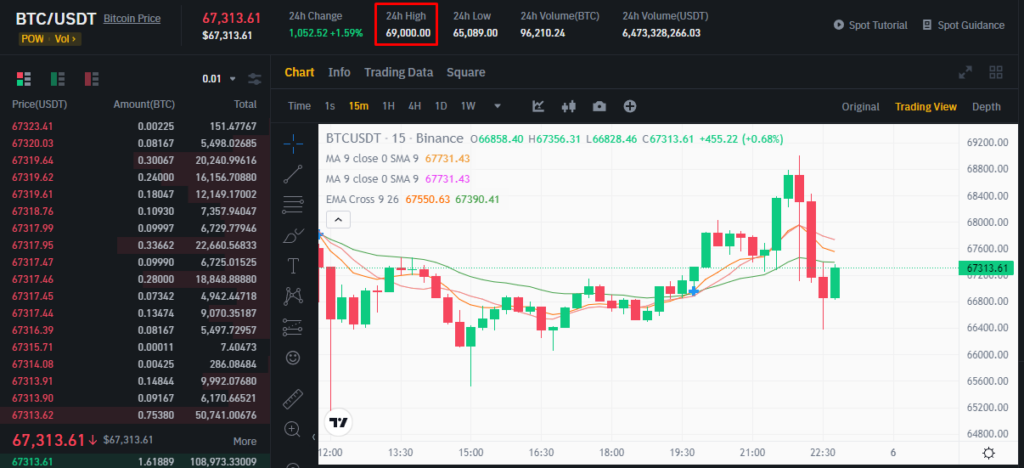

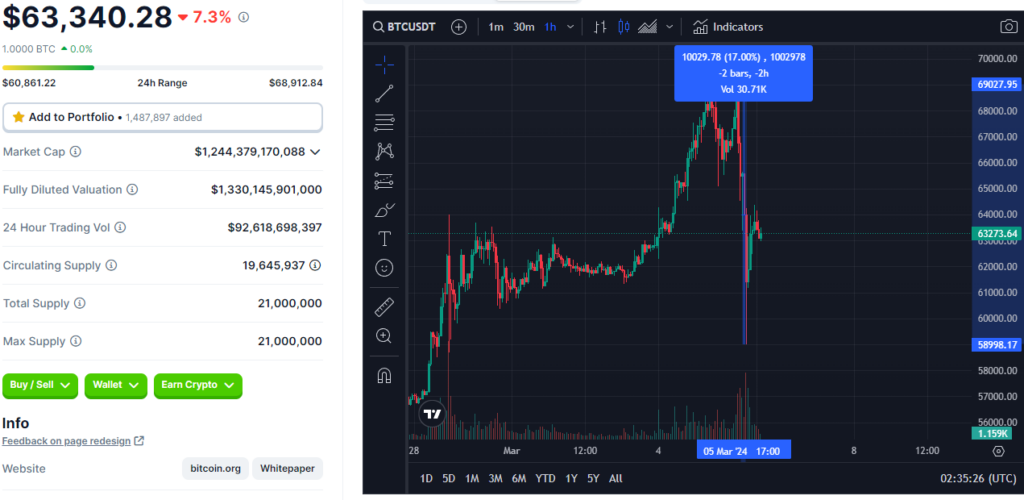

Bitcoin has soared to new heights, reaching an all-time high above $69,000 on March 5, backed by a 5% gain in the preceding 24 hours. Analysts are optimistic, asserting that the cryptocurrency’s recent rally may still have room to grow. The surge comes on the heels of a remarkable 21% increase in the past week, surpassing the previous record set at $68,990 on the Coinbase exchange in November 2021. A key catalyst for this surge has been the influx of funds from newly introduced spot Bitcoin exchange-traded funds (ETFs) in the United States, reshaping the landscape of the digital asset market.

ETFs Propel Bitcoin to New Highs

The emergence of exchange-traded funds (ETFs) has played a pivotal role in Bitcoin’s recent surge. These investment vehicles have introduced a wave of passive, price-agnostic demand for the cryptocurrency, further solidifying its status as a store of value. A research report by Bitfinex analysts highlights the ETF-driven demand as a significant factor contributing to Bitcoin’s impressive price appreciation. As of February 15, Bitcoin ETFs accounted for a staggering 75% of new investments in the cryptocurrency when it surpassed the $50,000 mark, according to CryptoQuant research.

However, right after reaching its ATH of $69,000, BTC dropped $10,000 in value to $59,000 and is now being traded at $63,273 at the time of writing this article.

Read more: Bitcoin’s Meteoric Rise: Insanely Bullish Factors Driving the Bull Market

Analysts’ Projections and Potential Challenges

The optimism surrounding Bitcoin’s current trajectory is supported by analysts projecting a conservative price objective of $100,000-$120,000 by the fourth quarter of 2024. The cycle peak is anticipated to be achieved sometime in 2025 in terms of the total crypto market capitalization. Analysts also suggest that the advent of spot ETFs may mitigate downside volatility, offering a more stable trajectory following market peaks. However, amidst this positive outlook, concerns about potential volatility after the upcoming halving persist. Paul Eisma, head of options trading at XBTO Futures, cautions that the simultaneous impact of the halving’s deflationary supply and ongoing demand shock from ETFs could introduce significant fluctuations, with options market indicators suggesting a range of $55,000–$85,000 by December 2024.

Read more: Bitcoin Records Unprecedented Daily Withdrawals as $2 Billion Exits Exchanges

Conclusion

As Bitcoin marks yet another milestone in its illustrious journey, the impact of ETFs on its value becomes increasingly evident. The cryptocurrency’s resilience and potential for sustained growth are highlighted by analysts forecasting a continued rally. However, caution is advised, with the looming specter of potential volatility post-halving. Investors and enthusiasts alike will be closely monitoring these developments as the cryptocurrency market continues to evolve in the face of changing dynamics.