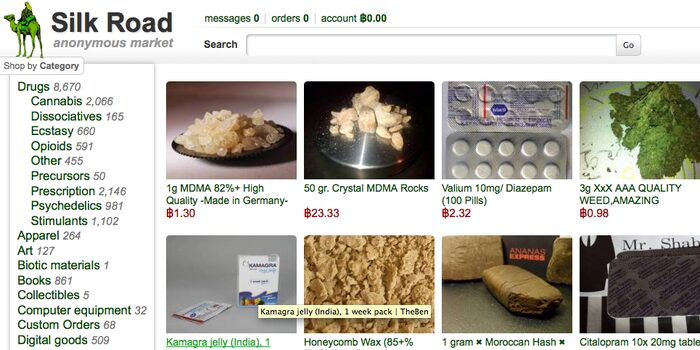

The U.S. government has announced its intention to sell $118 million worth of Bitcoin seized from the Silk Road hack, sparking concerns within the cryptocurrency community. However, experts are downplaying potential negative effects, citing the relatively small scale of the sale in comparison to recent transactions by Grayscale and the overall Bitcoin holdings of the U.S. government.

Size of Silk Road’s Sale Not a Cause for Concern

The planned sale involves 2,934 BTC seized after the sentencing of Silk Road’s Ryan Farace and his father for money laundering. Despite initial fears that such a significant sale could impact Bitcoin’s price, experts like Steven Lubka of Swan Bitcoin argue that it’s modest when compared to recent Grayscale Bitcoin Trust sales. Grayscale sold a substantial 106,575 BTC, valued at $4.2 billion, since transitioning into a spot Bitcoin ETF. Lubka suggests that the government’s sale is relatively inconsequential in the broader context of recent market activities.

Read more: Silk Road Rumors: Speculation Arises Over Alleged US Government Wallet Transfer of Seized Bitcoin

Government’s Bitcoin Holdings and Auction History

While the U.S. government’s sale from the Silk Road hack may raise eyebrows, it represents only 1.5% of their overall Bitcoin holdings, which stand at 194,188 BTC. Furthermore, this sale constitutes less than 1% of Bitcoin’s total supply. The government has been accumulating Bitcoin through various means, including the seizure of assets from the Bitfinex hack, Silk Road, and recovery from hacker James Zhong. Historically, the U.S. has conducted Bitcoin auctions, with notable instances like Tim Draper’s acquisition of 30,000 BTC at a government auction in 2014. However, recent trends suggest a preference for selling on exchanges, as evidenced by the sale of 9,118 BTC on exchanges in March 2023.

Read more: Mt. Gox Set to Unlock 200,000 Bitcoin: Implications for Crypto Markets

Conclusion

Despite initial concerns, experts reassure the cryptocurrency community that the U.S. government’s planned sale of $118 million in Silk Road Bitcoin is unlikely to have a substantial impact. The relatively small scale of the sale, both in comparison to recent market activities and the government’s extensive Bitcoin holdings, suggests that the broader market dynamics are not significantly influenced. As Bitcoin continues to mature and establish itself as a mainstream asset, occasional government sales are becoming a regular occurrence, with their impact mitigated by the overall resilience of the cryptocurrency market.

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 8 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Best Crypto Exchanges in UAE and Dubai to Buy Bitcoin ([currentyear]) 9 Best Crypto Exchanges In Uae And Dubai Featured Image](https://coinwire.com/wp-content/uploads/2024/01/best-crypto-exchanges-in-uae-and-dubai-featured-image-1024x683.jpg)

![Cardano vs Solana ([currentyear]): Is Cardano or Solana better? 10 Cardano Vs Solana Featured Image](https://coinwire.com/wp-content/uploads/2023/06/cardano-vs-solana-featured-image-1024x683.jpg)

![Paybis Review ([currentmonth] [currentyear]): Is It Safe and Legit? 11 Paybis Review Featured Image](https://coinwire.com/wp-content/uploads/2024/05/paybis-review-featured-image-1024x683.jpg)