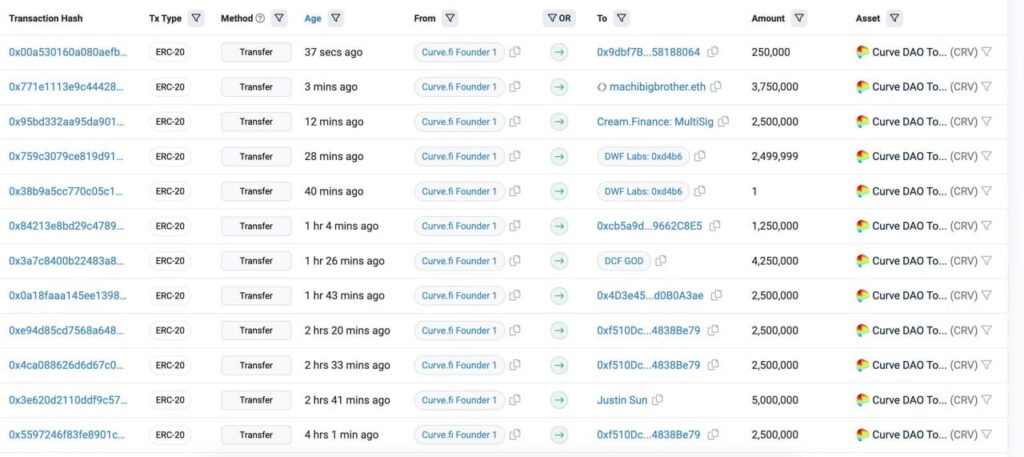

Curve founder, Michael Egorov, recently executed a strategic move by selling a total of 49.25 million CRV tokens through an over-the-counter (OTC) transaction, generating $19.8 million in USDT. Notable buyers in the transaction included Justin Sun, Machi Brother, DWF Labs, and Dream Finance. However, the purchase comes with a caveat, as the CRV tokens are subject to a lock-up period of 3 to 6 months, and can only be sold early if the CRV price surges above $0.8.

Positive Developments in CRV’s Recovery

Thanks to timely actions to gradually repay outstanding loans on AAVE, FRAX, and MIM, the situation surrounding CRV has become more optimistic. At the time of writing this article, the price of CRV has rebounded to $0.59 from a low of $0.49 earlier today. Despite the recent recovery, potential risks still linger in the market.

Related: Curve Finance Pools Hit by $47M Reentrancy Vulnerability

The Curve Founder’s decision to address outstanding loans on multiple lending platforms has bolstered CRV’s position. Notably, he managed to reclaim 41.6 million CRV at a liquidation price of $0.33 in FRAX, 43 million CRV at $0.38 in MIM, and a substantial 267 million CRV at $0.37 in AAVE.

Curve Founder Egorov’s Current Collateralization Status

At the time of writing this article, Egorov still has 394 million CRV tokens, valued at $236.8 million, pledged as collateral to secure over $87.5 million in stablecoins across various lending platforms. This collateralization strategy remains crucial in managing potential risks and maintaining stability in the market.

Conclusion

Michael Egorov’s strategic move to sell a portion of his CRV holdings through an OTC transaction has not only yielded substantial funds but also provided valuable insights into the cryptocurrency market’s dynamics. The positive developments in CRV’s recovery, coupled with Egorov’s proactive approach to addressing outstanding loans, have contributed to the currency’s recent price rebound.

As the market continues to evolve, it will be essential for Egorov and other key players to monitor and manage potential risks to maintain CRV’s stability and growth. With the lock-up period for the purchased CRV tokens, market participants will be closely observing the price movements and anticipating any potential surges above $0.8, which could further influence the cryptocurrency’s trajectory in the coming months.