With the boom in cryptocurrency investments, it’s more important than ever to stay on top of tax reporting and compliance. But filing cryptocurrency taxes can be a complicated and time-consuming process, especially when it comes to tracking gains and losses across multiple exchanges and wallets. That’s where ZenLedger comes in – an automatic cryptocurrency tax calculator that promises to simplify the process and save you time. In this ZenLedger review, we’ll look at its features, pricing, and overall usability, to help you make an informed decision about whether it’s the right tool for you.

Key Insights

- ZenLedger simplifies tracking transactions, calculating gains and losses, and generating tax reports for crypto investors and CPAs.

- The software integrates with over 400 crypto exchanges, 40 blockchains, 30+ DeFi protocols, 20+ wallets, and TurboTax, which makes it convenient for users to import data from various sources.

- The software supports different valuation methods for crypto holdings, including HIFO, FIFO, and LIFO, allowing users to choose the best method for their needs.

- ZenLedger provides robust security measures, which include encryption and 2FA, to protect user data.

ZenLedger Overview

ZenLedger simplifies calculating and filing taxes for crypto investors and Certified Public Accountants (CPAs). The software enables people, either personally or professionally, to keep track of what they trade, calculate what is taxable from crypto holdings, and keep track of their profits and losses.

| Founded | 2017 |

| Integration | 400+ crypto exchanges 40 blockchains 30+ DeFi Protocols 20+ wallets, and TurboTax |

| Pricing | $0-$999 |

| Official Website | https://www.zenledger.io/ |

ZenLedger Review: Pros and Cons

Pros

- It easily integrates with multiple exchanges.

- Accurate and up-to-date tax reports.

- Easy-to-use interface.

Cons

- It is costly for DeFi support.

- The free plan is very limited.

- Tax forms are available for download only for US users.

What is ZenLedger?

ZenLedger is a cryptocurrency accounting and tax software that enables you, as an investor, to track your digital currency portfolios in real-time. The software also allows you to manage your cryptocurrency tax reporting easily.

Related: Best Crypto Portfolio Tracker Apps: Our Top Picks

ZenLedger can integrate with different cryptocurrency exchanges and wallets, offering a centralized solution for tracking transactions, calculating gains and losses, and generating tax reports. As such, it simplifies taxes for DeFi, NFT, and crypto investments.

The software’s main advantage is that it can work with major exchanges, cryptocurrencies, and fiat currencies. ZenLedger is also IRS-friendly, quick and easy to use, and automatic. It is also considered a tax-loss harvesting tool.

Discover the best crypto tax loss harvesting guide and learn how to optimize your cryptocurrency investments by offsetting gains with losses now.

How Does ZenLedger Work?

ZenLedger is a convenient data collector software that brings together data from your wallet addresses and crypto exchanges. Once you enter the information into the software, it automatically produces a report you can use to file your taxes.

After reviewing your reports and ensuring accuracy, the software generates and files your tax reports.

Once you have tax reports from ZenLedger, you can take them to your own Tax Professional or integrate the files with TurboTax if you prefer to do your own taxes.

Furthermore, depending on your subscription plan, ZenLedger’s on-demand customer assistance is always accessible to answer your questions.

ZenLedger Review: Key Features

ZenLedger has several features that make it an ideal choice for crypto accounting and tax reporting.

Tax Loss Harvesting

This feature automatically identifies which crypto or NFT holdings have decreased in value since you purchased them. Ultimately, it helps you sell the assets and claim the losses on your taxes. As a result, you may be able to reduce your tax liability and minimize your taxes.

Downloadable Tax Reports

ZenLedger offers downloadable PDF format tax reports, which may include:

- IRS Form 8949 reports capital gains and losses from the sale of crypto.

- FBAR Report, which reports any foreign financial assets.

- IRS Form 1040 Schedule D reports your capital gains and losses annually.

- IRS Form 8275, which discloses particular positions taken on your taxes.

Crypto Portfolio Tracker

The software’s portfolio tracker lets you view your real-time cryptocurrency holdings, values, and gains or losses. It becomes essential for you to track how you monitor your performance.

TurboTax Integration

With TurboTax, you can comfortably prepare and e-file your tax returns virtually from any computer or mobile device with internet access. As such, ZenLedger offering this feature is a good alternative, as you can easily import your tax data into TurboTax and file your taxes.

Audit Report

The software’s audit report is a comprehensive report that outlines all your crypto transactions annually. It may come in handy if you want to ensure that your taxes are accurate and current.

CPA Access

This attribute allows you to pave the way for your CPA or tax professional to access your account. This way, you can easily outsource your taxation needs to someone else, primarily a professional.

HIFO/FIFO/LIFO Methods

There are different methods for valuing your cryptocurrency holdings that ZenLedger offers. They include HIFO (highest in, first out), where the highest-cost items are the first to be taken out of stock. It may help you decrease your taxable income since it will realize the highest cost of sale.

The software also offers the FIFO (first in, first out) method, where assets acquired are sold first. It also offers the LIFO (last in, first out) method, where deductions happen for the most recently acquired items, and assumes that the last inventory purchased is the first to be sold.

This feature is essential for investors who may want to choose the method that best suits their needs.

Mining, Donations, and Airdrops

Crypto earnings may come through mining and donations of crypto assets. As such, the mining, donation, and airdrop reporting features in ZenLedger may help you report such assets on your taxes. The same case applies to airdrops. Airdrops may help you get free tokens from some crypto projects. ZenLedger may assist you in tracking it and ultimately help you report it on your taxes.

FinCen/FBAR Alert

The feature for foreign financial assets notifies you if your assets meet the FBAR reporting requirements.

Crypto as Income

This feature means using your crypto assets to pay for goods and services. It is a vital tool for businesses willing to use crypto as a mode of payment.

User Experience and Interface

ZenLedger has a user-friendly interface and an intuitive user experience. The software has a clean and organized dashboard that allows you to navigate through your transactions, generate reports, and access different features effortlessly.

The platform’s simple design ensures that you can efficiently use ZenLedger to manage your crypto tax obligations, regardless of your technical expertise.

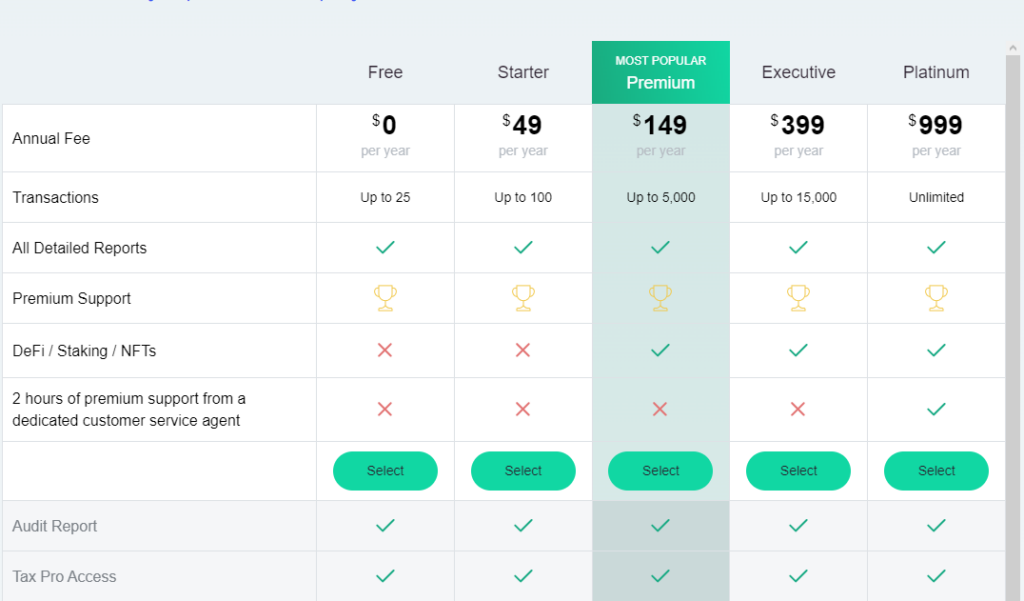

Pricing

ZenLedger offers a variety of pricing options to cater to different users’ needs. The pricing plans offered by the software are designed to accommodate individual users and tax professionals.

ZenLedger offers combined packages that cater to different users in different ways. The two packages depend on the transactions made and the value of the digital assets. The lowest-tier plans found on ZenLedger are free and limited to 25 crypto transactions. However, the platform can provide five other major pricing tiers:

- Hobbyist: This plan is ideal if you have limited transactions to report. It charges $69 if you have 100 crypto transactions or less with up to $15,000 in holdings.

- Starter: The pricing package is $149 for 101-500 transactions and up to $50,000 in total asset value.

- Premium: This pricing package charges $399 for 501-1,000 transactions with up to $300,000 total asset value.

- Executive: This pricing package charges $799 for 1,001-4,000 transactions with up to $1m total asset value.

- Unlimited: Charges $999 for unlimited transactions with no asset value cap. You can also get priority support.

However, some features are available for all pricing tiers, which include:

- Unlimited exchanges and unlimited transactions

- Mining or donations

- FinCEN/FBAR alert

- Tax-loss harvesting

- ICOs and Airdrops

- TurboTax integration

- Crypto as income

- CPA access

- Audit report

- HIFO/LIFO/FIFO methods

Supported Exchanges and Wallets

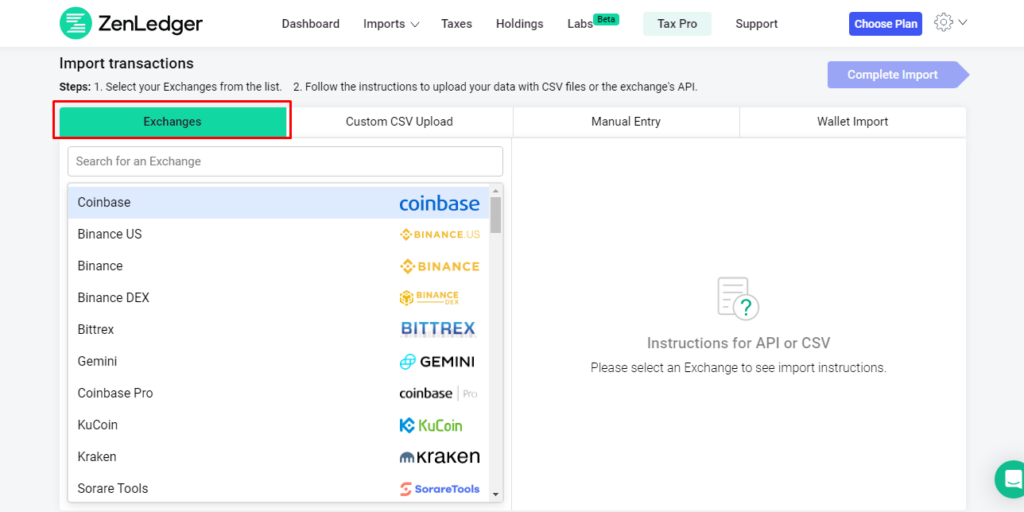

ZenLedger primarily supports more than 400+ cryptocurrency exchanges, 40+ different blockchains, and 20+ DeFi projects. It also integrates with different crypto wallets, with all integrations added weekly.

The main cryptocurrency exchanges include Coinbase, Binance, Bitfinex, and eToro. Huobi, OKCoin, and Nexo. However, a complete list of ZenLedger’s supported crypto exchanges can be found on the company’s website in the integration section.

ZenLedger also integrates with major hardware and software wallets, including Trust Wallet, MetaMask, Ledger, Trezor, Bitpay, and Edge. In the case of a multi-coin wallet, not all coins can be supported, as ZenLedger currently supports only these blockchains: Bitcoin, Ethereum, Ripple, Dash, Litecoin, NEOS, and EOS.

Countries Supported

ZenLedger offers explicit support for tax documents only in the United States. However, if you are from another country, you can also benefit from ZenLedger’s ability to calculate the amount of tax you owe in your jurisdiction.

However, the software supports more than 140 different fiat currencies. Additionally, any country that offers HIFO, FIFO, or even LIFO can be supported in the crypto tax reporting app in one way or another.

Security and Data Privacy

The sensitive nature of financial data calls for robust security measures, and ZenLedger takes this aspect seriously. As such, ZenLedger implements industry-standard security practices to safeguard user data and employs advanced encryption methods that protect sensitive information. ZenLedger paves the way for all best practices from the cybersecurity industry and has had no data breaches.

Additionally, ZenLedger cannot access your funds but only has to view rights on your exchanges to collect the needed data. The software is also protected through a 2FA layer of protection, and all data is transmitted through SSL encryption.

It is, however, important to note that the software does not comply with KYC requirements since the company is not an exchange. The platform also does not require you to share your private keys with the company. It only calls for Read Only access to generate tax reforms with transaction history.

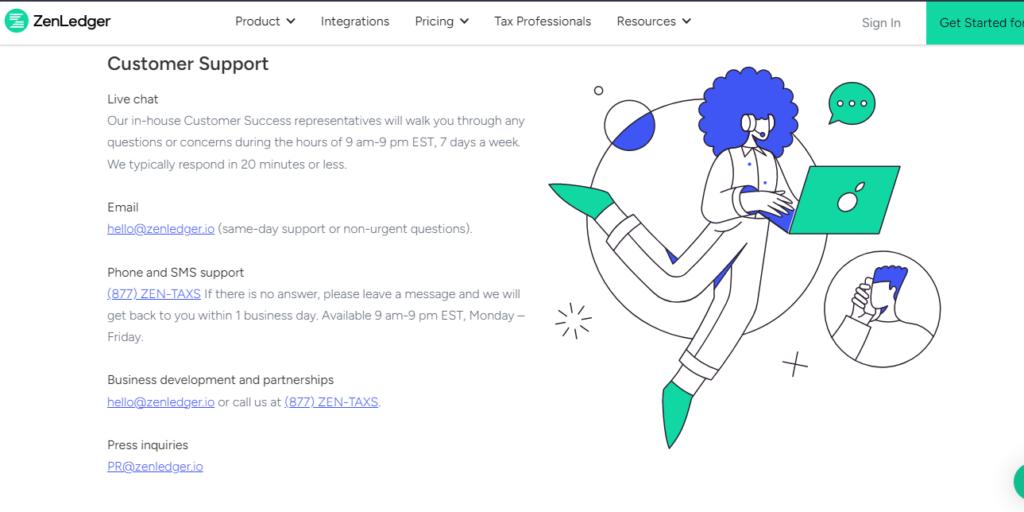

Customer Support

The platform’s customer support is fast and friendly. There is a chat button on their site where you can ask questions and get feedback almost instantly. You may also use a standard email ticket at hello@zenledger.io for same-day support for non-urgent questions.

They also have a huge knowledge base with their blogs, support center, recorded webinars, and crypto tax guide. These resources offer a huge pool of useful information about cryptocurrency taxation.

You can also access ZenLedger by phone or text. The customer success team responds to your concern within one business day.

Real-Time Gain/Loss Calculations and Tax Reporting

Calculating gains and losses for crypto investments can be complex, especially when dealing with multiple transactions and different cost bases. ZenLedger provides a simple way of providing real-time gain/loss calculations. The software factors in different parameters such as acquisition cost, holding period, and relevant tax regulations. Ultimately, it helps you determine the taxable gains or losses for every transaction.

The accuracy of tax filing depends on the range of tax reports provided. With the tax reports, the software can provide a clear breakdown of gains and losses, cost basis information, and other relevant details required for tax compliance.

You can also gain valuable portfolio analysis and insights as a user. Ultimately, you may have better decision-making, asset allocation, and understanding of the whole performance of your crypto portfolio.

ZenLedger’s Sign-Up Process

Here’s a step-by-step process on how to sign-up for a ZenLedger account.

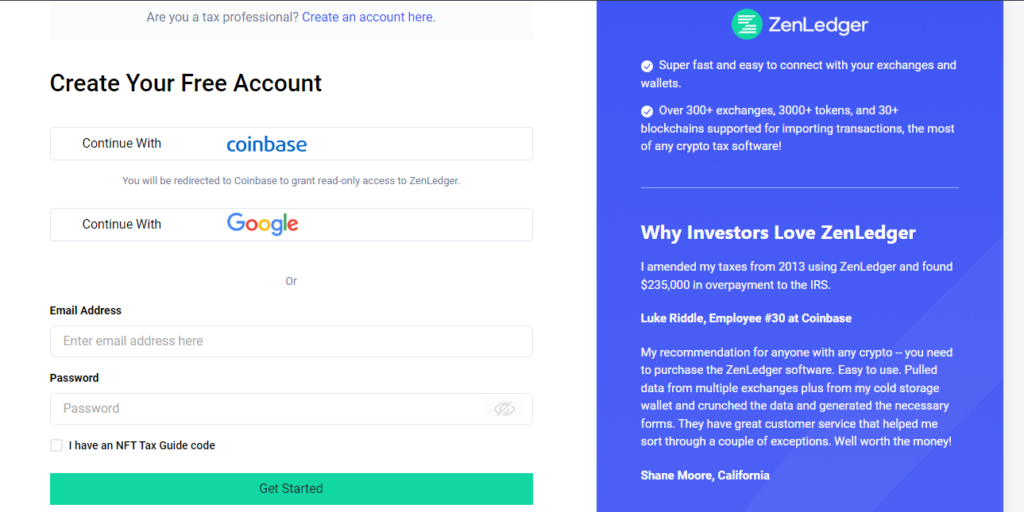

Step 1: On the website’s page, on the right-hand side, click on the ‘Get Started for Free‘ button, which will redirect you to a sign-up page. The page offers the choice of registering with your Coinbase or Google accounts.

Step 2: Click “Add Account” on the page and connect with your exchange.

Mobile Application

ZenLedger has a mobile app for Android devices. The application is smooth and easy to use, making it a great option for most users.

Comparison: ZenLedger vs CoinTracker

There is still a long way to go when it comes to cryptocurrency tax software. As such, there is still some space left between which platform offers the best options for filing taxes in crypto. ZenLedger stands up well against the competition due to its integrations.

Compared to CoinTracker, in terms of pricing, ZenLedger goes overboard, with a $0-$999 price according to transactions. On the other hand, CoinTracker is a little bit cheaper, with the number of transactions incurring between $0-$299.

In terms of integrations, ZenLedger integrates with more exchanges than CoinTracker; comparing, they have 400+ exchanges and 300+ exchanges, respectively. They both integrate with tax software, with a similar one being TurboTax. However, CoinTracker integrates with TurboTax and TaxAct.

They have, however, a free plan available. They also appear among the top favorites since they support many DeFi protocol integrations.

Related: Simplify your crypto tax filing process and monitor your assets easily with Cointracker.

Final Thoughts

ZenLedger brings a reliable and efficient solution for cryptocurrency tax reporting. Its seamless integration, automated transaction tracking, and real-time gain and loss calculations simplify the process of managing and reporting cryptocurrency transactions.

When ZenLedger streamlines the tax reporting process, you may not want to note that tax regulations vary by jurisdiction. Consult with a tax professional or accountant to ensure accurate compliance with local tax laws.

The only downside to the software is that localized tax documents are only available for users in the United States. It is also one of the most expensive crypto tax platforms, as Zenledger pricing can be up to $999 annually for users who want unlimited transaction options.

FAQs

Is ZenLedger good?

With all the features and integrations that the software provides, ZenLedger is a good crypto tax tool that you can use to track and manage your portfolio.

Where is ZenLedger based?

ZenLedger was founded in 2017 in Bellevue, Washington.

Is ZenLedger free?

Creating an account is free, but viewing, downloading, and accessing your tax reports every year may incur costs.

Who owns ZenLedger?

ZenLedger is a privately-owned company co-founded by Patrick Larsen.

![Bybit vs BingX [currentyear]: Which Exchange is Better? 24 Bybit Vs Bingx](https://coinwire.com/wp-content/uploads/2024/05/bybit-vs-bingx-1024x683.jpg)

![MEXC vs Kucoin: Which Crypto Exchange is Better in [currentyear]? 25 Mexc Vs Kucoin Featured Image](https://coinwire.com/wp-content/uploads/2023/10/mexc-vs-kucoin-featured-image-1024x683.jpg)

![Pionex Review ([currentyear]): Trading Bots, Fees, and Pros & Cons 26 Pionex Review Featured Image](https://coinwire.com/wp-content/uploads/2023/08/pionex-review-featured-image-1024x683.jpg)

![Cardano vs Solana ([currentyear]): Is Cardano or Solana better? 27 Cardano Vs Solana Featured Image](https://coinwire.com/wp-content/uploads/2023/06/cardano-vs-solana-featured-image-1024x683.jpg)