DEX screener is a tool that helps traders find the best investments for their portfolios. In this DEX screener review, we’ll explain how it can help traders make better investment decisions. We’ll also provide a step-by-step guide on using the DEX scanner to find the best investments for your portfolio.

What is a DEX Screener?

DEX Screener is a cryptocurrency research and screening tool traders and investors use to examine assets on several decentralized exchanges (DEX). Like any other crypto screener, it monitors, analyzes, and evaluates publicly accessible data on blockchains and cryptocurrency tokens.

The software helps traders find the best investments for their portfolios. Its algorithm evaluates securities to identify whether they are good candidates for investment. This information can be used to make informed trading decisions.

With so many choices available in the market, choosing which cryptocurrencies are worth investing in might not be easy. The DEX Screener tool assists in identifying the most outstanding investment prospects based on factors like price, trading volume, market size, and volatility, concentrated on decentralized exchanges. It is available in desktop and mobile browsers, although no smartphone app is present.

DEX Screener Review

Pros of DEX Screener

No matter which type of trader you may be, using the DEX screener can be beneficial in finding the best investments for traders. By scanning different assets, you can find those that meet your specific investment criteria and make sure you are getting the best return on your investment. Check out some of the advantages of using a DEX Scanner:

- Free-to-use platform

- Free charting tools through TradingView

- No KYC

- Easy DEX Analysis

- Over 1,200 coins and token pairs

Cons of DEX Screener

There are a few cons to using a DEX screener. These are:

- No mobile application

- Some users may not find it a user-friendly interface

Key Features

Trends

The Trends feature is used to spot crypto trends in the market. The tool presents them based on the current performance and rise and fall of prices. It provides data that can be filtered based on the following:

- Trend Type – Price Change (Up or Down), Increased Volume, or Recent Listing

- Platform – Ethereum, Polygon, BNB Chain, Avalanche, Cronos, etc.

- Frame Time – Last 5 minutes, Last hour, Last 6 hours, or Last 24 hours

New Pairs

The New Pairs tab shows a listing on different platforms, which you may filter based on your preferred network. As shown in the photo below, it is comprised of the following:

- Token

- Price

- Age

- Activity – Buys, Sells, and Volume Up or Down (as depicted by the price change frame time)

- Liquidity

- FDV

Gainers & Losers

The Gainers & Losers features allow users to view a particular network’s “gainers” and “losers.” You may customize the network you see according to the:

- Specified platform

- Rank (based on the 24-hour price change)

- Liquidity

- FDV

- Pair Age

- Transaction – Buy, Sell, Volume, Change (according to Frame Time)

MultiCharts

The MultiCharts section permits you to add up to 16 charts or add suggested charts. The outcome of your selection will vary based on your choices. For instance, if you select the Add Suggested Charts, you’ll see something like this:

Blockchain Networks

The DEX Screener tool offers its users a myriad of blockchain network options. These include networks such as Ethereum, Avalanche, and Celo, among many others.

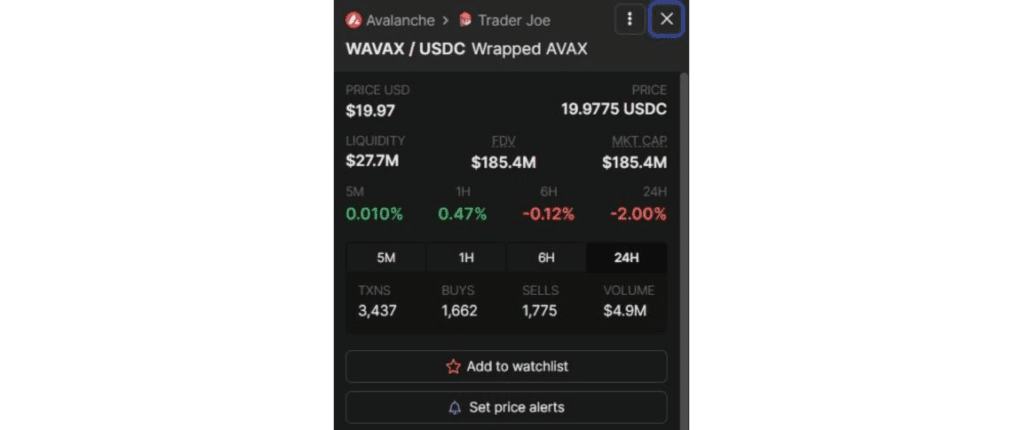

DEX Screener Alerts

The DEX Screener Alerts or Set Price Alerts option can be used to create trading pair alerts. These notifications serve as a means for the program to inform you when your objective has been reached.

Add to Watchlist

There’s an Add to Watchlist option for users to add their trading pairs when they monitor the rise and fall in prices.

DEX Screener API

The DEX Screener API is a collection of programming guidelines that enable software developers to connect with the DEX Screener and data set. Users may gather information on one or more pairs through a network or web address, get token data, and search DEX Screener’s pair data repository for a query that matches.

How to Use DEX Screener

DEX Screener is a free online tool that helps traders find the best investments for them. The tool uses a combination of technical analysis, fundamental analysis, and historical data to determine the best opportunities.

If you’re interested in using it, here’s what you got to do:

Step 1: Get a wallet and fund it

To begin investing in crypto, get a wallet to store your tokens. Most wallet options are Metamask and Coinbase. After that, you should fund it from exchanges such as KuCoin and Gate.io.

Step 2: Go to dexscreener.com and set up the chain, token, and DEX you wish to analyze

There’s no need to create an account. Simply visit the link and navigate the screen to select the trading pair of your choice.

Step 3: Set up a swap and begin trading

You may begin the trade or swap via an automatic transaction in the liquidity pool. ByBit is one of the exchanges that offer a wide variety of altcoins for you to choose from.

Learn more: PooCoin App Review: Is It The Best DeFi Analytics Tool?

Conclusion

If you’re a trader looking to find the best investments for your portfolio, then DEX screener is an essential tool. This screener helps traders sort through thousands of stocks and options to find the best opportunities for their investment goals. The DEX screener also offers tools to help traders track their progress and adjust as needed.

CoinCheck Review: Best Features, Limitations, Fees & Security

FAQs

Is there an app for the DEX screener?

As of now, the DEX screener doesn’t have any app. But you can still open it using your smartphone’s browser.

Does the DEX screener cost money?

The platform is free and accessible to the blockchain networks it supports. This makes DEX Screener an excellent platform for novice and pro traders and investors.

How safe is DEX trade?

The DEX Screener and the trades performed on the platform are safe and legit. Additionally, since it caters to decentralized exchanges, there’s little to no threat of being hacked.

Read more: Bilaxy Review: Can Bilaxy be Trusted?

![Bybit Review [currentyear]: Exchange Features, Fee, Pros and Cons 23 Bybit Featured Image](https://coinwire.com/wp-content/uploads/2022/06/Bybit-review-1024x683.png)

![MoonPay Review ([currentyear]): Fees, Pros & Cons, and Sign-Up Guide. 24 Moonpay Review Featured Image](https://coinwire.com/wp-content/uploads/2023/09/moonpay-review-featured-image-1024x683.jpg)

![Tristan Tate Net Worth ([currentyear]): Biography, Businesses & Cars 25 Tristan Tate Net Worth Featured Image](https://coinwire.com/wp-content/uploads/2023/07/tristan-tate-net-worth-featured-image-1024x683.jpeg)

![Coinigy Review [currentyear]: Features, Pricing, Pros & Cons 26 Coinigy Review](https://coinwire.com/wp-content/uploads/2024/04/coinigy-review-1024x683.jpg)

![Bybit vs Kucoin [currentyear]: Exchange Leverage, Fees, Pros & Cons 27 Bybit Vs Kucoin](https://coinwire.com/wp-content/uploads/2024/01/bybit-vs-kucoin-1024x683.jpg)