Following today’s FOMC meeting, the Federal Reserve decided to keep the benchmark interest rate unchanged, halting the string of consecutive rate hikes. Nevertheless, the central bank indicated that it may consider resuming rate increases in the future.

The Federal Reserve Chair, Jerome Powell expressed concerns about persistent inflation, particularly related to high rents and their contribution to the Consumer Price Index (CPI). Furthermore, FED acknowledges the importance of addressing rental costs, which constitute a significant portion of the CPI, and is closely monitoring the situation.

FED Holds Rates Steady but Signals More Hikes Later This Year

The Federal Reserve opted to hold the benchmark interest rate steady at the conclusion of today’s FOMC meeting, pausing the series of consecutive rate hikes. However, the central bank signaled its intention to potentially resume rate increases later this year.

In the FOMC meeting, FED announced a pause in interest rate hikes, keeping the rates unchanged at 5.25% – 5.00%.

According to the FED’s Summary of Economic Projections, the majority of committee members expect additional rate hikes to be necessary for the ongoing fight against inflation. While no decision has been made about specific rate hikes, the committee remains vigilant in assessing economic and financial developments to determine the appropriate course of action.

Related Article: FED to Raise Interest Rates by 5% and to Keep It At That Level For A While

FED Moderates Pace of Rate Hikes as Inflation Slows

The Federal Reserve opted to hold the benchmark interest rate steady at the conclusion of today’s meeting, pausing the series of consecutive rate hikes. However, the central bank signaled its intention to potentially resume rate increases later this year.

According to the FED’s Summary of Economic Projections, the majority of committee members expect additional rate hikes to be necessary for the ongoing fight against inflation. While no decision has been made about specific rate hikes, the committee remains vigilant in assessing economic and financial developments to determine the appropriate course of action.

Odds of Rate Hike in July Stand at 71%, Traders Prepare for Future Increases

Traders are already anticipating the possibility of a rate hike at the Federal Reserve’s July meeting, with the odds currently standing at 71%, according to the CME FedWatch Tool. While the central bank maintained the current rates at the latest meeting, it signaled the potential need for higher rates later this year. During his news conference, Chair Powell clarified that no decision had been made about July, but he acknowledged that it would be a live meeting. The market is preparing for the continuation of the rate-hike campaign based on the central bank’s indications.

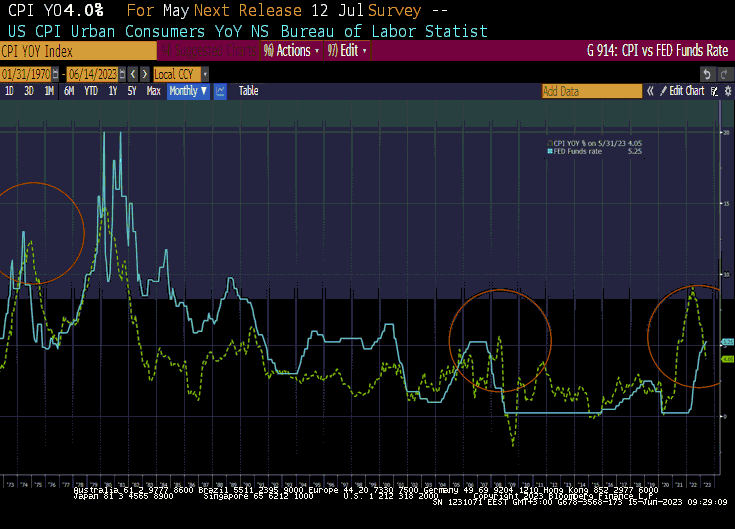

CPI is now lower than the FED’s Fund Rate (green line)

FED Chair Jerome Powell dismissed the possibility of rate cuts in the near term, citing the persistence of inflationary pressures. During the meeting, Powell highlighted that inflation has not significantly responded to the existing rate hikes implemented by the central bank.

While forecasts indicate a decline in inflation in the coming years, Powell emphasized the uncertainty surrounding these predictions. The FED remains committed to achieving price stability and identified it as a top priority.

FED Forecasts Higher Inflation and Improved Economic Growth

In its latest economic projections, the Federal Reserve revised its outlook for inflation and economic growth. Officials now anticipate core Personal Consumption Expenditures (PCE) inflation to end the year at 3.9%, higher than their previous forecast of 3.6%.

While the FED expects inflation to decline in the coming years, the projections indicate a more pessimistic view of reining in price increases. However, the central bank also forecasted improved economic growth, with GDP expected to grow by 7% in 2023, up from the previous projection of 6.5%. These projections suggest a reduced risk of recession and indicate the FED’s confidence in the economy’s ability to weather inflationary pressures.

Related article: US PPI Eases on Declining Energy and Food Costs, Signaling Subsiding Inflation

Conclusion

While the Federal Reserve decided to maintain the current interest rate range, it signaled a potential resumption of rate hikes later this year. The committee expressed concerns about stubbornly high rental costs and their impact on inflation. Traders are preparing for a rate hike in July, and the Federal Reserve dismissed the possibility of rate cuts in the near term.

As the economy approaches the target inflation rate, the pace of rate hikes is expected to moderate. The FED’s forecasts indicate higher inflation and improved economic growth, suggesting a reduced risk of recession in 2023. The committee will closely monitor economic data and make informed decisions in the coming months to ensure price stability and sustainable economic growth.

![Hasbulla Net Worth: How Does Mini Khabib Make Money in [currentyear]? 10 Hasbulla Net Worth Featured Image](https://coinwire.com/wp-content/uploads/2023/08/hasbulla-net-worth-featured-image-1024x683.jpeg)