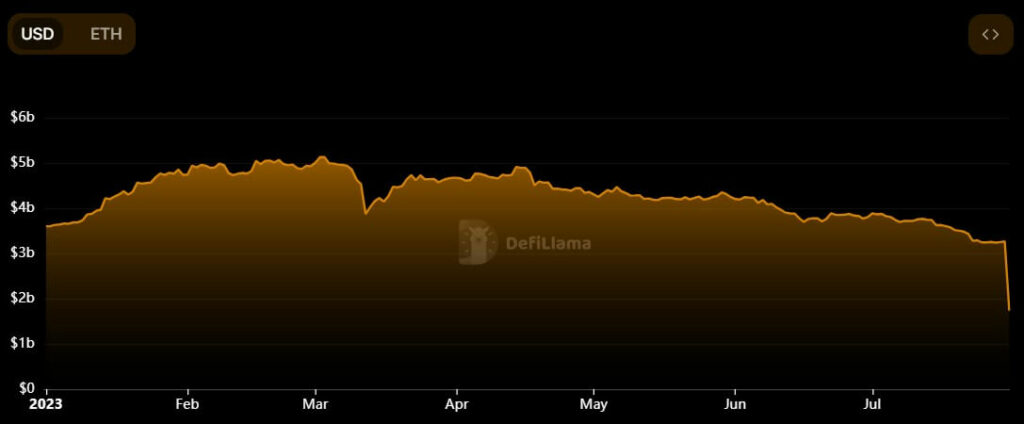

Curve Finance, a popular decentralized finance (DeFi) protocol, recently came under scrutiny following a significant reduction in the total value of assets locked in. In a span of 24 hours, the total value dropped nearly 50%, from $3.26 billion to $1.731 billion, according to data from DeFiLlama. This sudden exit has raised numerous questions, and in this article, we delve into the reasons and repercussions of this event.

Understanding the Exodus: The Why and the How

The steep decline is attributable to an exploit in the protocol, which left users fearing potential liquidation and bad debt. Consequently, community members hastily withdrew their assets from the crypto project. The exploit in question relates to the ‘reentrancy lock vulnerability’ found in multiple versions of Vyper, a smart contract language for Ethereum’s virtual machine (EVM).

The Extent of the Damage

While the exact amount stolen from Curve Finance’s stablecoin pools remains unclear, estimates suggest that the figure could be as high as $70 million. However, Taylor Monahan, a MetaMask developer, noted that there was “lots of whitehat activity + automated MEV bots,” implying that the stolen amount might be lesser.

The Impact on Curve Finance $CRV’s Price

The exploit led to high volatility in Curve’s native token, CRV. It witnessed a significant dip of around 15% to $0.64707, according to data from CryptoSlate. Additionally, CRV’s on-chain value hit lows of $0.109 as liquidity dwindled post the attack on the CRV/ETH pool.

Conclusion

The incident at Curve Finance highlights the inherent risks associated with DeFi protocols. While the industry offers numerous opportunities for growth and innovation, it is crucial for investors and participants to be aware of the potential vulnerabilities and take necessary precautions. As the field continues to evolve, it is hoped that such exploitations will be minimized, and confidence in the DeFi ecosystem will be restored.

![Bybit vs BingX [currentyear]: Which Exchange is Better? 12 Bybit Vs Bingx](https://coinwire.com/wp-content/uploads/2024/05/bybit-vs-bingx-1024x683.jpg)