A recent Forbes report has raised questions about the transparency of Binance’s initial coin offering (ICO) for Binance Coin (BNB) in 2017. The report alleges that Binance, one of the world’s largest cryptocurrency exchanges, may have significantly overstated the success of its ICO, leading to concerns about the accuracy of token allocations and the amount raised. These findings have sparked intense scrutiny within the cryptocurrency community, casting a shadow on Binance’s credibility.

Unveiling Discrepancies in Token Allocations

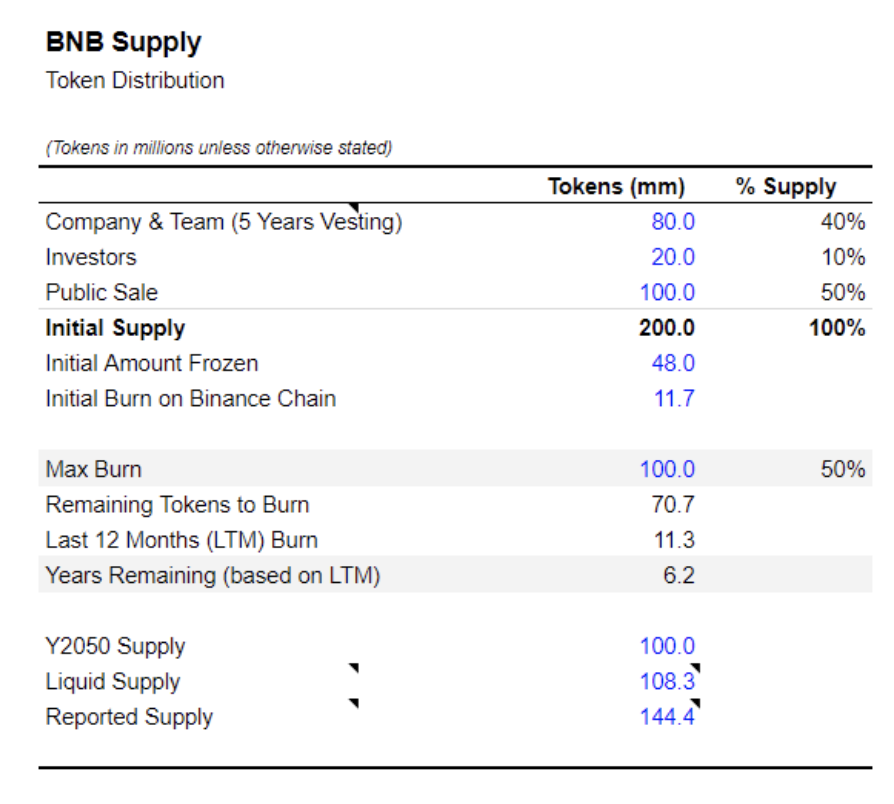

According to the investigative report, Binance’s ICO for BNB, which was conducted in July 2017, purportedly raised $15 million, with ICO investors receiving 100 million BNB tokens. However, the investigation revealed a stark contrast. ICO investors allegedly received only 10.78 million BNB, a mere fraction of the promised amount. Additionally, angel investors reportedly received 40 million BNB tokens, double the initially stated allocation of 20 million tokens. This significant disparity between the promised and actual token allocations has raised concerns about Binance’s integrity and transparency during its ICO.

Read more: Binance Halts BUSD Lending: What’s next?

Binance’s Potential Control of Billions in BNB

The discrepancies in token allocations suggest that Binance and its members might control a staggering amount of BNB tokens, potentially up to 65 million unsold tokens in addition to the 80 million BNB allocated for the exchange and its executives. Blockchain analysis conducted in the wake of these allegations revealed that suspected Binance wallets held approximately 63.1 million BNB, amounting to a jaw-dropping $15.7 billion. When combined with known wallets, Binance’s total control extends to 116.9 million tokens, valued at $27.3 billion. These findings have raised concerns about the concentration of power within Binance and its potential impact on the cryptocurrency market.

Read more: Binance Referral Code (Oct 2023): $100 Welcome Bonus

Conclusion

The revelations from the Forbes report have sent shockwaves throughout the cryptocurrency industry, prompting questions about Binance’s credibility and the need for greater transparency in ICO processes. As one of the leading cryptocurrency exchanges, Binance plays a pivotal role in shaping the market. The alleged discrepancies in its ICO raise concerns about investor trust and market fairness, emphasizing the importance of regulatory oversight and transparency in the evolving world of digital assets. As the cryptocurrency community grapples with these revelations, the spotlight is now firmly on Binance, urging the exchange to address these concerns and restore faith among investors and enthusiasts alike.