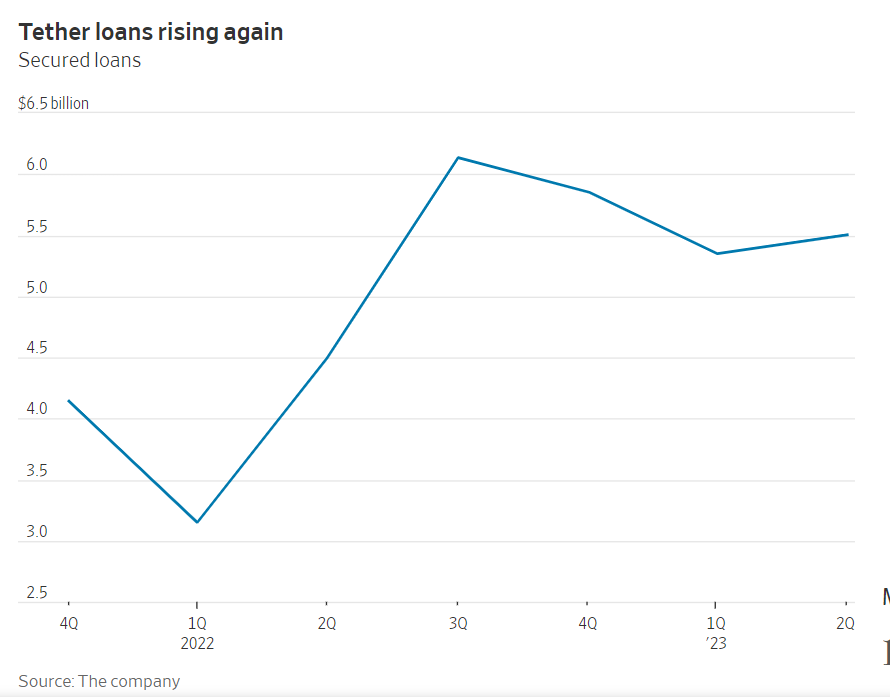

Tether, the leading issuer of stablecoins in the cryptocurrency market, has witnessed a notable increase in its stablecoin lending activities during 2023, despite a previous announcement in December 2022 stating its intention to phase out such loans by the end of that year. In its latest quarterly report, the company disclosed that its loan assets had risen to $5.5 billion as of June 30, up from $5.3 billion in the previous quarter. The company clarified that these new loans were provided at the request of long-standing partners, emphasizing its commitment to reducing these loans to zero by 2024.

Unforeseen Growth in Stablecoin Loans

The company’s unexpected growth in stablecoin lending during 2023 was attributed to short-term loan requests from trusted clients with whom the company has fostered enduring relationships. Despite its earlier announcement to discontinue this lending practice, Tether maintained its promise to eliminate such loans from its portfolio entirely within the next few years.

Stablecoin loans had emerged as a popular financial product offered by Tether, allowing users to borrow USDT in exchange for collateral. Nevertheless, these secured loans faced controversy primarily due to concerns about transparency surrounding the collateral and the borrowers.

Read more: Tether CTO Keeps Bitcoin Mining Locations Under Wraps

Controversy Surrounding Tether’s Stablecoin Loans

In December 2022, a report by The Wall Street Journal raised doubts about these lending products, asserting that the loans were not fully backed by collateral. The article questioned Tether’s ability to meet redemption demands during times of financial uncertainty.

In response to these controversies, the company addressed the concerns in 2022, labeling them as “FUD” (Fear, Uncertainty, Doubt) and asserting that the loans were actually overcollateralized. Subsequently, the company announced its intention to phase out secured loans in 2023.

Conclusion

Despite previous plans to reduce and eventually eliminate stablecoin loans, Tether has seen an increase in lending activities in 2023 due to short-term client requests. The company remains steadfast in its commitment to gradually eliminate these loans from its portfolio by 2024. As Tether continues to evolve and adapt to market dynamics, the controversy surrounding stablecoin loans underscores the ongoing challenges and debates surrounding transparency and stability in the cryptocurrency ecosystem.