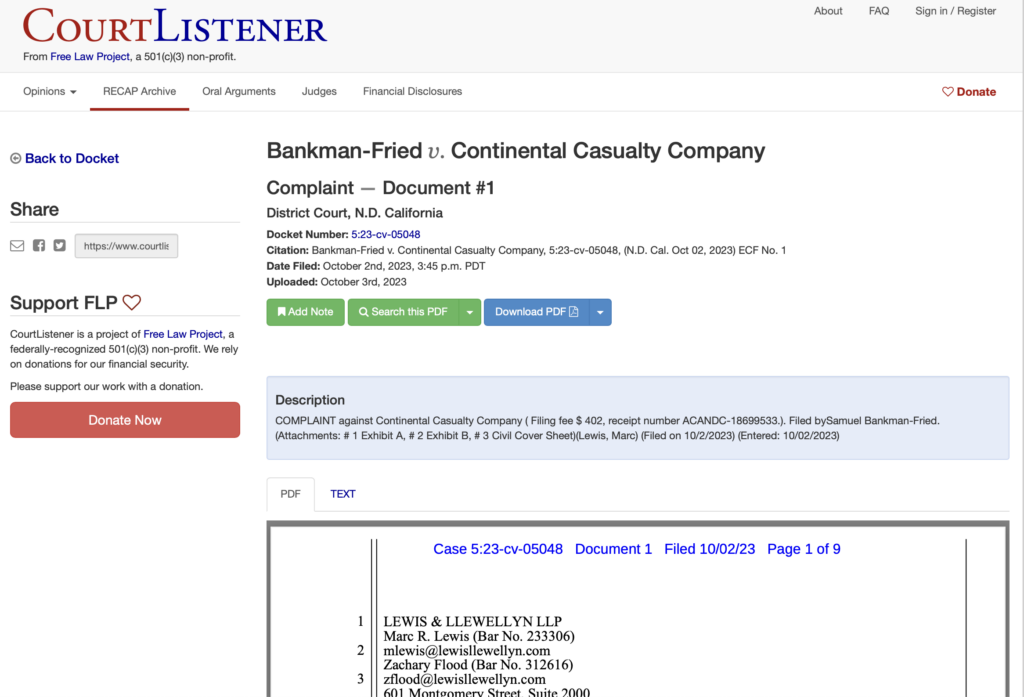

In a dramatic turn of events preceding Sam Bankman-Fried‘s trial in Manhattan, a legal saga is underway as the former FTX CEO files a lawsuit against Continental Casualty insurance company in the United States District Court of Northern California. Bankman-Fried alleges that the insurer, a provider for FTX Trading parent Paper Bird’s directors and officers (D&O) insurance, is refusing to fulfill its obligation. This lawsuit sheds light on the complexities of insurance policies and the challenges faced by individuals entangled in legal battles.

The Complexities of Sam Bankman-Fried’s D&O Insurance Policies

The heart of the matter lies in the intricate web of D&O insurance policies. Bankman-Fried’s defense costs were initially covered by two primary insurers, Beazley and QBE, providing a total of $10 million. Continental Casualty’s policy, intended to contribute an additional $5 million, has become contentious. D&O insurance, designed to protect directors and officers from personal losses during legal suits, operates on a tiered structure. In this case, the layers of policies and their interplay have led to a complex legal dispute.

Read more: DOJ Seeks Revocation of Sam Bankman-Fried’s Bail Over Allegations

Hiscox Syndicates Enters the Legal Fray

Adding another layer of complexity, Hiscox Syndicates, the third provider in Paper Bird’s D&O insurance tower, has also become embroiled in legal action. Hiscox filed an interpleader against Paper Bird and several insured individuals, including Bankman-Fried. This move aims to facilitate a fair disbursement of policy funds, illustrating the challenges faced by insurance companies and policyholders alike in determining liability and coverage in intricate legal scenarios.

Conclusion

The legal battle surrounding Sam Bankman-Fried’s defense costs underscores the intricate nature of D&O insurance policies and the complexities individuals face when navigating legal disputes. As the case unfolds in court, it serves as a reminder of the importance of clarity and transparency in insurance contracts. The outcome of this lawsuit will undoubtedly have implications for both policyholders and insurers, shaping future interpretations of D&O insurance agreements in similar legal contexts.

![Justin Sun Net Worth ([currentyear]): Where Does All Money Come From? 6 Justin Sun Net Worth Featured Image](https://coinwire.com/wp-content/uploads/2024/05/justin-sun-net-worth-featured-image-1024x683.jpg)