Learn everything about the Aevo cryptocurrency project and its airdrop eligibility criteria. Unlike typical decentralized exchanges, Aevo is built specifically with derivatives trading in mind. This focus on options and perpetual trading leads to unique features and a tailored user experience. With its innovative off-chain order book and on-chain settlement system, Aevo offers unparalleled advantages in a rapidly evolving market.

Key Insights:

- Underlying Technology: AEVO is a decentralized exchange (DEX) for options and perpetual traders, built on a custom EVM roll-up for unmatched speed and scalability.

- Transaction Settlement: It employs a hybrid model, featuring an off-chain order book for efficiency and on-chain settlement for maximum security.

- Token Economics: The AEVO token powers the platform, driving utility through governance, staking rewards, and fee discounts. The total AEVO token supply is capped at 1 billion.

- Airdrop Eligibility: To increase your chances of receiving the Aevo airdrop, trade on the Aevo exchange.

Aevo: Everything You Need to Know

AEVO is a decentralized derivatives exchange platform that facilitates options and perpetual contracts trading. Here’s a closer look at the technical underpinnings and features that define AEVO:

Layer 2 Rollup Technology:

- AEVO operates on its own rollup, Aevo Chain, which is a Layer 2 network built using the OP Stack and running atop the Ethereum blockchain. This enables AEVO to support over 5,000 transactions per second and manage a trading volume exceeding $10 billion, highlighting its scalability and efficiency.

- The Aevo Rollup, managed by Conduit’s Sequencers, plays a pivotal role in transaction management, ensuring that transactions are submitted to the Ethereum mainnet reliably every hour. This process maintains high throughput while keeping gas fees for transactions within the rollup payable in ETH.

Trading Infrastructure and Financial Instruments:

- AEVO’s trading infrastructure is designed for speed and security, utilizing off-chain orderbook management and on-chain processing. This unique combination allows for the rapid execution of perpetual and options trading while ensuring that all fund flows and position settlements remain transparent and verifiable on the blockchain.

- The platform offers a suite of financial instruments:

- Aevo Perp: Similar to Binance Futures, it enables users to trade with up to 20x leverage on long or short positions.

- Aevo Option: Provides an order book for options trading with various expiration dates, catering to diverse trading strategies.

- Aevo OTC: A peer-to-peer platform for trading options contracts with altcoins, offering flexibility for traders.

- Theta Vault and Earn Vaults: These features allow users to earn interest and provide liquidity to the market by selling options or depositing funds, respectively.

- Aevo Portfolio: A tracking tool for users to monitor their positions and trading history, aiding in the optimization of investment strategies.

The integration of these features ensures that AEVO is not only a platform for trading but also a comprehensive ecosystem for financial growth and participation in the governance of the platform. With AEVO’s mainnet for options trading launched on April 7th, 2023, supporting real settlement options and perpetual contract trading, the platform is set to become a significant player in the DeFi derivatives market.

AEVO’s Tokenomics and Use Case

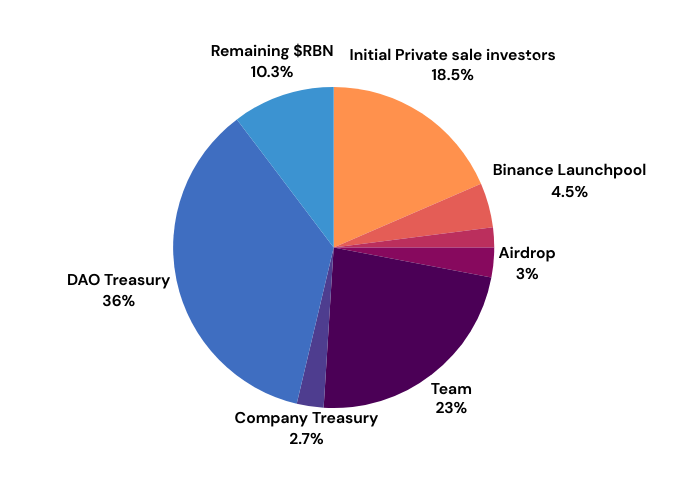

The AEVO ecosystem is fueled by its native token, with a maximum supply of 1,000,000,000 AEVO. Out of this, 45,000,000 AEVO (4.5% of the max token supply) are allocated as Launchpool Token Rewards, and the initial circulating supply is set at 110,000,000 AEVO (11% of the max token supply).

Token holders are not just investors but also play a crucial role in governance. They can propose and vote on governance proposals, providing an incentive to participate actively in the ecosystem. The sAEVO, a staked version of the AEVO token, grants additional rights such as higher voting power and eligibility to participate in special initiatives.

AEVO’s Token Release Schedule

The AEVO token ($AEVO) will see a distribution and issuance schedule that includes:

- Full unlocking of private investors (Seed and Series A) and team’s $RBN tokens by May 2024.

- A 1:1 exchange rate from $RBN to $AEVO, with a subsequent lock-in period of 2 months.

- An allocation of 16% of $AEVO tokens to future users and ecosystem incentives, expected to be distributed over a period exceeding 4 years.

AEVO’s Investors

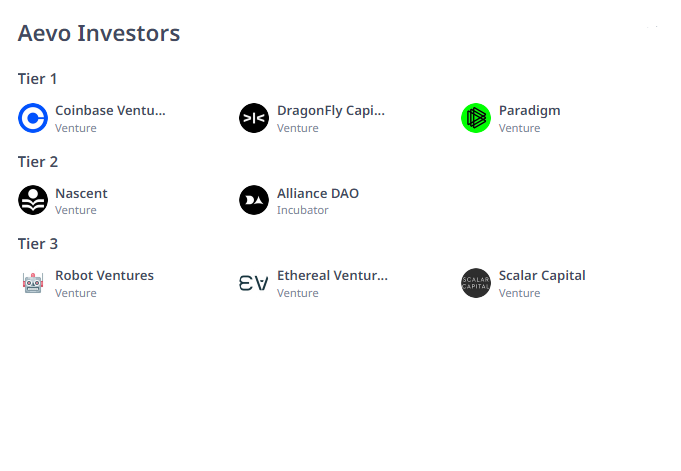

According to the official announcement, Aevo has successfully raised $16.6 million in capital through 3 rounds from major investment funds in the crypto market such as Paradigm, Dragonfly Capital, Ethereal Ventures, Coinbase Ventures, Nascent, Robot Ventures, Scalar Capital and Alliance

AEVO’s Integration with Binance Launchpool

As AEVO integrates with Binance Launchpool, users have the opportunity to participate in the farming of AEVO tokens. Here are the essential details you need to know about this process:

Staking and Rewards Distribution:

- Stake BNB and FDUSD: Users can stake their Binance Coin (BNB) and First Digital USD (FDUSD) to farm AEVO tokens. This event runs for a concise period, starting from March 8, 2024, at 00:00 UTC and concluding on March 12, 2024, at 23:59 UTC.

- Reward Allocation: A total of 45 million AEVO tokens, which accounts for 4.5% of the maximum token supply, are allocated as rewards for this event. Specifically, 36 million AEVO tokens are reserved for the BNB staking pool, and 9 million AEVO tokens for the FDUSD staking pool, representing an 80-20 split between the two pools.

- Claim Rewards Anytime: Rewards accrued from staking can be claimed directly into users’ spot accounts at any point during the farming period.

Listing and Trading Pairs:

- Binance Listing: AEVO is scheduled to be listed on Binance on March 13, 2024, at 10:00 UTC. Upon listing, multiple trading pairs will be available, including AEVO/BTC, AEVO/USDT, AEVO/BNB, AEVO/FDUSD, and AEVO/TRY.

- Seed Tag: As a newly launched project, AEVO will carry the “Seed Tag” to indicate its early development stage and the potential for high volatility.

Participation Requirements and Restrictions:

- KYC Verification: To engage in AEVO token farming, users must complete Know Your Customer (KYC) verification on Binance. There are hourly caps placed on the number of AEVO tokens that can be farmed: 30,000 AEVO for the BNB pool and 7,500 AEVO for the FDUSD pool.

- Eligibility: The opportunity to participate in AEVO token farming is not universal; it is subject to eligibility based on the user’s country or region of residence. Certain jurisdictions, including but not limited to the USA, Canada, and Japan, are restricted from participating due to local regulations.

- Risk Advisory: It is important to note that digital asset prices are subject to high market risk and volatility. Binance does not assume liability for any potential losses incurred from investment decisions related to AEVO token farming.

This integration with Binance Launchpool presents a unique opportunity for AEVO crypto and its potential investors. By staking BNB or FDUSD, users can directly contribute to and benefit from the growth of AEVO’s ecosystem, all while being a part of a significant milestone for the 48th project on Binance Launchpool.

Join Binance Community Now for the Latest Updates

- https://www.binance.com/en/community

- https://bit.ly/BinanceVietnamTelegram (for Vietnamese community)

Future Developments and Roadmap

AEVO’s vision for the future is marked by a series of strategic developments aimed at expanding its ecosystem and enhancing user engagement. The roadmap is designed to solidify AEVO’s position in the DeFi sector, with a focus on inclusivity for developers and incentives for users. Key points in AEVO’s future developments and roadmap include:

- Ecosystem Expansion:

- Opening up the Ethereum-based Aevo Rollup to support other protocols, fostering a more inclusive and expansive DeFi ecosystem.

- Allowing developers to launch their own protocols on AEVO’s rollup, thereby promoting innovation and diversity within the platform.

- Technological Advancements:

- Transitioning to Celestia for storing transaction data, a move aimed at reducing operational costs and enhancing efficiency.

- Introducing yield strategies in Q1 to provide users with additional avenues for financial growth within the platform.

- Incentive Programs:

- Launching an incentive program post-rebrand to drive platform metrics and user participation.

- Announcing an airdrop for early supporters who actively trade on the AEVO exchange, rewarding engagement and loyalty.

- Product Development:

- Expansion of financial instruments and features such as Treasury Vaults, Lend Vaults, and integration of Legacy Ribbon Finance.

- The addition of AEVO Exchange, AEVO Vaults, AEVO OTC, and AEVO Governance to the suite of services offered.

It’s important to note that the AEVO project contributors have shared these plans as part of the project roadmap, but this should not be considered a binding commitment. The roadmap is subject to change and may be amended or replaced, without an obligation to update the information beyond what is provided in the document. This approach ensures flexibility and adaptability as AEVO navigates the ever-evolving landscape of DeFi.

AEVO’s team, comprising individuals from prestigious organizations like Coinbase, Kraken, and top universities such as Stanford, MIT, and Cornell, is dedicated to building a robust Derivatives Layer 2 ecosystem. This ecosystem is designed to provide a comprehensive range of services, including options, perps, yield, and structured products trading, along with the creation, sharing, and monetization of digital assets like NFTs, games, music, and art through a DAO governance system.

AEVO Airdrop: Step-by-Step Guide

1/ Visit the official AEVO website. Locate the “Launch Exchange” button, typically found in the top-right corner of the website, and click on it. Alternatively, you can directly navigate to perpetual trading to start trading here.

2/ Now, you need to connect your crypto wallet. The Aevo exchange is compatible with Ethereum-based wallets (e.g., MetaMask, Coinbase Wallet). Follow the on-screen prompts to link your chosen wallet to the Aevo platform.

3/ Deposit funds to your account. Select a compatible cryptocurrency to deposit into your Aevo account. Popular options include ETH or USDC (on the Arbitrum or Optimism networks). Initiate a transfer from your crypto wallet to your Aevo exchange address. While there’s no strict minimum, a deposit of around $100-$200 is advisable to demonstrate activity.

4/ To start trading, navigate to the Aevo trading interface. Select a crypto pair (e.g., USDC/ETH) to begin trading. Execute trades to generate volume; the more you trade, the higher your potential airdrop allocation could be. You can use up to 20x leverage for futures trading.

5/ You can also perform additional activities to increase airdrop eligibility. One trick is to consider providing liquidity to earn rewards. You can also join the Discord community.

Conclusion

Throughout the exploration of AEVO as the 48th project on Binance Launchpool, we’ve delved into its potential to reshape the DeFi derivatives landscape with its advanced layer 2 solutions, robust tokenomics, and commitment to decentralized governance. By combining the efficiency of centralized exchanges with the benefits of decentralization, AEVO sets a new standard for user participation in digital finance—inviting stakeholders to contribute to a governed yet flexible trading environment. Its impending integration with Binance, marked by token farming and subsequent listing, positions AEVO as a formidable contender in the evolving decentralized market.

As AEVO charts its course in the DeFi sector, stakeholders look forward to experiencing its technological innovations that promise enhanced trading capabilities and dynamic governance participation. Individuals passionate about the amalgamation of finance and decentralized technology can actively engage with AEVO’s ecosystem, forging a community-driven path towards a redefined trading infrastructure. For those ready to take part in this groundbreaking platform, the opportunity to earn AEVO tokens is ripe, heralding the next stage of participation and investment in the digital economy’s future.

Elevate your crypto trading career with CoinWire Trading signals. Get Premium daily signal calls, trading insight, updates about the current market, and analytics about hidden crypto gems now.

![Best Crypto Exchanges for Day Trading [currentyear] - Top 6 Platforms 18 Best Crypto Exchanges For Day Trading](https://coinwire.com/wp-content/uploads/2023/10/best-crypto-exchanges-for-day-trading-1024x683.jpg)

![Best Free Crypto Sign Up Bonus Offers & Promotions in [currentyear] 19 Best Free Crypto Sign Up Bonus And Promotion](https://coinwire.com/wp-content/uploads/2023/08/free-crypto-sign-up-bonus-1024x683.jpg)