How complicated and time-consuming it can be to keep track of your transactions and calculate your taxes. You have to deal with multiple wallets, exchanges, coins, prices, fees, gains, losses, and more. Also, you have to comply with the tax laws and regulations of your country.

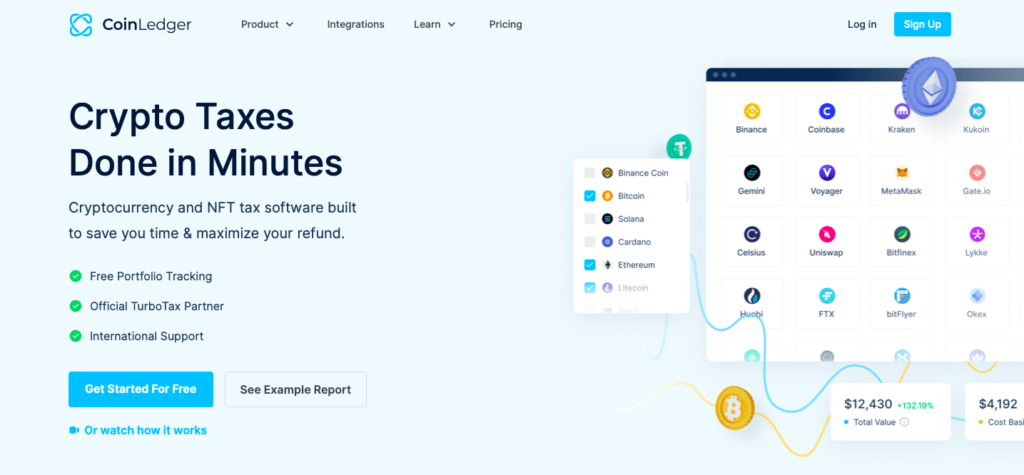

That’s why you need a tool like CoinLedger, a web-based platform that helps you generate your crypto tax reports in minutes.

In this CoinLedger Review, we will be covering its features, pros and cons, limitations, pricing, and how to get started with it.

CoinLedger At a Glance

| Exchanges | Coinbase, Binance, Kraken, Crypto.com, and 200+ other |

| DeFi Apps | Uniswap, OpenSea, etc. |

| Tax Softwares | TurboTax, TaxAct, TaxSlayer, and H&R Block |

| Pricing | Free: $0 Hobbyist: $49 Investor: $99 Unlimited: $199 |

| Cost Basis Methods | HIFO, FIFO, LIFO |

| Tax-Loss Harvesting | Yes |

| Free account | Yes (only Portfolio Tracking) |

| Mobile App | No |

| Supported Countries | US, Canada, Australia, and 14+ others |

| Transaction importing method | API Auto-sync and CSV uploading |

CoinLedger Review: Best Tax Tracking Software

CoinLedger is a crypto tax reporting and portfolio management tool that you can use for free. It helps you save money on your taxes and works with many digital assets and NFTs.

You can connect it to your crypto exchange or wallet accounts and get your tax report in any format. You can also send it to other tax programs like TurboTax or TaxACT.

CoinLedger has many other features like tax loss harvesting, analyzing your portfolio for investment opportunities, and portfolio tracking. Many traders and investors use CoinLedger and trust it. You can get your money back in 14 days if you don’t like it.

Pros and Cons of Using CoinLedger

| Pros | Cons |

|---|---|

| Simplifies tax tracking | May not integrate with all exchanges |

| Automates calculations | May have a learning curve |

| Provides accurate tax reports | Newer blockchains not supported |

| Helps identify tax savings | |

| Offers user-friendly interface |

CoinLedger Tax Reports Review

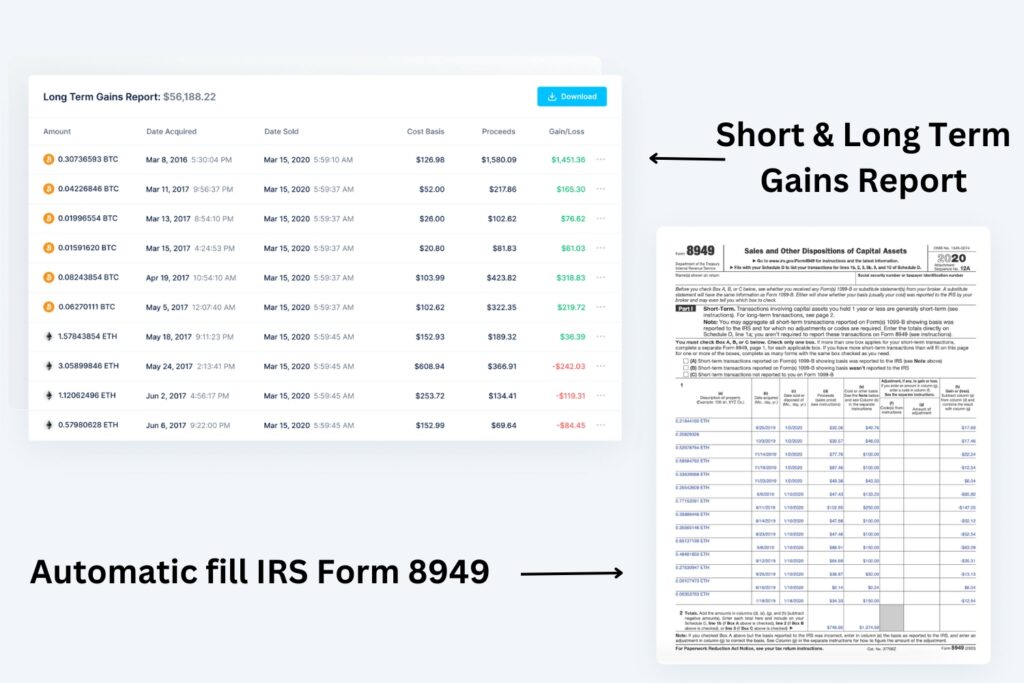

CoinLedger produces detailed and precise tax reports that follow the tax regulations of your country. You can select from various accounting methods, such as FIFO, LIFO, or HIFO, to determine your capital gains and losses. You can also create income reports for staking, lending, mining, airdrops, and other crypto activities.

Here are some of the basic types of tax reports generated by CoinLedger:

1. IRS Form 8949

You need this form to tell the IRS how much you made or lost from crypto. CoinLedger fills out this form for you. It shows your short-term and long-term capital gains from crypto and related investments.

2. International Tax Reports

These are reports for different countries where you have digital assets. CoinLedger can make these reports for over 14 countries and regions, like Australia, Canada, Germany, India, Japan, the UK, and more. You can make these reports by picking your country and the tax year.

3. Income Report

This is a report that tells you how much money you got from crypto investments in the tax year. It splits the money into Gifts, Mining, and Income. You can use this report to fill out your tax forms.

4. Capital Gains Report

It shows you how much you gained or lost from trading crypto. This includes the Cost Basis, Proceeds, and Net Gain/Loss for each trade. You can use this report to see how much tax you have to pay on your crypto trades.

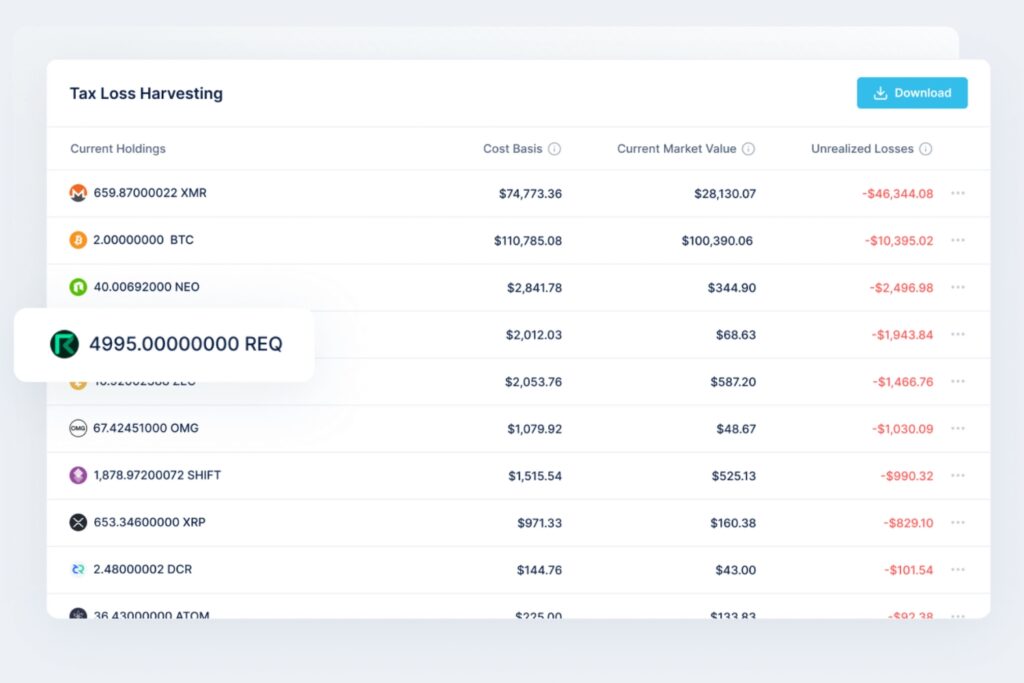

CoinLedger Tax Loss Harvesting Review

It is a tool that helps you find the best tax loss harvesting opportunities in your crypto portfolio. It shows you which crypto assets have the highest purchase price compared to the current market price, and how much you can reduce your taxes by selling them. You can also use it to harvest losses on your NFTs by connecting your Ethereum wallet.

Unlike stocks, cryptocurrencies are not affected by the wash sale rule, which means you can sell a crypto asset at a loss and buy it back right away without losing the tax benefit. But, this may change in the future, keep an eye on it.

CoinLedger Tax Software Integration Review

CoinLedger integrates with four different tax software:

- TurboTax

- TaxACT

- TaxSlayer

- H&R Block

This software helps you do your taxes online. They have different prices and features. They let you get your taxes checked by a tax expert before filing. You can also do video calls and talk with experts and tax professionals.

CoinLedger Core Features Review

Coinledger’s core features are crypto tax reporting and portfolio tracking. It covers more than 20,000+ crypto assets, DeFi, NFTs, and various tax methods such as FIFO, LIFO, and Adjusted Cost.

Here are its most popular features explained.

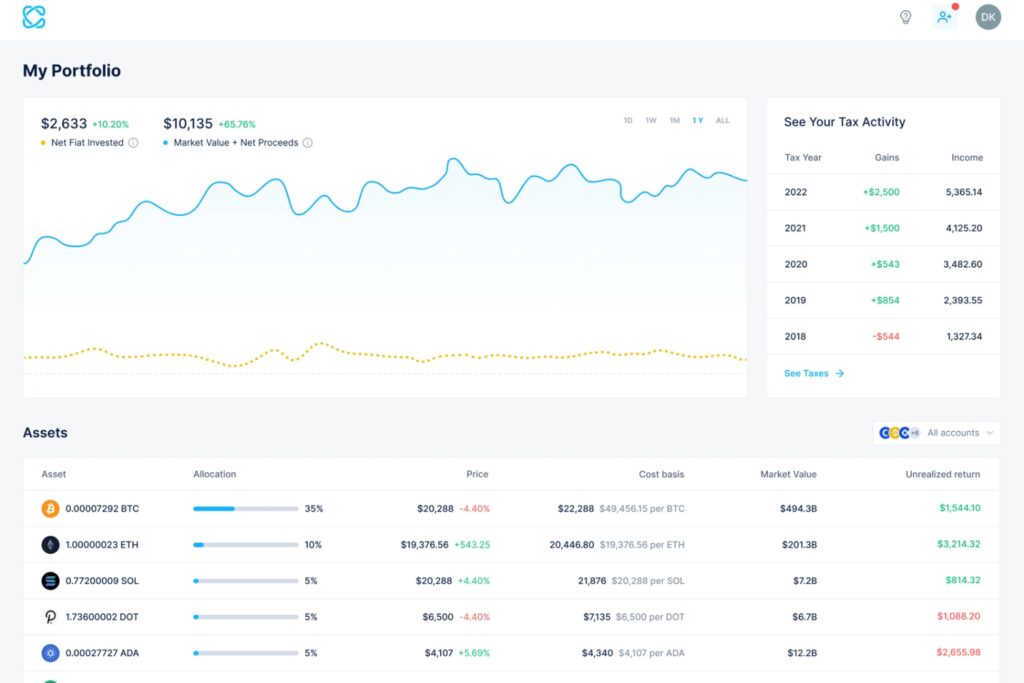

Crypto Portfolio Tracker

You can use its portfolio tracking feature to:

- Track your crypto assets for free across all your popular wallets and exchanges.

- Connect with exchanges like Coinbase and blockchains like Ethereum automatically.

- See your crypto performance with live charts that show your profit and loss, holding period, cost basis, and market value.

- You can also integrate CoinLedger with the CoinStats portfolio Tracker app.

Related: Best Crypto Portfolio Tracker Apps

NFT Tracking and Reporting

NFTs are unique digital items that are secured by blockchain technology. They can represent any form of art or other creative work.

Users can mint or trade NFTs, which means they have to pay taxes on them. CoinLedger is a software that helps you track your NFT transactions and calculate your taxes. You can use it by connecting your OpenSea account or by manually entering your wallet address.

If you use OpenSea, you can link your account using API and CoinLedger will automatically import your transaction data as it does with other exchanges. If you use a different marketplace, you can still use it by providing your wallet address for importing information.

CoinLedger will then show you how much profit or loss you made from your NFT trades. This is based on the difference between the price you paid to create or buy an NFT and the price you sold it for.

DeFi Integration

Coinledger works with both base-level blockchains and the dApps that are built on them. If it supports your base-level blockchain (Ethereum, Polygon, BSC, etc), you can import all of your transaction histories from your wallet into Coinledger—regardless of what protocol or dApp you interact with.

If it also works with your dApp, Coinledger will automatically classify your transactions into their proper types, e.g. swaps in Uniswap, NFT trades in OpenSea, interest income, etc.

Coinledger recently integrated with the Solana blockchain (SOL), which is a fast, scalable, and low-cost blockchain that supports many DeFi applications such as Raydium, Magic Eden, and Jupiter.

This means that users who transact on Solana can now easily import their data into Coinledger and get precise tax reports for their DeFi activities.

CoinLedger Supported Exchanges & Wallets Review

CoinLedger claims to support all popular exchanges, wallets, and blockchain networks. It tracks over 20,000 cryptocurrencies and NFTs, so you can monitor your portfolio and tax obligation for any crypto asset you own.

List of supported Exchanges and Wallets:

- Binance

- Binance US

- Bitfinex

- BitMart

- CEX.IO

- Changelly

- Coinbase

- CoinEx

- CoinJar

- CoinSpot

- Crypto.com

- Gate.io

- Gemini

- Paxful

- OKX

List of Supported Blockchains:

- Ethereum

- Binance Smart Chain

- Bitcoin

- Polygon

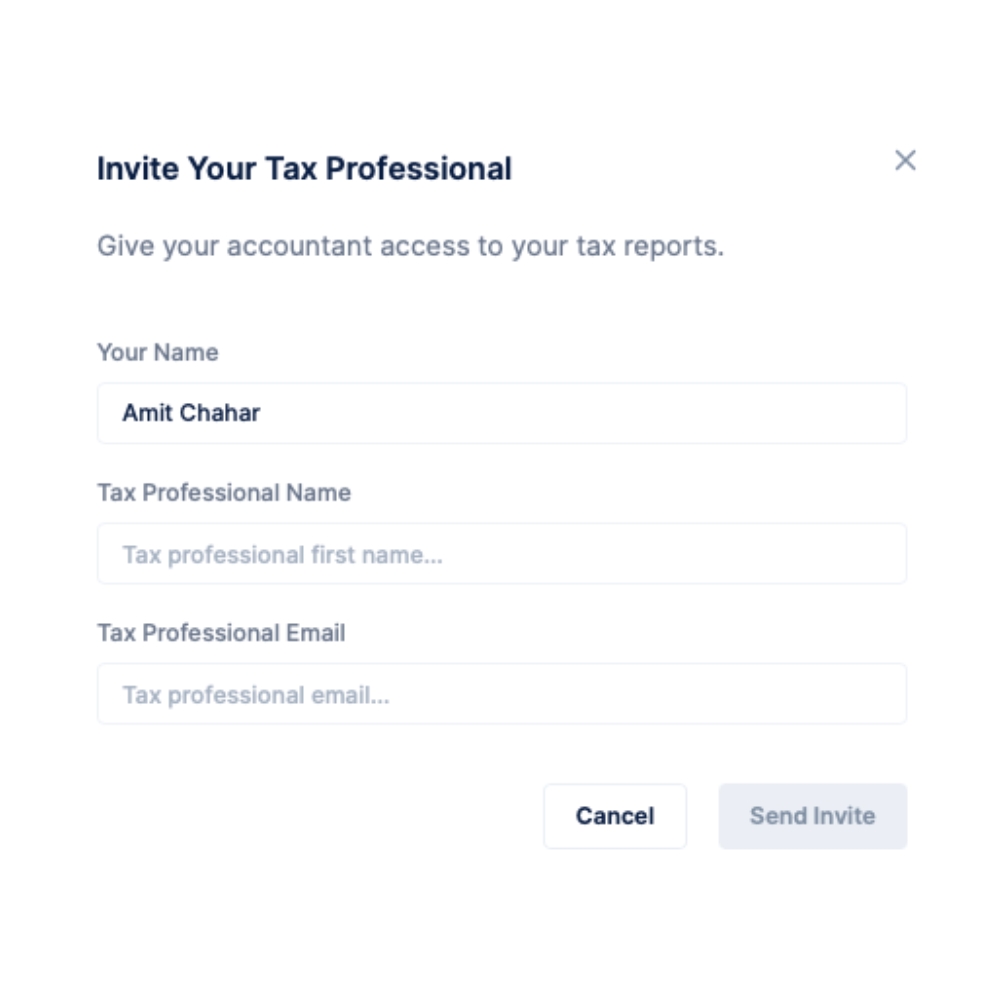

What is “Invite Your Tax Professional” in CoinLedger?

If you want to share your crypto tax report with your accountant, you can use the “Invite Your Tax Professional” feature in CoinLedger. This feature lets you send an invitation to your accountant by clicking the Add Tax Professional button on the home page of CoinLedger.

You will have to fill in their name and email address and click Send Invite. By inviting your accountant, you can enjoy some benefits such as:

- You can securely and easily share your crypto tax report with them.

- They can review your imported data and download the required tax forms for filing.

- They can access your account from a unified client dashboard and help you with any missing transactions.

- You can avoid sending sensitive information over email or other channels.

What is “Error Reconciliation” in CoinLedger?

Error reconciliation is a way of correcting common report errors that may arise when using CoinLedger. Some of the possible errors are:

- Historical data: CoinLedger cannot get the historical price data for some coins that have low volume or liquidity. You need to enter the price of the coin at the time of the transaction by yourself.

- Missing Cost Basis Warnings: These occur when CoinLedger does not know how you got a certain cryptocurrency that you later sold or traded. In this case, you need to import all of your transaction histories from all of your platforms that show how you purchased or received the cryptocurrency.

- Rounding Errors: These occur when some exchanges do not export enough decimal points after zero for some transactions. Now, you need to modify the CSV files and add the missing decimals.

CoinLedger Data or Transaction Importing Methods Review

CoinLedger provides various methods for importing your data from different exchanges, blockchains, and wallets. You can use the following methods to import your data:

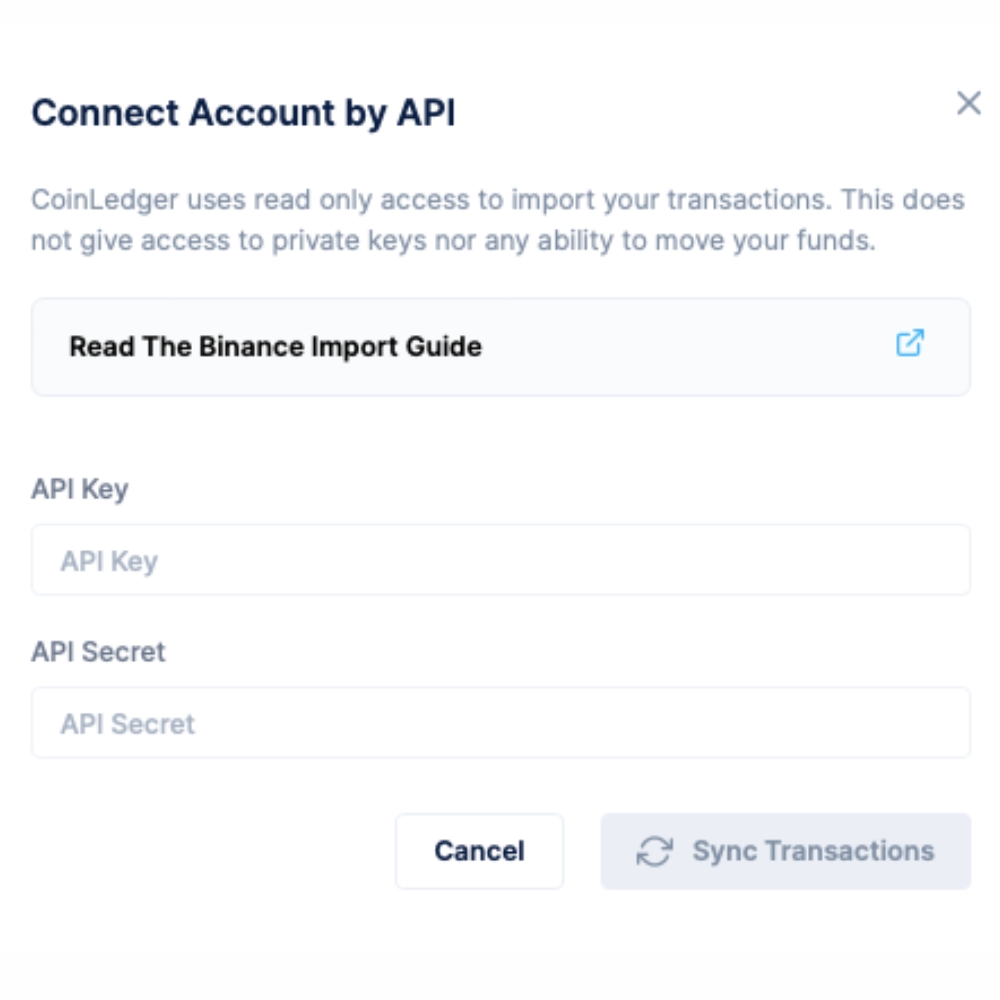

Import Using Exchange API Auto sync

You can follow these steps to sync transactions in CoinLedger with exchange API.

- Create an API key with read-only or view-only access in your exchange account. You can find guides for different exchanges on CoinLedger’s help center.

- Go to your CoinLedger account and select Add Account. Choose the tab for your exchange and click on Auto-Import.

- Enter your API key and API secret (if required) into the correct fields and click on Sync Transactions.

- Wait for CoinLedger to sync your transaction history and show it on your dashboard.

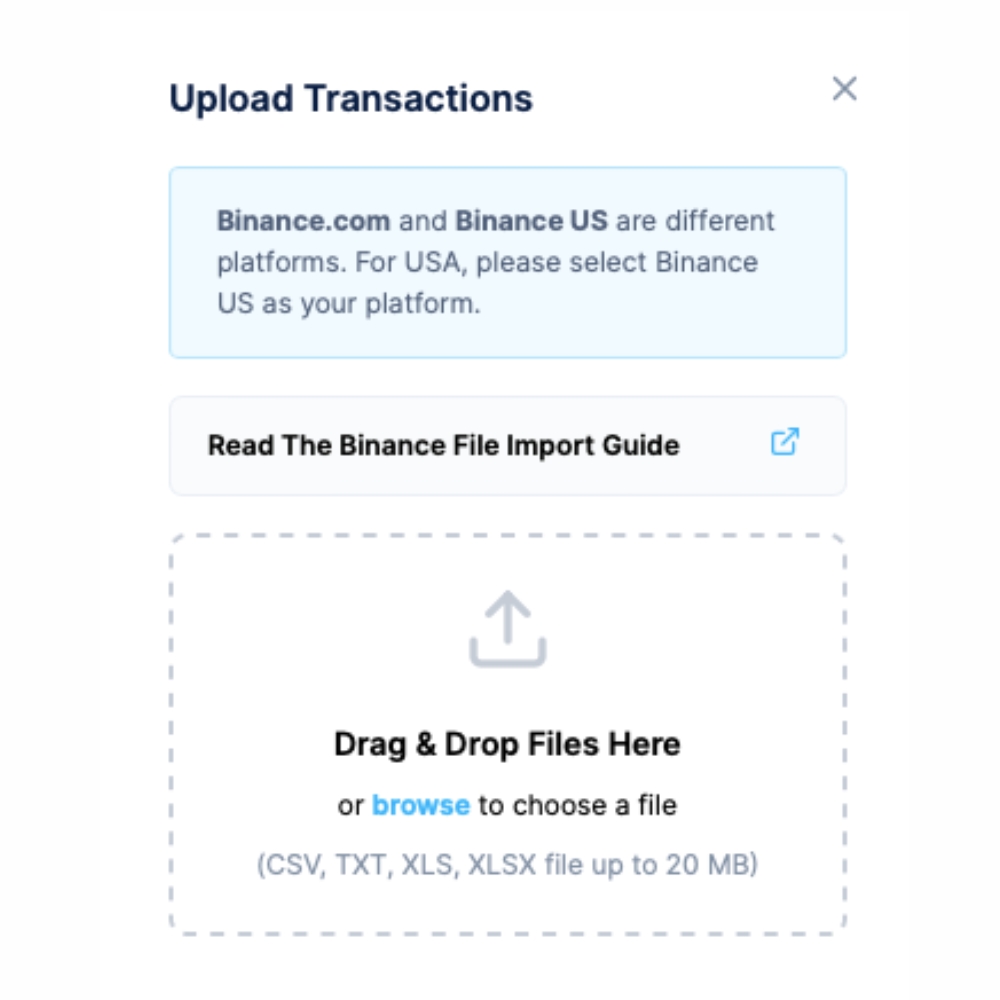

Import Using Exchange CSV File Format

- Log in to your CoinLedger account and go to the Import Transactions page.

- Click on the Exchange CSV File option and select the exchange you want to import from.

- Download the CSV file from your exchange. You can do this from the exchanges trade history or export data section. Now, upload it to CoinLedger.

- Review the imported transactions and make any necessary changes or corrections.

- Click on Save & Continue to generate your tax report.

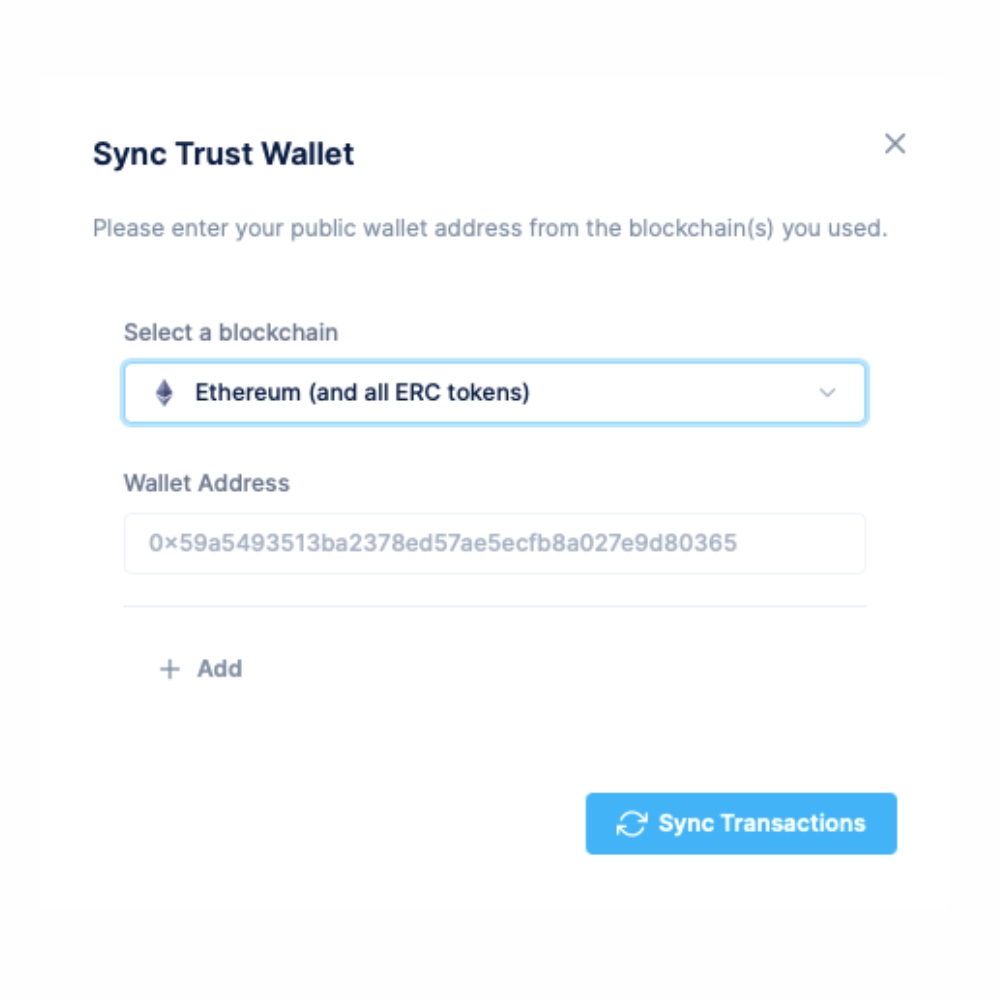

Import Using Wallet Address Auto Sync

- Open the CoinLedger app and go to ‘Add Account’. Choose the blockchain that you want to import from.

- Next, you need to get the relevant wallet address from your wallet provider. For example, if you have Trust Wallet, you can go to Receive on the left-hand side Menu of the Trust Wallet App.

- Pick the wallet address that you want to use in the Account. Make sure you select the correct one for the blockchain that you want to import from!

- After that, copy your wallet address.

- Paste your public wallet address in the CoinLedger app, and let the platform import your transactions from the blockchain.

- If you have transactions from different blockchains, you can repeat steps 2-5 for each blockchain on your wallet.

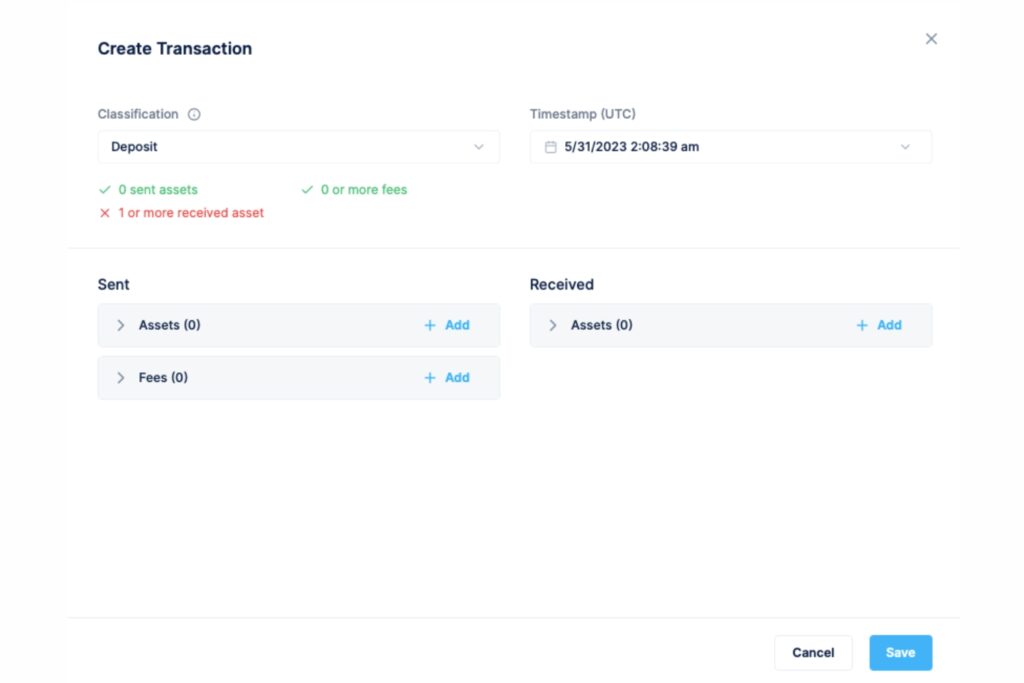

Import Using Custom CSV File Format

The custom CSV file format import method lets you manually enter your transactions from platforms that are not supported by CoinLedger.

You can use different templates to import different kinds of transactions, such as trades, income deposits, outgoing payments, etc. You can also use the CoinLedger universal manual import template to import all transactions in one file.

To use the custom CSV file format import method, you need to do these steps:

- Copy the template that you want to use in Google Sheets.

- Fill out the template with your transaction details. Make sure you enter the right information for each column and follow the formatting rules.

- Save the template as a CSV file on your computer.

- Go to the CoinLedger app and select Add Account. Choose the Other Account tab and upload your CSV file.

- You can also customize the name of your manual import.

CoinLedger Pricing Review

CoinLedger has a pricing model based on the number of transactions you do each tax season. You can use it for free to add your crypto transaction history, and monitor your portfolio, and calculate your net capital gains and losses. You only have to pay when you want to download and view your complete tax report.

It has three paid plans:

- Hobbyist ($49): You can add up to 100 transactions and view your tax report. This plan is good for occasional crypto users who don’t trade often.

- Investor ($99): You can add up to 1,000 transactions and view your tax report. This plan is perfect for regular crypto traders who have more transactions.

- Unlimited ($199+): You can add more than 3,000 transactions and view your tax report. This plan is made for high-volume crypto traders who need more room. The price goes up based on the number of transactions you go over.

CoinLedger User Experience & Customer Support

CoinLedger has a clean and intuitive user interface that makes it easy to import transactions, classify them, and generate tax reports.

It has received mostly positive reviews from its customers on Trustpilot, who praised its user-friendly interface, expert review service, and responsive customer support.

However, some customers also suggested that CoinLedger could improve by adding more blockchain support and creating more newbie-friendly tutorials.

What are the Limitations of CoinLedger Tax Tracker?

Some of the drawbacks of CoinLedger Tax Tracking software are:

- It only supports popular crypto wallets. Some new and lesser-known wallets are not supported.

- Users who don’t pay for the service can’t access or download tax reports.

- It only integrates with high-volume blockchains. New blockchain networks may not be supported.

CoinLedger Security Review

CoinLedger encrypts all data sent to or from the platform using 256-bit encryption. It hashes all passwords and credentials.

It also implements other security measures such as two-factor authentication (2FA), and secure socket layer (SSL) technology. It claims to regularly conduct security audits of its API infrastructure to identify and address potential vulnerabilities.

CoinLedger Alternatives and Comparison

If you need to calculate and report your crypto taxes, you have many options besides CoinLedger.

Some of the other platforms that offer similar services are Koinly and CoinTracker. They each have their own strengths and weaknesses that you should consider.

| Tax Software | Basic Pricing Plans per year | No. of Transactions (basic Plan) | Countries | Supported Wallets & Exchanges | NFT Support |

| CoinLedger | $49 – $199+ | 100 | 14 | 200+ | Yes |

| Koinly | $49 – $179 | 100 | 30 | 500+ | Yes |

| CoinTracker | $9 –$199 | 25 | 5 | 513 | Yes |

CoinLedger vs Koinly

CoinLedger and Koinly have similar features and services, such as DeFi & NFT support, FIFO, LIFO, HIFO methods, email and live chat support, error reconciliation, CSV and wallet import, etc. But CoinLedger also provides a tax-loss harvesting report and an expert review service, which Koinly does not.

Koinly supports more integrations than CoinLedger. Koinly supports over 500 wallets and exchange integrations. It also supports 170+ blockchain networks.

CoinLedger and Koinly both support multiple countries and tax jurisdictions. But Koinly supports more countries than CoinLedger. Koinly supports over 30 countries, while CoinLedger only supports 14 countries.

CoinLedger vs CoinTracker

CoinLedger has a free plan that allows unlimited transactions and portfolio tracking, while CoinTracker’s free plan is limited to 10k transactions.

CoinTracker currently supports only 5 countries for full tax reports. It supports the US, India, the UK, Canada, and Australia and partial support for others. CoinLedger didn’t give the exact number, but it claims to support more countries than CoinTracker.

Related: Delta Portfolio Tracker Review

Final Thoughts: Is CoinLedger Worth it?

If you need a hassle-free way to handle your crypto taxes, CoinLedger might be the perfect platform for you. It can import your transactions from hundreds of sources, classify them automatically, and generate accurate tax reports.

It also has features like tax loss harvesting, portfolio tracking, and expert review. CoinLedger works with various tax filing software and supports multiple blockchains and DeFi protocols.

CoinLedger is definitely a top tax software for a crypto trader and investor. Before signing up, You must do your own research, compare multiple tax apps, consider your budget, and choose the best tax tracker.

CoinLedger FAQs

Is CoinLedger Free to Use?

You don’t have to pay anything to use CoinLedger for tracking your portfolio and seeing your net capital gains and losses. You only pay when you want to access and download your complete tax report.

The cost varies based on how many transactions you have done in a tax season. You can pick from different plans that fit your budget.

Who is CoinLedger Best For?

CoinLedger is best for cryptocurrency investors and traders who want to accurately calculate and report their tax obligations. Specifically, it is useful for:

- Individual cryptocurrency investors

- Active crypto traders

- Cryptocurrency businesses

- Tax professionals

Is CoinLedger Safe & Secure?

Yes, It is Safe to use. You can use CoinLedger with confidence and peace of mind. It uses encryption and SSL certificates to keep your data safe. It does not keep your API keys or wallet addresses on its servers. It only uses read-only access to get your transactions from your exchanges and wallets.

Who is the Owner of CoinLedger?

CoinLedger was founded in 2018 by David Kemmerer, Lucas Wyland, and Mitchell Cookson. Currently, the CEO of CoinLedger is David Kemmerer.

What countries are supported by CoinLedger?

CoinLedger supports more than 14 countries and regions, including Australia, Canada, the United Kingdom, the United States, and more. It can create tax reports in any currency and format that match your local tax authority.

![KeepKey Review [currentyear]: Features, Security, Pros, and Cons 31 Keepkey Review](https://coinwire.com/wp-content/uploads/2023/05/keepkey-review-1024x683.jpg)

![Ledger vs Trezor: Which One Should You Use? (Updated [currentyear]) 32 Ledger Vs Trezor Featured Image](https://coinwire.com/wp-content/uploads/2023/03/ledger-vs-trezor-featured-image-1024x683.png)

![MEXC Referral Code ([currentyear]): Steps to Earn $1000 Sign-Up Bonus 33 Best Mexc Global Referral Code (Mexc-Cwrefcode)](https://coinwire.com/wp-content/uploads/2023/09/best-mexc-global-referral-code-featured-image-1024x683.jpg)