Earlier today, Bitcoin made history by surging to an astounding $35,000, sending shockwaves of excitement through the trading community. This unexpected rally has led experts and enthusiasts alike to dive deep into the intricacies of this momentous achievement. In this article, we meticulously explore the dynamics of Bitcoin’s recent price movement, delving into various theories and market indicators to uncover the underlying forces that propelled Bitcoin to this significant milestone.

Bitcoin’s Unpredictable Trajectory: Deciphering the Mysteries

Bitcoin‘s remarkable ascent to $35,000 has left traders and analysts in awe, sparking intense speculation about the factors driving this surge. One prevailing theory revolves around the concept of a ‘gamma squeeze,’ suggesting that market makers were compelled to adjust their positions, triggering a chain reaction in BTC’s price.

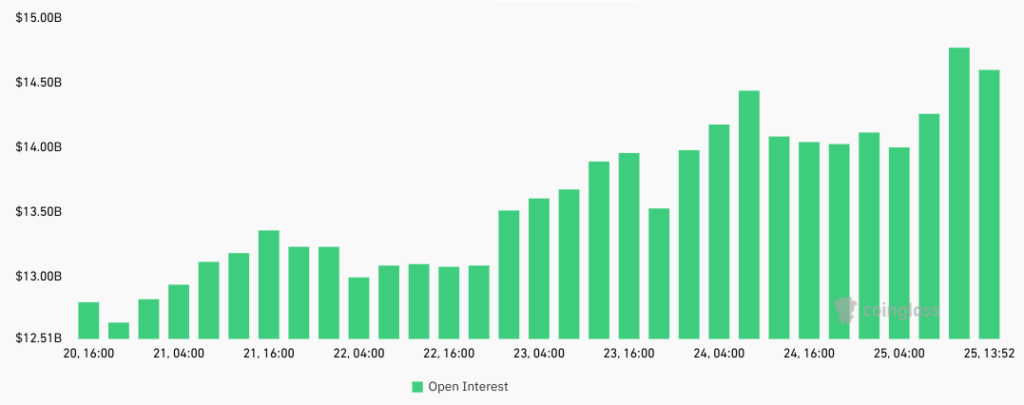

Noteworthy figures within the crypto community, such as NotChaseColeman, have highlighted how arbitrage desks were forced to hedge short positions, fueling the rally. Interestingly, this rally was accompanied by a simultaneous increase in Bitcoin futures open interest, challenging conventional wisdom and adding to the complexity of crypto trading.

Read more: BlackRock’s iShares Bitcoin ETF Resurfaces, Sparking Market Frenzy

BNB, CZ, and Venus Protocol: An Intriguing Intersection

Amidst this whirlwind, intriguing theories have emerged regarding Changpeng “CZ” Zhao‘s strategic moves in the market. Speculations abound about CZ’s utilization of BNB as collateral on Venus Protocol, a decentralized finance platform. Some believe CZ strategically intervened, selling Bitcoin to stabilize positions and later rebalancing it using BNB.

While the specifics of these maneuvers remain mysterious, the sheer volume of BNB supply on the platform hints at the potential impact of these actions. Yet, as compelling as these narratives are, confirming such speculations remains challenging, underscoring the speculative nature of crypto markets.

Conclusion

Bitcoin’s triumphant journey to $35,000 today highlights the unpredictable and fascinating nature of the crypto market. As enthusiasts and experts grapple to comprehend the intricacies of this surge, one thing remains clear: the world of digital currencies continues to surprise and challenge our understanding. While market indicators offer valuable insights, the interplay of factors in this historic rally remains elusive. As the crypto saga unfolds, it reaffirms that predicting the twists and turns of this dynamic landscape is a captivating challenge embraced by all those captivated by the crypto phenomenon.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 11 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 12 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)