The much-anticipated mainnet launch of Blast, an Ethereum layer-2 network, has set off a flurry of activity within the crypto community. With approximately 180,000 users on board, the network has seen a substantial withdrawal of around $400 million in Ether (ETH) immediately following the launch. This development has successfully unlocked nearly $2.3 billion in staked crypto that was previously inaccessible on the network. As the platform gains momentum, it promises users an optimistic rollup blockchain scaler, offering up to a 5% annual percentage yield on Ether and stablecoins.

Blast’s Initial Surge and TVL Milestone

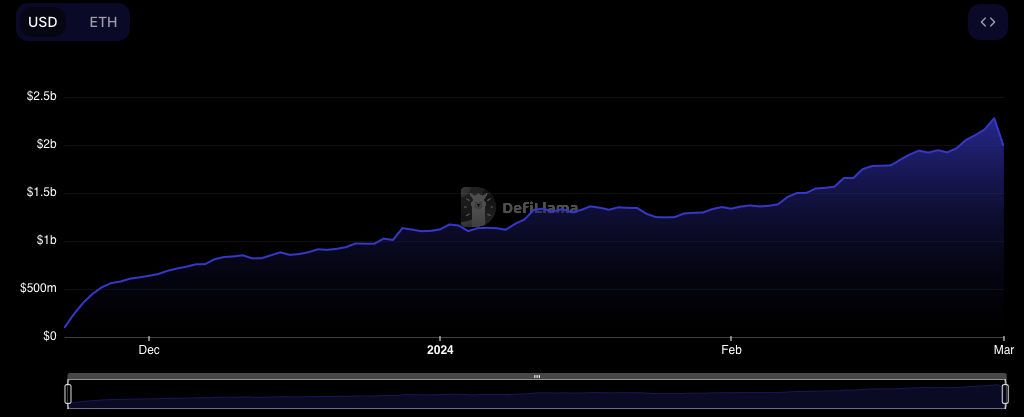

Blast’s mainnet launch on February 29 at 9:00 pm UTC marked a significant turning point for the platform. Users, eager to access their locked crypto, withdrew approximately $400 million, resulting in a total value locked (TVL) of $2.27 billion. However, since the launch, there has been a 17.5% decrease in TVL, settling at $1.87 billion. Notably, the network had surpassed its $2 billion TVL milestone just days before the mainnet launch on February 27. The surge in activity has captured the attention of airdrop hunters, who are now actively farming the network in anticipation of Blast tokens scheduled for release in May.

Read more: a16z Invests $100M in EigenLayer, Ethereum’s Top Restaking Protocol

Controversies and Challenges

Despite its successful mainnet launch, Blast has not been without controversy. Paradigm, a seed investor in Blast, expressed disagreement with the project’s decisions, particularly criticizing the decision to “launch the bridge before the L2” and the choice not to allow withdrawals for three months. The firm believes such actions set a negative precedent for other projects and raised concerns about the marketing strategies employed by Blast. Additionally, the network faced its first alleged exit scam on February 26, when a gambling protocol named “Risk on Blast” vanished with 420 ETH, equivalent to $1.25 million at the time, collected for its RISK presale token.

Read more: Starknet Airdrop Attracts Airdrop Farmers Ahead of Token Launch

Conclusion

Blast’s mainnet launch has undeniably made waves in the crypto space, unlocking billions in staked crypto and attracting significant user attention. As controversies surrounding the launch and early challenges emerge, the project must navigate these hurdles to solidify its position in the ever-evolving decentralized finance landscape. With a planned token release in May, the community eagerly awaits further developments from Blast and how it will address both the opportunities and controversies that accompany its ascent in the crypto ecosystem.

![Best Crypto Exchanges for Day Trading [currentyear] - Top 6 Platforms 8 Best Crypto Exchanges For Day Trading](https://coinwire.com/wp-content/uploads/2023/10/best-crypto-exchanges-for-day-trading-1024x683.jpg)

![Best Free Crypto Sign Up Bonus Offers & Promotions in [currentyear] 9 Best Free Crypto Sign Up Bonus And Promotion](https://coinwire.com/wp-content/uploads/2023/08/free-crypto-sign-up-bonus-1024x683.jpg)