures Grid: It is like the spot grid, but it works on the futures market, where users can trade with leverage. It can go long or short to follow market trends and adjust the grid dynamically.

- Martingale: It buys gradually when the price falls and sells all at once when the price rises, following the martingale principle.

- Smart Rebalance: This bot is made to create and manage a balanced portfolio of cryptocurrencies. It rebalances the portfolio regularly to keep the target allocation and reduce risks.

- Infinity Grid: It is another variation of the spot grid, but it has no upper limit for the price range. It can handle bullish market conditions and capture price movements without missing opportunities.

- DCA: This bot is based on the dollar-cost averaging strategy, which involves buying a fixed amount of cryptocurrency at regular intervals. It can reduce the effect of market volatility and lower the average cost of entry.

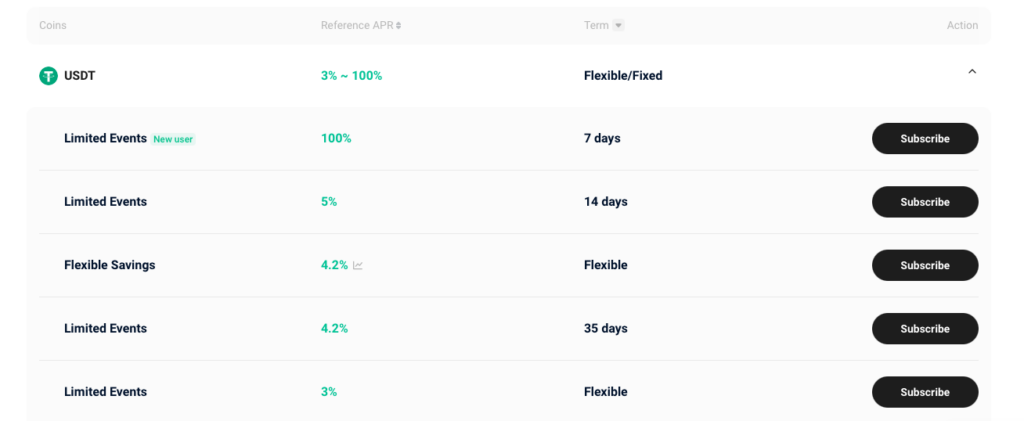

Kucoin Earn and Saving Products

KuCoin Earn is an innovative feature that gives users multiple choices to earn passive income from their crypto assets. Here is a summary of all KuCoin Earn products:

- Savings: Users can deposit their crypto assets and get interest every day. The scheme is flexible and users can subscribe and redeem their funds anytime. Savings supports more than 50 assets, such as USDT, BTC, ETH, and more.

- Staking: You can lock your crypto assets on a Proof of Stake blockchain and get rewards for helping the network security and governance. Kucoin staking supports more than 40 assets, such as KCS, ADA, DOT, and more. Some staking products also give POL mining rewards, which are the native tokens of the Pool-X platform.

- Snowball: You can guess the market range of a certain asset within a specific period and get increased returns if they are right.

- Crypto Lending 2.0: Users can lend their crypto assets to other users and get interest with adjustable APYs.

Coinbase Standout Features

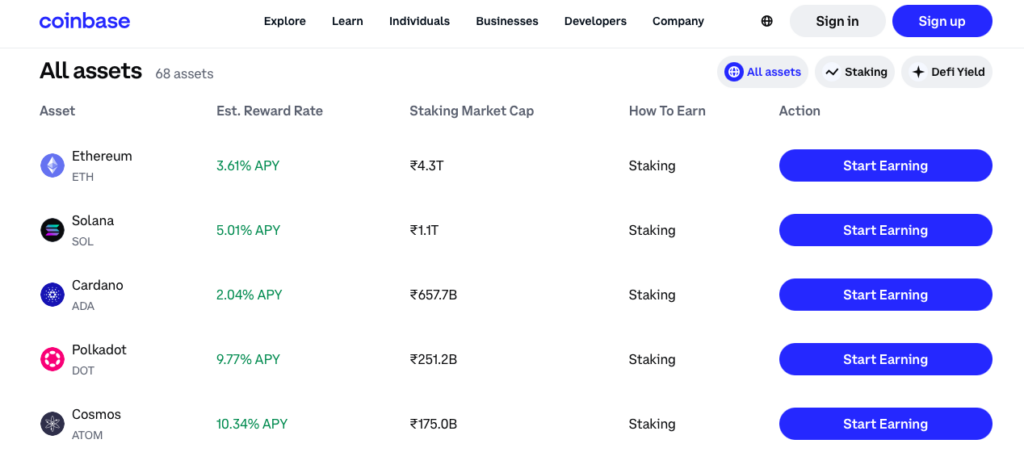

Crypto Staking & Other Rewards

Coinbase also supports staking, similar to Kucoin, with up to 10% APY. Currently, it supports the staking of 68 coins such as Ethereum, Solana, Cardano, Polkadot, and more.

The exchange also has other ways for users to earn rewards, such as Coinbase Earn, which pays users to learn about different cryptocurrencies, and Coinbase Card, which gives users cashback in crypto when they use their debit card. You can also get free sign-up rewards. You can also check out our Coinbase referral code for some extra perks.

Coinbase One

Coinbase One is a subscription service ($29.99/month) that gives users more benefits and features for their crypto journey. For a monthly fee, users can enjoy unlimited trading with zero fees, access to advanced trading tools and analytics, priority customer support, and pre-filled tax forms.

Coinbase also partnered with CoinTracker for portfolio tracking and tax tracking. Users can also get fee waivers for other Coinbase products, such as Coinbase Card, Borrow, and Coinbase Direct Deposit.

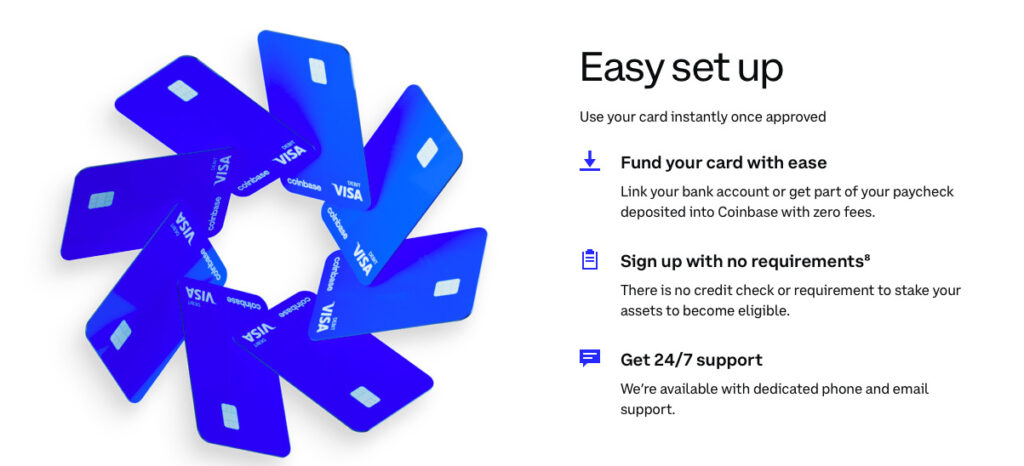

Coinbase Card

Coinbase Card is a “Visa” debit card that allows users to spend their crypto balance anywhere that accepts Visa. Users can select which crypto they want to use for each transaction, and Coinbase will automatically convert it to fiat currency at the point of sale.

Users can also get up to 4% back in crypto rewards for every purchase, depending on the selected reward token. Users can control their card settings, see transactions, and track rewards through the Coinbase app. Coinbase Card is available in select countries and regions such as the US (excluding Hawaii).

Coinbase Wallet

Coinbase Wallet is a self-hosted crypto wallet that enables users to store, send, and receive any ERC-20 token and interact with decentralized applications (dApps) on the Ethereum network.

Unlike Coinbase.com, which is a custodial service that holds users’ funds on their behalf, Coinbase Wallet gives users full control over their own private keys and funds. You can also explore the decentralized web (Web3) through the Wallet app, which has a built-in browser that supports various dApps, such as decentralized exchanges, games, and NFT marketplaces. You can read our full guide on Coinbase Wallet vs MetaMask.

Coinbase Prime

Coinbase Prime is a brokerage platform that serves institutional investors and high-net-worth individuals who want to invest in digital assets.

It offers a suite of services, such as trading, custody, lending, staking, data, and execution. It also provides access to deep liquidity, low fees, and best execution across multiple markets and venues. Coinbase Prime is trusted by some of the world’s leading hedge funds, asset managers, and corporations

Kucoin vs Coinbase: Mobile App

Kucoin and Coinbase both have a dedicated mobile app that is available on both Android and iOS devices. You can download the apps from the Google Play Store or the Apple App Store.

Both mobile apps have a sleek and modern design that is easy to navigate and use. They are having a dark theme that is pleasing to the eye and reduces battery consumption. You can access various features and functions such as markets, trading, assets, and more.

Conclusion: Which is Better?

When we compare KuCoin and Coinbase, we see that both platforms offer opportunities for buying and selling cryptocurrencies, but they have some key differences. Kucoin is for more advanced trader who prefers features like margin trading, leveraged tokens, automated trading bots, etc.

The Coinbase platform is especially good for the US and European traders where it supports many funding methods and has a financial license to operate. When it comes to fees, Coinbase tends to have higher costs, which might not be suitable for those who want to save on transaction fees. KuCoin often offers lower fees, making it more cost-effective.

Therefore, If you’re a beginner, Coinbase might be your go-to. If you’re more experienced and seek a wider range of cryptocurrencies, KuCoin could be your choice.

FAQs

How much does Kucoin charge to withdraw?

The withdrawal fees for different cryptocurrencies on Kucoin vary according to the network and transaction costs. For example, the withdrawal fee for Bitcoin (BTC) is 0.0008 BTC and 0.01 ETH (ERC20) for Ethereum.

Is KuCoin cheaper than Coinbase?

Yes, Kucoin is cheaper than Coinbase in terms of trading fees, as Kucoin charges a flat fee of 0.1% for both makers and takers, while Coinbase exchange has a variable fee structure. It charges a flat fee of $0.99 for orders below $10, $1.49 for orders between $10 and $25, and so on. If you are using Coinbase Pro, you need to pay 0.4% maker and 0.6% taker fee.

Is it legal to use KuCoin in the US?

Kucoin is not authorized to operate in the US and does not comply with US regulations and laws. Therefore, it is technically illegal to use Kucoin in the US, and US users may face legal consequences if they do so.

Kucoin also limits access to certain features and services for US users, such as futures trading, margin trading, and crypto lending. US users who want to use Kucoin may have to use a VPN to bypass the geo-restrictions, but this is risky and potentially against local laws.

Can I transfer crypto from Kucoin to Coinbase?

Yes, you can easily transfer crypto from Kucoin exchange to Coinbase or vice versa. It just requires a recipient’s wallet address and network transactions can be processed.

Does Kucoin and Coinbase require KYC verification?

Yes, Kucoin and Coinbase have KYC verification as a mandatory requirement for their users. Previously, Kucoin was a no-KYC exchange, but recently it announced that all users need to complete the KYC verification to trade on the platform. This helps the platforms follow global compliance standards, enhance the security level of user accounts, and ensure a safer trading environment.

![LBank Review: What is It? Is This Exchange Legit? ([currentmonth] [currentyear]) 41 Lbank Review Featured Image](https://coinwire.com/wp-content/uploads/2024/05/lbank-review-featured-image-1024x683.jpg)

![OKX vs Coinbase [currentyear]: Full Features and Pricing Review 43 Okx Vs Coinbase](https://coinwire.com/wp-content/uploads/2024/05/okx-vs-coinbase-1024x683.jpg)

![Backpack Exchange Review [currentyear]: Guide to Backpack Airdrop 44 Backpack Exchange Review](https://coinwire.com/wp-content/uploads/2024/05/backpack-exchange-review-1024x683.jpg)

![Justin Sun Net Worth ([currentyear]): Where Does All Money Come From? 45 Justin Sun Net Worth Featured Image](https://coinwire.com/wp-content/uploads/2024/05/justin-sun-net-worth-featured-image-1024x683.jpg)