Ethena (ENA) is not just another cryptocurrency; it stands out with its unique proposition and governance model. As the designated governance token of Ethena, a cutting-edge protocol aiming to revolutionize the decentralized finance bond system outside traditional banking, ENA is at the forefront of facilitating a novel economic ecosystem.

With the innovative approach towards creating a dollar-pegged synthetic token, Ethena showcases the potential for a new era in financial inclusivity and stability. The excitement around ENA is palpable, especially with the upcoming airdrop earmarked for participants in its shard campaign, demonstrating Ethena’s commitment to engaging and rewarding its community. Spanning from its remarkable growth post-seed round funding to the anticipation surrounding the airdrop’s 30-day window, ENA encapsulates the dynamic spirits of digital finance.

Understanding the fundamentals becomes crucial as you delve into Ethena (ENA) price prediction analyses. Equally important are the factors influencing ENA’s price, which will be comprehensively explored. This article aims to provide insights into ENA’s performance, leveraging fundamental analysis and machine learning models for nuanced price forecasting. From delving into ENA’s operational framework on Binance Launchpool to outlining strategic investment approaches, the forthcoming sections intend to offer a well-rounded perspective on navigating the possibilities that Ethena (ENA) holds for savvy investors and enthusiasts alike.

Understanding ENA’s Fundamentals

Understanding the fundamentals of Ethena (ENA) involves diving into its operational framework, governance model, and unique financial offerings. Here’s a breakdown to guide you through ENA’s core aspects:

- Operational Framework and Governance:

- Blockchain Foundation: ENA operates on the Ethereum blockchain, ensuring a secure and decentralized infrastructure for its transactions and governance processes.

- Governance Rights: Holding ENA tokens grants users governance rights on the Ethena platform, allowing them to participate in crucial decision-making processes.

- Staking and KYC Verification: To engage in staking, ENA enforces KYC verification, aligning with regulatory compliance and enhancing platform security.

- Tokenomics and Distribution:

- Comprehensive Distribution Plan: ENA’s tokenomics outlines a strategic distribution plan, allocating tokens to core contributors, investors, the foundation, and initiatives aimed at ecosystem development.

- Rewards and Governance: Token holders are eligible to claim their share of 750 million ENA tokens. This not only provides them with governance rights but also offers staking opportunities and rewards based on accumulated shards.

- Financial Offerings and Security Measures:

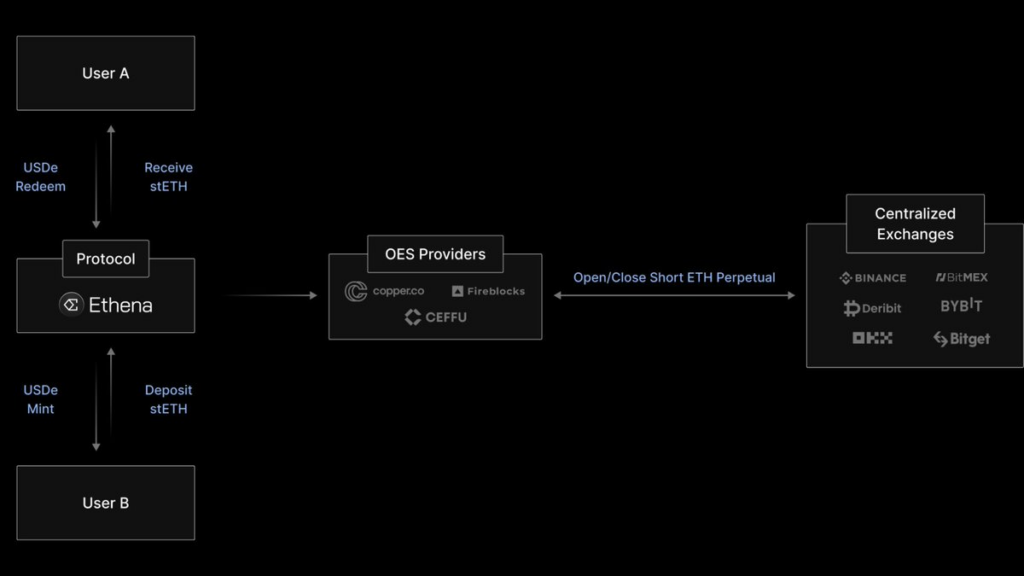

- Innovative Financial Solutions: ENA introduces the ‘Internet Bond,’ a globally accessible savings tool, alongside a synthetic dollar (USDe) token that aims to offer predictably higher returns compared to traditional financial systems and simple staked ETH.

- Algorithmic Stablecoin: USDe, an algorithmic stablecoin pegged at $1, is minted as ETH tokens are deposited, offering a yield generated from staking ether and shorting ether futures.

- Platform Security: Prioritizing user safety, Ethena implements robust security measures to protect its platform and users’ investments.

By understanding these fundamental aspects, you can better grasp how Ethena (ENA) distinguishes itself in the DeFi space through its governance model, token distribution, and financial offerings, all while maintaining high security and compliance standards.

Factors Influencing ENA’s Price

When considering the Ethena (ENA) price prediction, it’s essential to understand the myriad of factors that influence its market value. Here’s a breakdown of these critical components:

- Market Forces and Supply/Demand Dynamics:

- Total Circulating Supply: ENA’s total circulating supply is a staggering 15,000,000,000 ENA tokens. This vast supply plays a pivotal role in its price determination.

- Supply and Demand: Similar to Bitcoin, which has a finite supply introducing scarcity, ENA’s price is significantly influenced by the balance of supply and demand in the market.

- Overall Market Situation: The cyclical nature of the broader cryptocurrency market also impacts ENA’s price forecasting.

- External Influences:

- Competition: The presence of other cryptocurrencies with unique features can sway investors, affecting ENA’s market position and price.

- Media Coverage: News and media narratives can dramatically sway investor sentiment, leading to price volatility. Positive news can lead to price surges, whereas negative press can cause declines.

- Regulations: The ever-changing landscape of cryptocurrency regulations can have profound implications on ENA’s market dynamics and pricing. Regulatory crackdowns or endorsements in key markets can lead to significant price shifts.

- Operational Costs and Accessibility:

- Production Costs: For cryptocurrencies like Bitcoin, production costs, including infrastructure and electricity for miners, influence its price. By extension, these costs can impact ENA’s market value as it navigates the broader cryptocurrency ecosystem.

- Exchange Availability: The ease of access to ENA tokens, particularly its availability on centralized exchanges, plays a crucial role in its demand and subsequent price.

Understanding these factors is crucial for investors aiming to make informed decisions regarding Ethena (ENA). Each element, from market dynamics to regulatory environments, weaves into the complex tapestry of ENA’s price prediction, offering a multifaceted view of its potential trajectory.

Ethena (ENA) on Binance Launchpool Details

Ethena (ENA) is set to make a significant entry into the cryptocurrency market through Binance, one of the world’s leading digital asset exchanges. This section provides detailed insights into ENA’s integration within the Binance Launchpool, highlighting key aspects that potential investors and enthusiasts should consider.

- Listing and Trading Pairs

- ENA will be officially listed on Binance on April 2nd, 2024, at 08:00 UTC, introducing trading pairs such as ENA/BTC, ENA/USDT, ENA/BNB, ENA/FDUSD, and ENA/TRY.

- The initial circulating supply of ENA tokens on Binance will be 1,425,000,000, which is 9.5% of the total supply, ensuring ample availability for trading and investment.

- Launchpool Details and Token Farming

- Binance Launchpool will feature ENA from March 30, 2024, 00:00 UTC to April 1, 2024, 23:59 UTC, allowing users to stake BNB or FDUSD to farm ENA tokens.

- An additional 300,000,000 ENA, equating to 2% of the maximum supply, will be allocated as Launchpool token rewards, offering an attractive incentive for participants.

- Users can stake their tokens in separate pools for BNB and FDUSD, with a total of 300,000,000 ENA designated for rewards; 240,000,000 ENA for the BNB pool (80%) and 60,000,000 ENA for the FDUSD pool (20%).

- The farming period is set from March 30 to April 1, 2024, with hourly snapshots taken to calculate users’ rewards, which can be claimed directly to their spot accounts at any time.

- Airdrop and Pre-Market Activities

- A significant 750 million ENA tokens airdrop is announced to occur on April 2, following the listing, aiming to reward the community and increase token circulation.

- Prior to the official listing, the ENA pre-market began on March 28, 2024, with an average price of approximately 0.69, indicating strong early interest and potential for price appreciation

- Additionally, ENA/USD pre-debut futures surged over 20% early Friday before the listing, hinting at robust market anticipation and investor confidence in ENA’s value proposition

This integration into Binance Launchpool not only provides a platform for ENA’s introduction to the wider cryptocurrency market but also offers a unique opportunity for users to engage with and benefit from the Ethena ecosystem through staking and farming activities. With the structured airdrop and pre-market movements, ENA is poised for an impactful debut, reflecting its foundational strength and potential for growth.

(Note: If you do not have a Binance account, you can register via CoinWire’code to gain -10% trading fee)

Join Binance Community Now for the Latest Updates

- https://www.binance.com/en/community

- https://bit.ly/BinanceVietnamTelegram (for Vietnamese community)

Ethena (ENA) Price Prediction

Diving into the future, the Ethena (ENA) price predictions showcase a fascinating trajectory of growth, reflecting both the potential of Ethena’s innovative financial solutions and the broader cryptocurrency market dynamics. After listing on Binance, Ethena’s (ENA) market capitalization is predicted to soar to a range between $1 billion and $1.8 billion, indicating a per ENA token price ranging from $0.7 to $1.3. Despite encountering a few noteworthy challenges, we are confident that with its robust working mechanism, unwavering commitment, and groundbreaking concept, Ethena has the potential to emerge as one of the most compelling narratives of the year, surpassing billions in market capitalization

Here’s a closer look at the forecasted figures in the long-term future:

- 2024-2030 ENA Price Predictions:

- 2024: The price is expected to fluctuate between $1.65 and $2.47, with an average settling at $2.06

- 2025: A significant jump, with prices ranging from $3.40 to $5.10 and an average of $4.25, indicating growing investor confidence.

- 2026: Doubling down, the forecast suggests a range of $7.00 to $10.50, with an average price of $8.75, as Ethena continues to expand its ecosystem.

- Monthly Predictions for 2024:

- From April to December 2024, a consistent forecast shows a minimum, average, and maximum price of $1.01, indicating a stable period post-launch before the anticipated growth.

This data not only provides a comprehensive overview of Ethena’s price expectations but also underscores the importance of fundamental analysis and machine learning models in price forecasting. The steady increase in price predictions over the years reflects a combination of Ethena’s robust operational framework, innovative financial offerings, and the growing adoption of cryptocurrency as a viable financial asset. Investors and enthusiasts should consider these projections as part of their broader strategy, keeping in mind the inherent volatility of the cryptocurrency market and the unique opportunities it presents.

Conclusion

Through an in-depth exploration of Ethena (ENA), it’s evident that this dynamic cryptocurrency holds significant promise within the decentralized finance landscape. From its innovative governance model and financial offerings to its strategic integration into Binance Launchpool, ENA stands poised for significant growth. The forecasts from 2024 to 2030 depict a trajectory of appreciation, emphasizing the role of comprehensive analysis and understanding of market dynamics in navigating investments in ENA. Such insights not only illuminate the potential of ENA but also highlight the evolving narrative of cryptocurrency’s role in reshaping our financial systems.

As we consider ENA’s journey and the broader implications for investors and the DeFi ecosystem, it’s crucial to remain informed and adaptable. The fluctuations observed in ENA’s early market performance reinforce the importance of strategic investment planning, emphasizing timing, liquidity, and vigilant monitoring of exchange rates. With its solid foundation and the backing of substantial entities, ENA presents a captivating addition to the cryptocurrency markets, offering avenues for both short-term gains and long-term investment strategies. As the digital finance realm continues to evolve, Ethena (ENA) exemplifies the innovative spirit driving this transformation, holding promise for those who navigate its waters with insight and foresight.

FAQs

What is the expected value of one Ethereum by the year 2030?

The anticipated value of one Ethereum by the end of 2030 could reach a high of $26,575.21. As of now, one Ethereum is valued at $3,601.20182536.

Can you provide a realistic forecast for Ethereum’s value in the year 2025?

Unfortunately, the information for Ethereum’s price prediction in 2025 is not provided.

What are the price expectations for Ethereum in the year 2024?

In the short term, Ethereum’s price is expected to trade between $3,400 and $3,600 in March 2024. These figures could vary based on overall market sentiment and the impact of the Ethereum Dencun Upgrade.

What are the price projections for Altcoins in the year 2025?

The price prediction for Altcoins in 2025 has not been specified.