Bitcoin (BTC) reached a historic milestone on March 8, surging to an all-time high of $70,184 on Bitstamp. The cryptocurrency’s impressive rally was catalyzed by unexpected developments in the United States job market, causing a ripple effect across the financial landscape. As Bitcoin enthusiasts celebrate the new record, market dynamics are shifting, prompting a reassessment of cycle dynamics and raising questions about the cryptocurrency‘s future trajectory.

U.S. Unemployment Data Fuels Bitcoin Bull Run

The buoyant BTC price action was directly influenced by the latest United States jobless data, which exceeded expectations for February. The national unemployment rate rose to 3.9%, surpassing forecasts by 0.2%. This unexpected increase suggested that inflationary pressures were easing, likely due to the implementation of restrictive economic policies. In response, Bitcoin and other altcoins followed equities in a risk-asset revival, with Bitcoin hitting the $70,000 mark for the first time in history. Market participants, noting the significance of these developments, emphasized that Bitcoin might be heading towards a macro cycle top sooner than previously anticipated.

Read more: Bitcoin Smashes Records, Surpasses $69,000

U.S. Dollar Weakens Amidst Bitcoin Surge

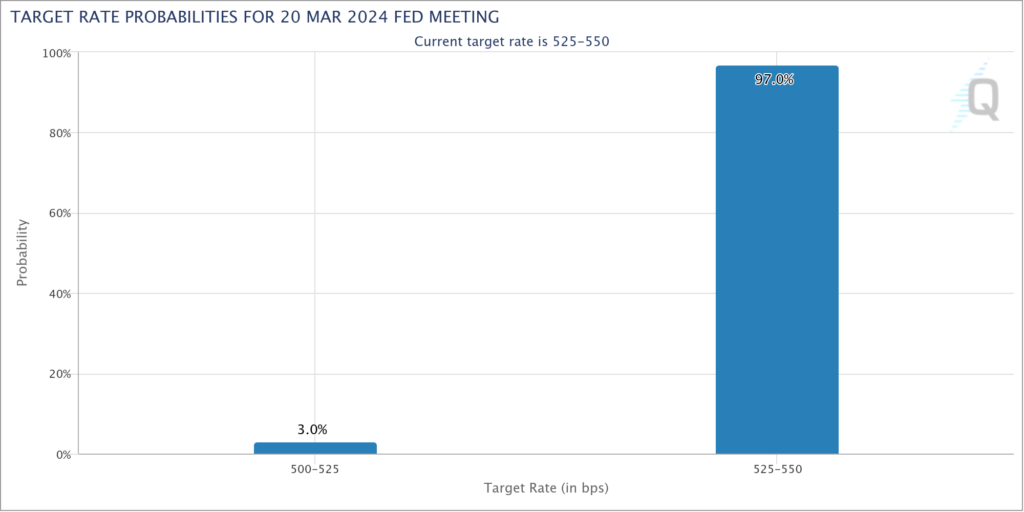

Simultaneously, the rally in Bitcoin dealt a blow to the strength of the U.S. dollar. The U.S. dollar index (DXY) experienced a sharp decline, reaching its lowest levels in two months at 102.36. This marked a nearly 5% decrease from its year-to-date highs. The unexpected rise in unemployment prompted speculation about potential interest rate cuts, affecting the dollar’s standing in the global market. With the Federal Reserve’s decision on interest rates scheduled for March 20, the market remains on edge, although current estimates from CME Group’s FedWatch Tool suggest only a 3% likelihood of a rate cut. Federal Reserve officials, including Chair Jerome Powell, have maintained a cautious stance on future policy timing in their recent communications.

Read more: Bitcoin’s Meteoric Rise: Insanely Bullish Factors Driving the Bull Market

Conclusion

As Bitcoin continues to rewrite historical precedents, its ascent to $70,000 is not just a testament to its resilience but also a reflection of the interconnected nature of global financial markets. The unexpected impact of U.S. unemployment data on both Bitcoin and the U.S. dollar underscores the intricate relationship between traditional and digital assets. As market participants grapple with the evolving dynamics, the question of Bitcoin’s long-term trajectory takes center stage, with the looming Fed decision adding an additional layer of uncertainty to the current landscape.