Ether.Fi stands at the forefront of decentralized finance (DeFi) protocols, introducing a novel approach to staking with its non-custodial, decentralized delegated staking protocol and a Liquid Staking Derivative token. As a part of the rapidly growing ecosystem, Ether.Fi allows you to maintain full control over your keys while benefiting from increased yields through Eigenlayer’s native re-staking feature, maximizing your staking rewards. Moreover, the Eth.Fi token, adhering to the ERC20 standard on Ethereum, plays a pivotal role in governance, protocol upgrades, and fee distributions within the ecosystem.

As the DeFi space continues to evolve, Eth.Fi’s commitment to decentralization, sustainability, and community focus heralds a new era for staking on Ethereum.By enabling key control for stakers and simplifying the Ethereum staking experience, Ether.Fi differentiates itself significantly. Whether it’s getting to know the Eth.Fi, participating in the Binance Launchpool, looking into the airdrop, or maximizing staking rewards, this article will guide you through the essentials you need to know about the Eth.Fi.

What is Ether.fi?

Ether.Fi emerges as a groundbreaking staking protocol, enabling users to fully control their keys and assets while engaging in ETH staking activities. This innovative approach is facilitated by allowing funds to be deposited into Ether.Fi to be effortlessly re-staked using Eigenlayer. This mechanism not only strengthens external systems, such as rollups and oracles, but also amplifies yields for ETH stakers, marking a significant advancement in the DeFi sector.

Key features of Ether.Fi include:

- Decentralized and Non-Custodial Nature: As a decentralized, non-custodial delegated staking protocol for Ethereum, Ether.Fi ensures that stakers retain control over their keys. This distinctive feature sets it apart in the DeFi landscape, emphasizing user autonomy and security.

- Innovative Liquid Staking Token (LST): The introduction of a Liquid Staking Token, specifically eETH, by Ether.Fi, represents a pivotal development. This token facilitates a more flexible approach to staking, accommodating the needs of diverse participants.

- Comprehensive Staking Solutions: Ether.Fi operates through three strategic phases – delegated staking, liquidity pool, and node services. This comprehensive approach allows for staking in multiples of 32 ETH or participation in a liquidity pool with less than 32 ETH, catering to a wide range of staking preferences and capacities.

Furthermore, Ether.Fi stands as the largest liquid restaking protocol by total value locked, boasting over $2.51 billion. This achievement underscores the protocol’s robustness and the trust it has garnered within the community. The commitment to decentralization, sustainability, and community focus remains at the core of Ether.Fi’s values, guiding its operations and future expansions, including the planned incorporation of node services leveraging NFTs for economic incentives.

In essence, Ether.Fi not only simplifies the Ethereum staking process but also enhances it through Distributed Validator Technology (DVT), which lowers the barriers to becoming a solo node operator. This, along with the ability for eETH holders to earn additional rewards through native re-staking, illustrates Ether.Fi’s dedication to rewarding its ecosystem and supporting the broader Ethereum community.

Eth.Fi Tokenomics

The tokenomics of Eth.Fi are designed with a comprehensive strategy aimed at fostering a balanced and sustainable ecosystem for its users and stakeholders. Here’s a detailed breakdown:

- Total Supply and Circulation:

- The maximum token supply of Eth.Fi is set at 1 billion tokens, with an initial circulating supply of approximately 115.2 million, representing 11.52% of the maximum supply. This initial allocation was made available when Eth.Fi was listed on Binance, the world’s largest cryptocurrency exchange by trading volume.

- A significant portion of the tokens, 20 million (2% of the total supply), is allocated for the Launchpool campaign, allowing users to farm Eth.Fi tokens by staking BNB and FDUSD.

- The remaining tokens are scheduled to be unlocked by the start of 2028, adhering to a release schedule detailed in the Binance Research Report.

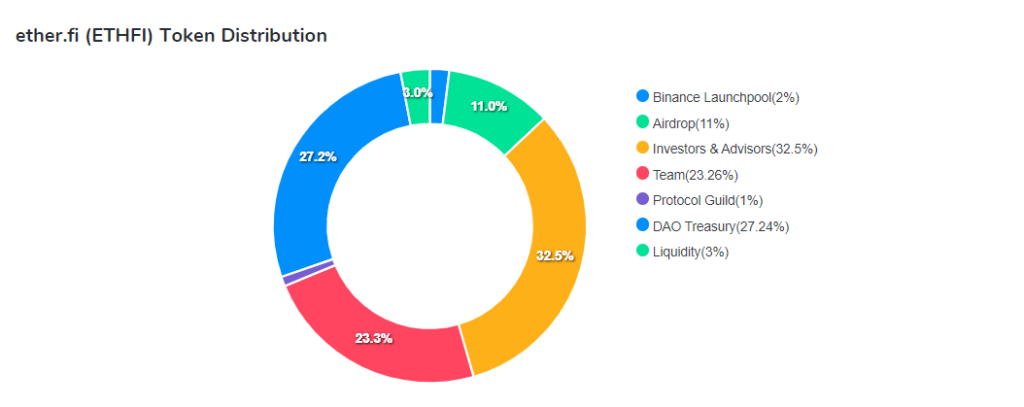

- Distribution Strategy:

- Investors and advisors are allocated a third of the entire supply, amounting to 325 million tokens (32.5%)

- The team is allocated 232.6 million tokens (23.26%), with the rest distributed among the protocol guild (1%), the DAO treasury (27.24%), liquidity (3%), and the airdrop initiative (11%)

- Governance plays a pivotal role in the Eth.Fi ecosystem, where the token grants the community the power to make decisions regarding the Eth.Fi treasury, protocol upgrades, and fee distribution.

- Staking and Validator Incentives:

- Eth.Fi introduces Distributed Validator Technology (DVT) to enhance the security and operations of validators within the Ethereum network, promoting international decentralization and reducing reliance on centralized data centers.

- Permissionless users who stake a 2 ETH bond can run a validator, while permissioned users can operate a node without this bond, adhering to specific criteria including staking experience and a robust internet connection.

- Rewards are distributed among stakers, node operators, and the protocol at rates of 90%, 5%, and 5% respectively, with node operators receiving their payments quarterly.

This strategic approach to tokenomics and rewards distribution underscores Eth.Fi’s commitment to creating a secure, decentralized, and community-driven ecosystem.

ether.fi Token Binance IEO Details

| Token Name | Eth.Fi |

| Token Type | ERC-20 |

| Initial Circ. Supply When Listed on Binance | 115,200,000 (11.52% of total supply) |

| Total and Maximum Token Supply | 1,000,000,000 |

| Binance Launchpool Allocation | 20,000,000 (2% of total supply) |

| Binance Launchpool Start Date | March 14, 2024 |

| Hourly Hard Cap per User | 16,666.66 Eth.Fi in BNB pool, 4,166.66 Eth.Fi in FDUSD pool |

ether.fi (Eth.Fi)’s Investors

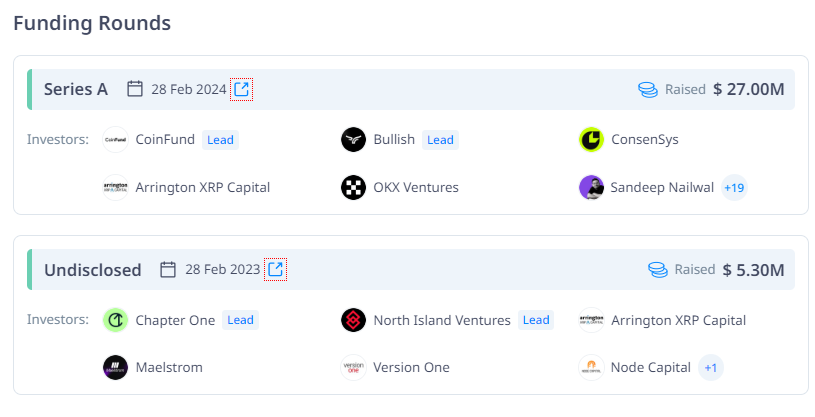

According to the official announcement, ether.fi has successfully raised $32.3 million in capital through 2 rounds from major investment funds in the crypto market. Particularly, this liquidity staking protocol finished the seed round on Feb-2023 with a total raised of $5.3M, led by North Island Ventures and Chapter One. The Series A is finished with a total raise of $27M, led by CoinFund and Bullish.

Security Measures

Eth.Fi prioritizes security through a transparent and accessible approach to its source code and operational status. The project’s source code is hosted on multiple platforms including Codeberg, GitHub, Mirror 1, and Mirror 2, ensuring transparency and the ability for independent verification by users and developers alike. Additionally, Eth.Fi maintains a dedicated status page, providing real-time updates on the system’s health and any issues that might affect its operation. This level of openness is crucial for trust and reliability within the DeFi community.

In terms of website security and user privacy, Eth.Fi employs a comprehensive cookie strategy to enhance user experience while safeguarding personal information. The website uses necessary cookies for essential functions, preference cookies to remember user settings, statistics cookies for anonymous analytics, and marketing cookies to offer personalized advertisements. This approach not only complies with privacy regulations but also aligns with best practices for online security and user data protection.

To further bolster the security of its ecosystem, Eth.Fi follows rigorous practices in Ethereum smart contract programming. This includes using the latest version of Solidity, thorough testing and verification of code through frameworks like Truffle, Hardhat, or Remix, and employing security patterns such as Checks-Effects-Interactions and Circuit Breakers. External audits and bug bounties are also part of Eth.Fi’s strategy to ensure the integrity and security of its contracts, demonstrating a proactive stance on safeguarding user assets and interactions within the platform.

Guide to get the $Eth.Fi from Binance Launchpool

To celebrate the 49th project on Binance Launchpool, Binance is allowing their users to farm Eth.Fi tokens in separate pools by staking the BNB and staking FDUSD in four days, starting from 2024-03-14 00:00 (UTC) to 2024-03-17 23:59 (UTC).

A total of 20,000,000 Eth.Fi tokens, which is 2% of the token’s maximum supply, are allocated for rewards in the Launchpool. Participants can choose to stake their tokens in one pool at a time but have the flexibility to reallocate their assets between the two pools as desired.

Eth.Fi Farming Details

| Dates | Total Rewards | BNB Pool Rewards (Eth.Fi) | FDUSD Pool Rewards (Eth.Fi) |

| Mrrch-14 – March-17 | 20,000,000 Eth.Fi | 16,000,000 Eth.Fi | 4,000,000 Eth.Fi |

(Note: If you do not have a Binance account, you can register via CoinWire’code to gain -10% trading fee)

Join Binance Community Now for the Latest Updates

- https://www.binance.com/en/community

- https://bit.ly/BinanceVietnamTelegram (for Vietnamese community)

Use Cases and Applications

Ether.Fi’s roadmap showcases a strategic plan to introduce a suite of products named Stake, Liquid, and Cash, each designed to enhance the user experience within the DeFi space. These products aim to streamline the process of staking, liquidity provision, and digital currency transactions, reflecting the platform’s commitment to innovation and user-centric development.

In the realm of earning opportunities within the cryptocurrency sector, Ether.Fi extends a comprehensive array of options:

- Airdrops: Users can participate in various airdrop campaigns, including DeFi airdrops, NFT airdrops, and those specifically featured or upcoming. This array ensures participants have access to a wide range of earning opportunities through new and past airdrops, fostering engagement and reward within the community.

- Earning Mechanisms: Beyond airdrops, Ether.Fi provides information on a multitude of earning mechanisms. These include earning with NFTs, DeFi protocols, learn & earn programs, affiliate programs, liquidity mining, play & earn activities, and distinguishing between airdrops & bounties. Such diversity in earning methods caters to users with different interests and capabilities, broadening the scope of engagement within the platform.

This multifaceted approach not only enriches the user experience by offering various avenues for engagement and earning but also positions Ether.Fi as a comprehensive platform for users seeking to maximize their cryptocurrency endeavors.

Conclusion

Ether.Fi establishes itself as a formidable force within the decentralized finance space, emphasizing user autonomy, enhanced security, and a community-driven approach to staking on the Ethereum network. By integrating innovative features such as its non-custodial decentralized delegated staking protocol, the Liquid Staking Token (LST), and the utilization of Distributed Validator Technology (DVT), Ether.Fi significantly improves the staking experience for its users.

Moreover, the Eth.Fi token plays a vital role in governance, protocol upgrades, and the distribution of fees, further solidifying its utility and importance within the ecosystem. The platform’s dedication to maximizing yields for Ethereum stakers while ensuring control and flexibility showcases its potential to positively impact the broader DeFi landscape.

As we reflect on the functionalities, security measures, and strategic direction of Ether.Fi, it becomes clear that it represents more than just a staking platform; it embodies the future of decentralized finance. Emphasizing decentralization, security, and community engagement, Ether.Fi not only simplifies the Ethereum staking process but considerably enhances it.

Looking ahead, the implications of Ether.Fi’s advancements are vast, promising a more accessible, secure, and rewarding staking ecosystem. As the platform continues to evolve and expand its offerings, it undoubtedly paves the way for further innovation within the DeFi space, fostering a more inclusive and resilient Ethereum blockchain ecosystem.

FAQs

Can you explain what Eth.Fi is?

Ether.Fi (Eth.Fi) is a groundbreaking staking protocol designed for the Ethereum blockchain that prioritizes decentralized, non-custodial practices. It allows users to participate in staking while retaining full control over their private keys, meaning they do not have to relinquish possession of their assets to take part in the staking process.

![Bybit Review [currentyear]: Exchange Features, Fee, Pros and Cons 13 Bybit Featured Image](https://coinwire.com/wp-content/uploads/2022/06/Bybit-review-1024x683.png)