In the rapidly progressive cryptocurrency trading world, finding the right tools to navigate the market with precision and efficiency is paramount. This is where platforms like Cryptohopper come into play.

With its user-friendly interface, advanced features, and vibrant community, Cryptohopper has garnered significant attention among novice and experienced traders.

In this comprehensive Cryptohopper review, we will delve into the key aspects of this platform, exploring its automated trading capabilities, strategy marketplace, backtesting functionalities, and more. Let’s uncover how Cryptohopper simplifies and empowers cryptocurrency trading for enthusiasts around the globe.

Key Insights

This article will help you understand Cryptohopper’s features, pros, and cons. Here’s a list of the most important insights in this article.

- A breakdown of what Cryptohopper is

- An explanation of how Cryptohopper works

- Deep dive into Cryptohopper’s main features, including automated trading, copy trading, trailing, dollar cost averaging, arbitrage, and backtesting

- A summary of Cryptohopper’s pros and cons

- Cryptohopper’s affiliate program

- Cryptohopper pricing and security details

What Is Cryptohopper?

Cryptohopper is an automated cryptocurrency trading platform that enables users to trade cryptocurrencies using trading bots. It provides users with a user-friendly interface and a range of tools and features to automate and optimize their own trading strategy. Cryptohopper is designed to simplify the process of trading cryptocurrencies for both beginners and experienced traders.

The platform was created by a Dutch company called Cryptohopper BV. The platform was launched in 2017 by two brothers, Ruud Feltkamp and Pim Feltkamp, along with a team of developers.

Since its launch, Cryptohopper has gained popularity among cryptocurrency traders worldwide. The platform continues to evolve and offer new features to enhance the trading experience for its users.

How Does Cryptohopper Work: Deep Dive into Trading Bots

Cryptohopper’s main function is to enable traders to run automated crypto trades. To achieve this, the platform offers users a variety of trading bots called hoppers. These competing trading bots are suited for different needs. Here’s a summary of the site’s most popular trading bots.

- Trading Hopper: The Template Hopper is a basic type of hopper that allows users to select from pre-configured trading templates that determine how the crypto bot will launch trades. These templates include various trading styles, such as scalping, trend following, or mean reversion. Users can choose a template that aligns with their trading goals and customize it as needed.

- Arbitrage Hopper: The Exchange Hopper is designed for users who want to focus on trading on a specific exchange. This cryptocurrency trading bot provides features specific to the chosen exchange, including order types, market data, and exchange-specific settings. This hopper is suitable for users who prefer to trade exclusively on a single exchange rather than across multiple exchanges.

- Copy Hopper: The Mirror Hopper allows users to mirror the trades of selected successful traders in real-time. Users can choose from a selection of verified traders on Cryptohopper and replicate their trades automatically. This type of cryptocurrency trading bot is suitable for users who want to leverage the expertise and success of experienced traders without manual trade execution.

Cryptohopper Review – Features

Cryptohopper provides a comprehensive toolkit for users to customize their trading approaches. This robust set of features is designed to streamline and optimize cryptocurrency trading.

From automatic trading strategies and a marketplace for trading templates to backtesting and paper trading access, this platform empowers both beginner and experienced traders to navigate the complexities of the crypto market easily.

In this section, we will explore the diverse and powerful features offered by Cryptohopper. Here is a detailed summary of the platform’s most impressive offerings.

Automated Trading

Automatic trading is the first and most impressive feature of Cryptohopper. This automatic trading attribute allows the platform to launch trades on behalf of users using predefined trading strategies and parameters. Here’s an explanation of how automatic trading works on Cryptohopper:

- Strategy Selection or Creation: Cryptohopper has a range of pre-built trading strategies. These strategies define the conditions and rules for entering and exiting trades, such as specific indicators, price thresholds, or market trends. Users can select one or more of these strategies or create custom ones.

- Configuration: This allows users to customize the behavior of their trading bot based on their preferences and risk tolerance. Users can add various parameters and settings for their trading bots. These settings include indicators, trade size, trailing stop-loss, risk management rules, and other parameters relevant to the selected strategy.

- Exchange integration: When setting up automatic trades, users need to select their preferred crypto trading platforms. Cryptohopper integrates with some of the leading altcoin exchanges globally. This integration enables the trading bot to access the user’s Cryptohopper account and execute trades on the exchange account of their choice.

- Market monitoring and trade execution: Once the crypto bot is configured and activated, it constantly monitors market data, including price movements, volume, and other indicators, to identify trading opportunities. The bot automatically runs trades on the connected exchange when it spots trading signals that match the defined strategy.

- Portfolio management: Cryptohopper’s auto-trading feature also comes with a built-in cryptocurrency portfolio tracker. This option allows users to track their trade history, view profit/loss statistics, and analyze the performance of their portfolio. It may also offer features like portfolio rebalancing and performance tracking.

Automated trading on Cryptohopper is an exciting opportunity for many traders. However, it’s important to note that the feature does not guarantee profits or eliminate the risks associated with cryptocurrency trading. Therefore, you should carefully define and test your strategies, monitor the bot’s performance, and regularly review and adjust settings to avoid significant losses.

Related 11 Best Crypto Exchanges in Australia (Updated in Jun 2023)

Copy Trading

Another outstanding Cryptohopper feature is copy trading. Copy trading allows users to study trade patterns used by professional investors and traders and replicate them.

This feature can be a convenient option for users who want to leverage the knowledge and expertise of successful traders. Below is an explanation of how copy trading works on Cryptohopper:

- Strategy Marketplace: Cryptohopper provides a marketplace where experienced traders can create and sell their strategies. These strategies are available for other users to purchase and use in their trading bots.

- Strategy Selection: Copy trading investors can browse the strategy marketplace on Cryptohopper. They can evaluate different strategies based on various factors, such as historical performance, risk levels, and other relevant metrics.

- Purchasing Strategies: Once users find a strategy they want to copy, they can buy it from the Cryptohopper marketplace. The creator of the strategy sets the price and terms of the strategy.

- Configuration: After purchasing a strategy, users can apply it at the configuration level when creating their auto-trading settings.

Cryptohopper is one of the best copy trading platforms for users who want to leverage the knowledge and expertise of successful traders. However, it’s crucial to conduct due diligence, evaluate strategies carefully, and monitor performance to make informed decisions and manage risks effectively.

Trailing Features

Maximizing profits and mitigating losses are two major concerns for most traders when trading crypto. Cryptohopper understands this and offers its users cryptocurrency trailing features.

Specifically, the platform offers trailing stop orders and take profit orders. A trailing stop order is a dynamic order that adjusts the stop price as the market price of an asset moves in a favorable direction. On the other hand, a trailing profit order, also known as a trailing take-profit order, focuses on capturing profits.

These features help users maximize profits during upward price trends while minimizing losses if the market reverses. Here’s an explanation of the trailing features on Cryptohopper:

- Trailing stop-loss: With Cryptohopper’s trailing stop-loss feature, users can set a trailing percentage or value. If the price moves favorably, the stop-loss level will trail along with the price, adjusting the stop-loss level upward, thereby reducing the risk of loss.

- Trailing take-profit: Cryptohopper’s trailing take-profit feature allows users to set a trailing percentage or value. As the price increases, the take-profit level will trail along with the price letting their winning trades run while protecting against price reversals.

- Trailing indicator: Cryptohopper also offers a trailing indicator feature. This allows users to set specific indicators to trigger trailing stop-loss and take-profit levels. Users can select from a range of technical analysis indicators, such as Moving Average (MA) or Percentage Price Oscillator (PPO), to define the trailing behavior.

Dollar Cost Averaging

Dollar-cost averaging (DCA) is an investment strategy that helps mitigate loss-making positions or improve buying prices over a long period of time. To facilitate dollar cost averaging over a long period, investors put in equivalent amounts of money at periodic intervals despite price fluctuations. This way, their investment averages over the long term.

For mitigated losses, DCAs work under the assumption that a token’s value will increase over time. Therefore, for investors holding coins whose value is declining, DCA will suggest they double the investment instead of selling the coin at a loss. Since the purchase will happen at a lower price, investors will likely earn more if the coin’s value rises.

Cryptohopper allows users to implement a DCA strategy on Cryptohopper by manually configuring their trading bot. They are fully responsible for managing and adjusting the trading bot’s settings and monitoring market conditions. Here are a few important settings to configure when running a DCA strategy on Cryptohopper.

- Order type: The first set of DCA is the order type, which allows you to set limits or market orders. Limit orders are orders set at a specific price in the order book. Because of their specific nature, limit orders may fail to be implemented if the exact price is not attained. On the other hand, when a market order is placed, the transaction is executed immediately at the prevailing market price, regardless of the specific price level.

- DCA after X time open: It helps determine when you allow the hopper to place orders. Cryptocurrency prices can be very volatile, so this helps determine at what point you want to double down on your existing position.

- DCA max retries: This refers to the maximum number of DCA orders created for a given coin. The count is adjusted after every successful sale of a DCA order. Set this number low to minimize the risk of losses.

Dollar-cost averaging is a lucrative long-term investment strategy because it reduces the impact of short-term price volatility. It does not guarantee profits or protect against losses, and it may also be financially draining, especially when you have to double down several times before market prices peak.

Arbitrage

Arbitrage in the context of cryptocurrency trading typically involves buying a cryptocurrency at a lower price on one exchange and simultaneously selling it at a higher price on another exchange to profit from the price discrepancy.

This process requires quick execution and access to multiple exchanges, which is often a challenge for many. It takes time to transfer funds from one exchange to the other, and this time-lapse can result in price changes and a reduction in trading profits.

Cryptohopper solves this challenge using its exchange arbitrage feature. With exchange arbitrage, users can manually execute arbitrage trades by connecting their Cryptohopper accounts to different exchanges. This ensures the funds are accessible across multiple exchanges and saves on the time required for the trade.

Backtesting

Backtesting on Cryptohopper is a feature that allows users to evaluate the performance of their trading strategies using historical market data. It enables users to simulate how a particular strategy would have performed in the past without actually executing real trades.

By backtesting strategies, users can assess the effectiveness of their trading approaches before deploying them in live trading. Here’s how backtesting works on Cryptohopper:

- Historical Market Data: Cryptohopper uses historical market data, typically from the cryptocurrency exchanges it supports, to simulate past market conditions. This data includes historical price charts, trading volumes, and other relevant market information.

- Strategy Configuration: Users configure their selected strategy in Cryptohopper, setting the parameters and indicators according to the strategy’s requirements. This includes selecting the period for backtesting and adjusting other settings relevant to the strategy.

- Backtesting Execution: Users initiate the backtesting process once the strategy is configured. Cryptohopper simulates the execution of trades based on the selected strategy and historical market data. The platform calculates the theoretical buy and sell signals and tracks the strategy’s performance over the specified historical period.

CryptoHopper App Pros and Cons

Cryptohopper has many impressive features that ensure users get the best possible automated trading experience. However, like every crypto platform, the site has its cons. Let’s look at the most glaring advantages and disadvantages of using Cryptohopper for digital asset trading.

Pros

- Automation: Through an automated trading bot, users save time and effort in cryptocurrency trading. Users can set up a Cryptohopper trading bot to execute trades based on predefined strategies, indicators, and parameters.

- Strategy marketplace: Cryptohopper offers a marketplace where users can buy and sell trade strategies. This provides an opportunity for users to access proven strategies created by professional traders, saving them the time and effort of developing their own strategies from scratch.

- Backtesting and paper trading accounts: Cryptohopper provides features for backtesting trading strategies using historical data and for paper trading in a simulated environment. These features allow users to evaluate and refine their strategies before deploying them in live trading.

- Multi-exchange integration: Cryptohopper supports integration with several major cryptocurrency exchanges, allowing users to execute trades across different platforms from a single interface. This provides convenience and flexibility in trading.

- Community and Support: Cryptohopper has an active community of users who share trading strategies, insights, and tips on the platform’s forums and social media channels. Additionally, Cryptohopper offers customer support through various channels, including email and live chat.

Cons

- Learning curve: Cryptohopper has a learning curve like any other automatic trading platform. Users need to understand trading concepts, strategies, and technical indicators to utilize the platform’s features effectively.

- Subscription cost: Cryptohopper offers different subscription plans, and some of the more advanced tools and features may require higher-priced plans. Users should consider the subscription cost and determine if the features and benefits justify the expense.

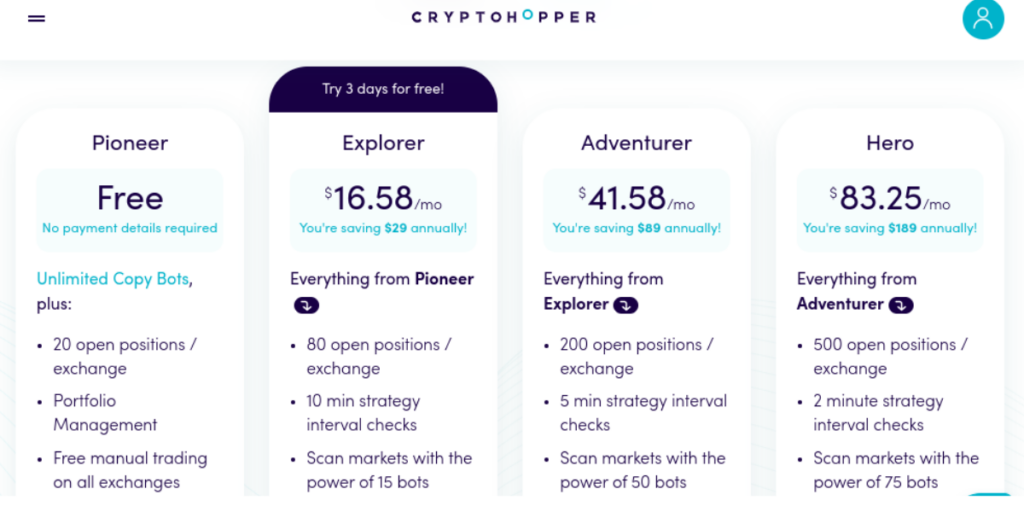

Cryptohopper Pricing

To cater to different users’ needs, Cryptohopper has a tiered pricing system. Below is a breakdown of each tier and its benefits.

- Free: The free plan allows users to open up to 20 positions and connect to a maximum of 20 exchanges. In addition, it offers portfolio management and free manual trading on all exchanges.

- Explorer Plan: This plan costs $16.58 monthly and includes features such as 80 positions, 15 selected coins, advanced analysis tools, and basic support.

- Adventurer Plan: Priced at $41.58 per month, this plan offers more advanced features than the Explorer Plan. It includes 200 positions, 50 selected coins, additional advanced trading tools, access to the strategy backtesting feature, and priority support.

- Hero Plan: The Hero Plan is the most comprehensive plan offered by Cryptohopper, costing $83.25 per month. It provides unlimited positions, unlimited selected coins, all available technical analysis indicators, advanced order types, access to the strategy backtesting and paper trading features, and premium support.

Cryptohopper Affiliate Program

The Cryptohopper affiliate program is a way for users to earn commissions by referring new users to the Cryptohopper platform. This program offers a tiered commission structure, where affiliates can earn a percentage of the subscription fees paid by their referred users.

To track the referrals, Cryptohopper generates a unique referral link or an affiliate ID. When a user signs up for a paid subscription using the affiliate’s link or ID, they are attributed as the referring affiliate.

Typically, the commission rates may vary based on the number of referrals and the subscription plan chosen by the referred user. However, the commissions are recurrent as long as their referred users maintain active paid subscriptions.

Cryptohopper Security

Cryptohopper places a strong emphasis on security to protect user accounts and sensitive information. For its authentication and user verification processes, the site uses Two-Factor Authentication (2FA). This requires users to enter a verification code generated by an authentication app or sent via SMS in addition to their login credentials.

The site also requires API key permissions when users want to integrate with exchanges. Cryptohopper recommends users set limited permissions on these API keys to restrict the access granted to the platform, minimizing potential risks.

Additionally, Cryptohopper uses SSL encryption to secure transaction data as it moves through the internet. Plus, the platform does not gain access to clients’ funds. The site operates with read-only access to user wallets on connected exchanges, ensuring that withdrawal capabilities are unavailable through the platform.

Cryptohopper Customer Support

Cryptohopper provides customer support services to assist users with their inquiries and issues. The platform has effective support channels where clients can reach out for assistance. This typically includes email support and a ticketing system where users can submit their queries or concerns. The availability of live chat or phone support may vary depending on the specific plan or subscription level.

Besides support channels, Cryptohopper has a broad knowledge base and rich documentation. These resources cover various aspects of the platform, including setup guides, tutorials, FAQs, and troubleshooting instructions. Users can refer to these materials to find answers to common questions or explore self-help options.

Also, there are active community and user forums where clients can engage with each other, share experiences, and seek advice. This community-driven support can be valuable in finding solutions and insights from fellow users who may have encountered similar challenges.

FAQs

Is Cryptohopper legit?

Cryptohopper is a legit auto-trading platform. The site has existed since 2017 and has affiliations with reputable crypto platforms such as Binance, Kraken, Bitfinex, and more.

What is the minimum investment in Cryptohopper?

As a platform, Cryptohopper does not have a minimum investment requirement. However, users may have to adhere to the minimum deposit requirements indicated on the exchanges they connect to through Cryptohopper.

Who owns Cryptohopper?

Cryptohopper was created by a Dutch company called Cryptohopper BV. The platform was launched in 2017 by two brothers, Ruud Feltkamp and Pim Feltkamp, along with a team of developers.

Ruud Feltkamp, known for his acting career in the Netherlands, recognized the potential and demand for an automated trading platform in the cryptocurrency market. The Feltkamp brothers and their team developed Cryptohopper to provide a user-friendly solution for cryptocurrency trading automation.

Is Cryptohopper bot free?

Cryptohopper offers a tiered pricing plan for its services. There is a free plan that allows you to set up automated trading. Besides the free plan, you can choose the explorer, adventurer, or hero plans, which cost $16.58, $41.58, and $83.25, respectively.

![KeepKey Review [currentyear]: Features, Security, Pros, and Cons 15 Keepkey Review](https://coinwire.com/wp-content/uploads/2023/05/keepkey-review-1024x683.jpg)