Cryptocurrency custodial services provider Prime Trust has initiated Chapter 11 bankruptcy proceedings in Delaware following a prolonged period of inability to meet customer withdrawal demands. This financial turmoil has led the company to file for bankruptcy protection, revealing substantial debts and liabilities compared to its assets. The move highlights the challenges inherent in the rapidly evolving crypto landscape and underscores the importance of financial stability in this sector.

Prime Trust’s Bankruptcy Filing and Financial Woes

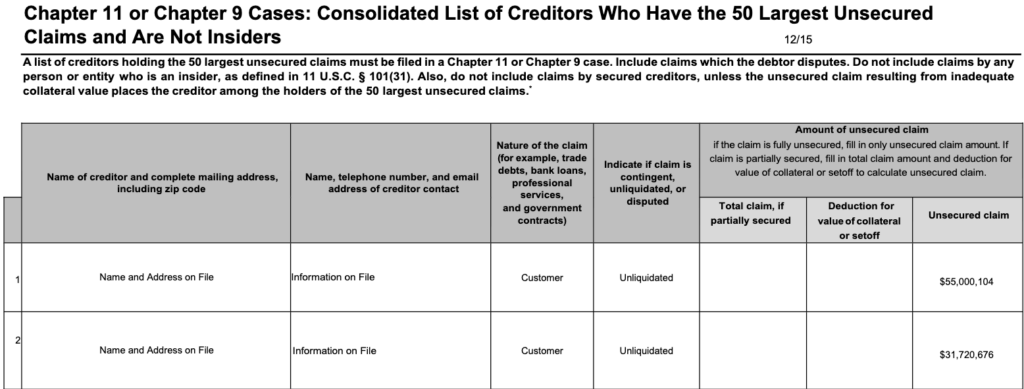

Prime Trust, a key player in the crypto custody space, has taken the drastic step of filing for Chapter 11 bankruptcy protection. This decision arises from its failure to fulfill customer withdrawal requests over the course of several months. The filing, made on August 15, reveals the company’s alarming financial state, with an estimated 25,000 to 50,000 creditors and liabilities ranging from $100 million to $500 million. In contrast, its estimated assets stand at a mere $50 million to $100 million.

The accompanying press release from the custodial services provider outlines the company’s intentions in the midst of this crisis. It plans to present motions to the Bankruptcy Court, aiming to streamline an evaluation of various strategic alternatives. This includes the potential sale of the company’s assets and ongoing operations. Furthermore, the company emphasizes its commitment to its employees by seeking approval to continue disbursing wages and benefits during this challenging period.

Read more: Prime Trust Placed into Receivership as Regulators Take Over

Precipitating Factors and Regulatory Intervention

Their bankruptcy filing follows regulatory intervention and adverse developments that have significantly impacted its financial stability. The company had previously faced regulatory action from Nevada’s business authority, which issued a cease and desist order on June 21. The order was issued due to Prime Trust’s critically deficient financial condition, causing it to fail in meeting customer withdrawal requests. Subsequently, on June 26, Nevada’s regulator sought legal recourse to place Prime Trust into receivership, a request that was approved on July 18.

The catalyst for this regulatory intervention was Prime Trust’s precarious financial position. The company’s fiat liabilities had ballooned to over $85 million owed to clients, whereas its available funds were a mere $2.9 million. The digital asset side of its balance sheet painted a similar picture, with Prime Trust owing approximately $69.5 million in cryptocurrency and holding only around $68.6 million.

Related: TrueUSD – A Highly Regarded Stablecoin by Binance Temporarily Pauses TUSD Minting Via Prime Trust

Conclusion

Prime Trust’s Chapter 11 bankruptcy filing underscores the challenges that crypto custodians and financial service providers can face in the volatile digital asset industry. The inability to meet customer demands, coupled with regulatory scrutiny, has led the company down the path of bankruptcy protection. As the proceedings unfold, the industry will closely monitor Prime Trust’s efforts to navigate this financial crisis, as well as the broader implications for the regulatory framework surrounding crypto custody and financial stability.