As you navigate the ever-evolving cryptocurrency market, understanding the dynamics behind the Renzo (REZ) price prediction becomes crucial. With the digital currency’s novelty, precise price forecasts are challenging without comprehensive historical trading data. Yet, the importance of such predictions grows as the market matures, propelled by algorithms that learn from past price trends and the crypto market’s cyclical nature. Renzo, a liquid restaking protocol introduced by James Poole and Lucas Kozinski in 2023, aims to streamline access to the EigenLayer ecosystem, showcasing a unique blend of innovation and user-centric design.

Exploring the future of Renzo (REZ) in 2024 and beyond, this article will delve into the protocol’s fundamentals, the mechanics driving its economy, and external factors that could influence its market value. By comparing it against similar projects and weaving in expert insights, we aim to equip you with a well-rounded view of REZ’s potential trajectory. Whether you’re a seasoned investor or new to the crypto scene, these perspectives will guide your strategies in the dynamic landscape of cryptocurrency investments.

Renzo (REZ) Price Prediction

Exploring the future of Renzo (REZ) involves delving into various expert opinions and price predictions that sketch a broad spectrum of possibilities for its market performance. Here’s a detailed look at the anticipated trajectory of REZ prices over the coming decades and expert insights on its potential market impact.

Based on comparisons with similar projects launched through Binance Launchpool, Renzo is poised for a promising start:

- Market Cap Expectations: Estimated to reach a market cap of approximately $400M – $500M.

- List Price Forecast: The REZ token is predicted to list at about 0.3x – 0.5x USD.

Renzo Protocol Overview

Renzo Protocol has quickly emerged as a leader in the Decentralized Finance (DeFi) space, boasting significant growth in both active users and Total Value Locked (TVL). This growth has catapulted Renzo into the top 10 DeFi protocols, reflecting its robust market acceptance and user trust.

Growth and Funding

Renzo’s journey began with a successful seed funding round where it raised $3.2 million. This round was led by Maven11 and saw participation from various other investors, setting the stage for its rapid development and deployment.

Integration with EigenLayer

At its core, Renzo Protocol operates as a liquid restaking protocol built on EigenLayer’s innovative staking solution. This integration allows Renzo to offer an easy-to-use interface for the EigenLayer ecosystem, enhancing the staking experience for ETH holders. By using Renzo, ETH holders can achieve higher yields compared to traditional staking methods.

Innovative Products and Services

Renzo introduces a liquid derivative platform that fundamentally changes how users interact with staking protocols. Users can deposit either ETH or existing Liquid Staking Tokens (LSTs) to receive ezETH. This token represents the user’s restaked position within the Renzo protocol, simplifying the staking process while enhancing liquidity.

Strategic Collaborations and Future Plans

Looking ahead, Renzo plans to expand its services by launching native ETH restaking on the BNB Chain. This move, facilitated through a partnership with the cross-chain protocol Connext, signifies Renzo’s commitment to broadening its ecosystem and enhancing user accessibility across different blockchain networks.

Community Engagement and Support

Renzo maintains an active presence across multiple social platforms including Twitter, Telegram, Mirror, and Discord. This engagement plays a vital role in fostering a robust community around Renzo’s offerings and future developments.

Renzo Protocol not only simplifies the complexities associated with liquid staking but also positions itself as a pivotal bridge to the EigenLayer ecosystem. By doing so, it ensures that users can leverage Ethereum’s robust security model while participating in Actively Validated Services (AVSs) that enhance their staking rewards. Through these innovations, Renzo is set to redefine the landscape of staking protocols, making it a significant player in the DeFi space as we move into 2024 and beyond.

Tokenomics of REZ

Renzo (REZ) has established a comprehensive tokenomics structure designed to support its long-term viability and growth within the DeFi ecosystem. Below is a detailed breakdown of the REZ token distribution and its strategic implementation:

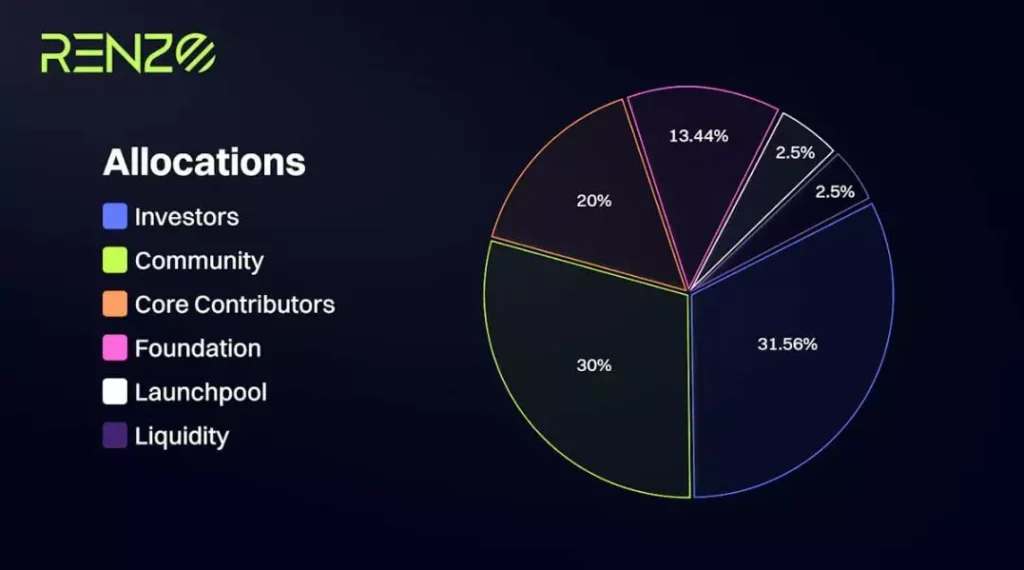

Token Distribution Overview

Renzo Protocol has set the total supply of REZ tokens at 10 billion, with specific allocations designed to support various aspects of the protocol’s development and operational framework.

- Investors & Advisors: 31.56% of the total supply is allocated to investors and advisors who play a crucial role in the protocol’s development and expansion.

- Community Initiatives: 32% is dedicated to community incentives, including airdrops and rewards for community engagement.

- Core Contributors: 20% of the tokens are reserved for the team members and contributors who are at the forefront of the Renzo Protocol development.

- Foundation: 12.44% is allocated to the Renzo Foundation, which supports ongoing research and development within the ecosystem.

- Binance Launchpool: 2.5% of the total supply is designated for participants of the Binance Launchpool, allowing a broader base of investors to contribute and benefit from the protocol’s success.

- Liquidity Provisions: 1.5% is set aside to ensure liquidity across various exchanges and trading platforms, facilitating smoother transactions for REZ token holders.

Strategic Vesting and Allocation

To align the interests of the stakeholders with the long-term goals of the Renzo Protocol, a strategic vesting schedule has been implemented:

- Initial Circulating Supply: At launch, approximately 1.05 billion REZ tokens were in circulation, ensuring initial liquidity and accessibility for traders and investors.

- Vesting Conditions: Major stakeholders, including the largest wallets, are subjected to a vesting period where 50% of their holdings are unlocked at the Token Generation Event (TGE), with the remaining 50% vesting linearly over six months.

- Airdrop Strategy: 10% of the total supply is allocated for airdrops, with 52.5 million REZ reserved for the season 1 airdrop, incentivizing early adopters and active community members.

Governance and Utility

REZ tokens not only serve as a medium of exchange within the Renzo ecosystem but also empower holders with governance rights. This dual function enhances the token’s utility:

- Governance: Token holders can vote on key proposals that determine the protocol’s direction and implementations.

- Utility: Holders benefit from discounts on transaction fees, access to exclusive services, and participation in governance.

Future Plans and Adjustments

Renzo Protocol remains adaptable to the evolving DeFi landscape, with plans to redistribute unclaimed or unvested tokens to loyal users, thereby encouraging prolonged engagement and investment in the ecosystem.

This strategic approach to tokenomics ensures that Renzo (REZ) is not only a functional asset within the cryptocurrency market but also a valuable tool for achieving decentralized consensus and community-driven governance.

Factors Influencing REZ Price

Market Dynamics and Economic Indicators

Understanding the factors that could influence the price of Renzo (REZ) involves looking at both market dynamics and broader economic indicators. Here’s how these elements play a role:

- Federal Reserve’s Interest Rate Decisions: With the Federal Reserve adjusting interest rates possibly only once this year, the broader financial environment remains a critical determinant. Lower interest rates generally make riskier assets like cryptocurrencies more attractive, potentially boosting REZ’s price post-listing.

- Global Economic Conditions: The ongoing geopolitical tensions and the threat of a global financial recession could lead to increased volatility in the cryptocurrency markets, including REZ. Such conditions often drive investors towards or away from riskier assets, impacting prices significantly.

Performance of Similar Launchpools

Previous launchpool performances can offer insights into potential market reactions to new listings:

- Previous Launchpool Outcomes: The underwhelming performance of the OMNI launchpool shortly after its debut may temper expectations and influence the initial market reception for REZ. This could affect the initial trading momentum of REZ in the crypto market.

- Comparative Launchpool Success: On the other hand, recent successful launchpools on platforms like Binance, which featured projects like Manta Network and xai, showed promising double-digit APY rewards and significant price rallies post-listing. These successes could set a positive precedent for REZ.

Technological and Social Impact

The role of technology and its social implications also play a crucial part in shaping the price trajectory of new cryptocurrencies like REZ:

- Technological Advancements: As cryptocurrencies evolve, so do the technologies that underpin them. Innovations in blockchain technology and the integration of features that enhance user experience and security can make REZ more appealing to both retail and institutional investors.

- Increasing Financial Access: Cryptocurrencies are recognized for their potential to provide financial services to those outside traditional banking systems. This growing social impact could bolster the adoption of REZ, particularly in underserved markets, enhancing its price stability and growth potential.

Market Predictions and Restaking Trends

Market predictions and emerging trends in cryptocurrency investment strategies like restaking also guide price expectations:

- Market Capitalization and Price Predictions: Post-listing, REZ is anticipated to have a market capitalization ranging from $250 million to $350 million, with prices expected to hover between $0.22 and $0.30. These predictions set a benchmark for early investors gauging the asset’s potential growth.

- Emergence of Restaking: The increasing interest in restaking projects, evidenced by major funds investing in these areas, suggests a robust future for protocols like Renzo. This trend could lead to sustained demand and possibly higher prices for REZ as the market matures.

By considering these factors, you can better understand the potential influences on REZ’s price as it enters the market. Whether you’re a seasoned investor or new to the crypto scene, keeping an eye on these dynamics can help in making informed investment decisions.

Participation in the Binance Launchpool

Participating in the Binance Launchpool is an exciting opportunity for those interested in the Renzo Protocol (REZ). To get started, you’ll need a Binance account and to complete the KYC verification process. Once set up, you can engage in token farming by staking FDUSD or BNB to earn REZ rewards.

Key Details of the Launchpool Event

- Launch Date: The Renzo Protocol will hold its Launchpool event on Binance starting April 24, 2024.

- Staking Options: Users have the flexibility to stake either BNB or the FDUSD stablecoin.

- Withdrawal Flexibility: Staked coins can be withdrawn at any time without forfeiting the accumulated REZ rewards.

- Distribution of Rewards: A significant 85% of REZ rewards are allocated to BNB stakers, while the remaining 15% go to those staking FDUSD.

Listing and Reward Structure

Renzo (REZ) is set to be listed on several platforms, enhancing its accessibility and trading options:

- Binance: Official listing on April 30, 2024, with trading pairs including REZ/BTC, REZ/USDT, REZ/BNB, REZ/FDUSD, and REZ/TRY.

- Other Platforms: Pre-market listings on Gate.io and Bitget scheduled for April 24, 2024.

Staking Caps and Period

The Launchpool event has specific caps and timelines designed to ensure a fair distribution of rewards:

- Hourly Hard Cap: Each user’s contribution is capped at 147,569.44 REZ for the BNB pool and 26,041.67 REZ for the FDUSD pool per hour.

- Farming Period: The event runs from April 24, 2024, 00:00 UTC to April 29, 2024, 23:59 UTC.

Claiming REZ Rewards

Participants can look forward to claiming their REZ tokens shortly after the farming period:

- Claim Date: REZ rewards can be claimed on April 30, 2024, at claim.renzoprotocol.com.

This structured participation in the Binance Launchpool not only offers a straightforward way to earn REZ but also highlights the growing integration and acceptance of Renzo within the crypto community. By providing these clear pathways for engagement, Renzo Protocol demonstrates its commitment to fostering a robust and dynamic ecosystem.

Join Binance Community Now for the Latest Updates

- https://www.binance.com/en/community

- https://bit.ly/BinanceVietnamTelegram (for Vietnamese community)

Comparative Analysis with Similar Projects

Blockchain Consensus Mechanisms

Renzo (REZ) and similar projects utilize different blockchain consensus mechanisms, each with unique attributes affecting their overall ecosystem. Proof of Work (PoW) and Proof of Stake (PoS) are the two primary types, distinguished by their approach to security, energy consumption, and scalability:

- PoW is known for its high energy consumption but provides robust security through computational work.

- PoS, adopted by Renzo, focuses on energy efficiency and scalability, allowing for faster transactions and reduced centralization risks.

Trading and Earning Options

Renzo (REZ) offers a variety of trading and earning opportunities that are common in the DeFi space. Here’s how they compare with similar projects:

- Trading Options: Both Renzo and its counterparts provide platforms for Spot, Margin, P2P, Convert & Block Trade, and Futures trading, catering extensively to the DeFi and NFT markets.

- Earning Opportunities: Users can engage in staking, liquidity provision, yield farming, and liquidity mining. These features are integral to fostering user participation and investment growth within the DeFi systems.

Community Engagement and Partnerships

Community engagement is a cornerstone for Renzo (REZ) and similar DeFi projects. They actively involve their communities through various platforms:

- Community Platforms: Engagement occurs via websites, forums, social media, and community-driven governance, ensuring a decentralized approach to project development.

- Partnerships: Strategic collaborations with entities like Connext and Chainlink mirror the partnership strategies of other projects, aiming to enhance functionality and market reach.

Security Measures and Regulatory Compliance

Security and compliance are critical for the acceptance and success of blockchain projects:

- Security Protocols: Renzo uses smart contracts and delegated node operators for secure transactions and consensus, similar to the security frameworks of other DeFi projects.

- Regulatory Compliance: Both Renzo and its peers strive to align with legal standards, working closely with regulatory bodies to ensure compliance and foster trust among users.

Comparative Market Analysis

To understand Renzo’s market position, consider its market capitalization in relation to other notable projects during their all-time high in this bull run:

| Project | Market Cap at ATH |

| Altlayer | $735M |

| ETHFI | $900M |

| Pendle | $1.76B |

| Renzo | Comparable Range |

This comparison highlights Renzo’s competitive stance within the market, reflecting its potential for growth and investor interest similar to established projects.

Conclusion

Reflecting on the comprehensive analysis of Renzo (REZ) and its burgeoning position within the Decentralized Finance (DeFi) sector, it’s evident that REZ embodies a blend of innovative technology, strategic growth initiatives, and a deeply rooted community engagement strategy. The protocol’s integration with EigenLayer, unique tokenomics, and commitment to expanding services across blockchain networks not only solidify its market presence but also anticipate promising growth trajectories for 2024 and beyond. Such attributes render Renzo a noteworthy contender in the dynamic realm of cryptocurrency investments, particularly for those aiming to navigate the complexities of liquid staking and DeFi with a forward-looking approach.

Moreover, the projections surrounding REZ’s market entry, coupled with expert insights and comparative analyses with similar projects, underscore its potential to make a significant impact. As the cryptocurrency landscape continually evolves, the foresight and adaptability demonstrated by the Renzo Protocol suggest a vibrant future lies ahead. For investors and crypto enthusiasts alike, keeping a watchful eye on REZ’s development and market performance could unveil opportunities in harnessing the transformative prospects within the DeFi space. In essence, Renzo’s journey encapsulates a compelling narrative of innovation, community, and growth, positioning it as a pivotal piece in the puzzle of cryptocurrency’s expansive ecosystem.