Prime Trust, a custodial company in the cryptocurrency industry, has been placed into receivership by the Nevada Financial Institutions Division (FID). The FID has taken control of the company’s operations to protect the interests and assets of Prime Trust’s customers. This development follows the discovery of significant financial deficits and an inability to meet customer withdrawal requests.

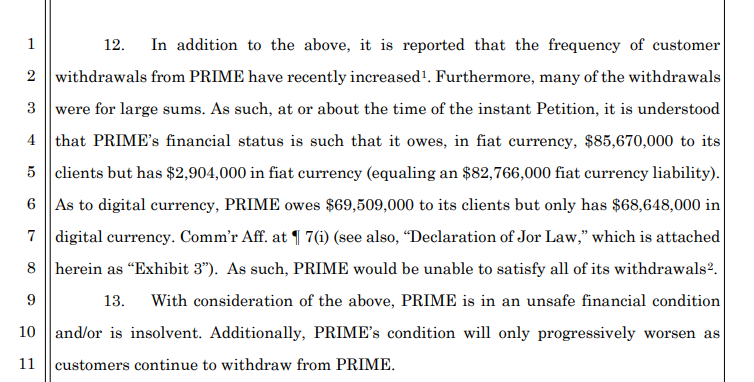

Prime Trust Owes Customers $85 Million but Only Has $3 Million on Hand

It finds itself in a precarious situation as it faces an outstanding debt of $85 million owed to its customers. However, the company has a mere $3 million in available cash, resulting in a significant shortfall. Furthermore, the company holds approximately $68.6 million worth of crypto assets, with the majority represented by Token $AUDIO, accounting for around $60 million.

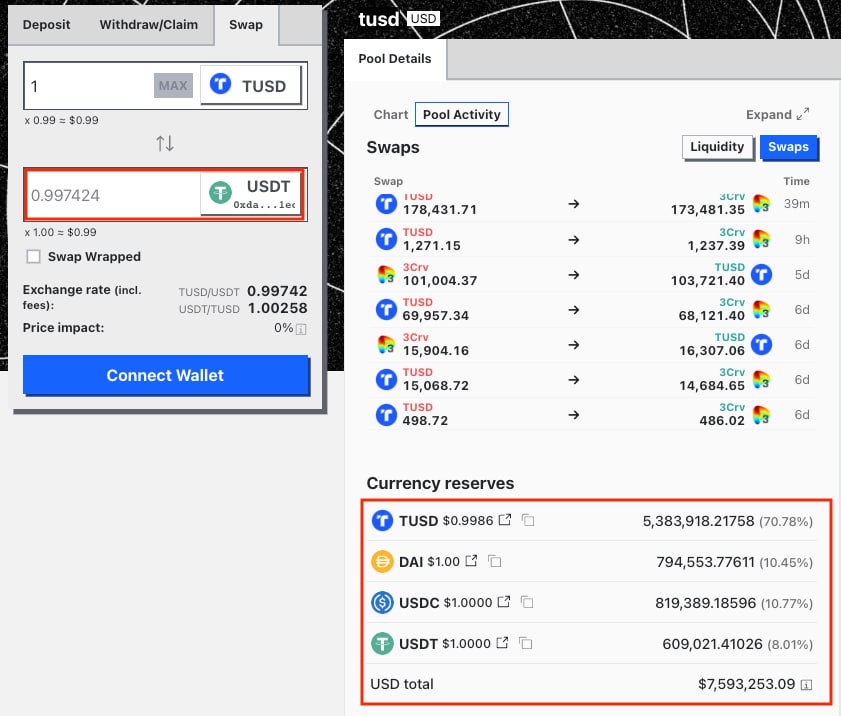

Furthermore, the TUSD pool on Curve is currently facing an imbalance between four stablecoins, namely TUSD, DAI, USDT, and USDC, with the TUSD ratio surpassing 70% and resulting in a slight deviation from its peg.

The court filing reveals alarming financial gaps within Prime Trust’s operations. The company only holds approximately 3.5% of the $85 million owed to its clients in fiat currency, leaving a significant cash shortfall. Additionally, there is a $900,000 shortfall in crypto assets. The financial infrastructure API company’s equity deficit stands at $12 million, while challenges persist in accessing some of its crypto wallets.

Nevada’s FID Takes Control, Halts Operations, and Seeks a Receiver

Following the discovery of financial deficiencies, the Nevada Financial Institutions Division (FID) has intervened by placing Prime Trust into receivership. The FID has halted the company’s operations and is seeking a receiver to oversee its affairs. The regulator’s action comes shortly after custodian BitGo withdrew its bid to acquire Prime Trust and follows a cease-and-desist order due to concerns of insolvency.

Read more: TrueUSD – A Highly Regarded Stablecoin by Binance Temporarily Pauses TUSD Minting Via Prime Trust

Conclusion

Prime Trust’s placement into receivership by the Nevada Financial Institutions Division signifies the severity of its financial woes and inability to meet customer obligations. The intervention aims to protect customers’ interests and assets, with a receiver appointed to assess the company’s finances and determine the best course of action. The situation serves as a reminder of the risks involved in the cryptocurrency industry and highlights the importance of regulatory oversight to safeguard investors.