Jun Du, the co-founder of Huobi, has acquired a significant stake of 10 million Curve tokens (CRV). This acquisition, amounting to $4 million, was made through a direct purchase from Michael Egorov, the founder of Curve. Du’s decision to lock up the tokens as veCRV provides him with voting rights on the platform, making him a key player in the governance of the decentralized finance (DeFi) ecosystem.

The Acquisition

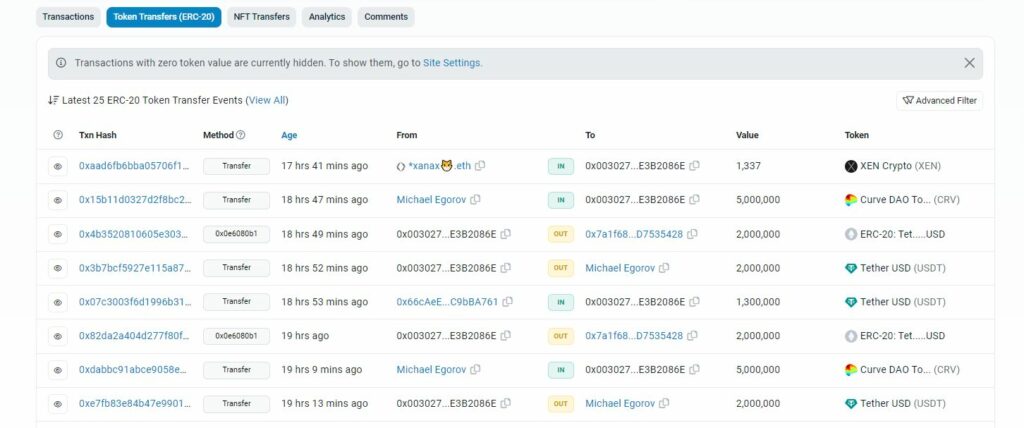

Du expressed his intent to acquire 10 million CRV tokens through a tweet on August 1. The prevailing market rate of $0.40 per token was established through over-the-counter transactions involving Egorov and members of the crypto community. Following the successful completion of the purchase, Du decided to lock up the tokens as veCRV. This lockup ensures that the tokens remain inaccessible for a specific duration, providing Du with voting rights on the Curve platform.

Jun Du’s Support for Curve

Du, known for his involvement in the crypto industry as the CEO of New Huo Tech and as a co-founder and GP at the web3 fund ABCDE, took to Twitter to express his support for Curve. He drew parallels to his previous assistance during BendDAO’s liquidity crisis and emphasized the temporary nature of the existing challenges. Du believes that the industry as a whole will benefit from collective support and collaboration.

Curve’s Liquidity Crisis and Egorov’s Debt Burden

Egorov, the founder of Curve, faced a liquidity crisis and took out a $100 million DeFi stablecoin loan using his own CRV stash as collateral. However, the protocol was exploited on July 30, resulting in a 30% crash in CRV prices. Egorov managed to repay over $17 million in stablecoin loans, improving the overall health of the loans. Despite this progress, he still faces a significant debt burden, with approximately $60 million owed on Aave, $12 million on Abracadabra, and around $8 million on Inverse.

Abracadabra Money’s Suggestion

To mitigate the risks associated with its exposure to Curve DAO (CRV), Abracadabra Money has suggested raising the interest rate on its outstanding loans. This move aims to protect the platform from potential losses caused by the instability in the CRV market.

Conclusion

Jun Du’s acquisition of 10 million CRV tokens plays a vital role in supporting Curve and strengthening his position in the DeFi governance landscape. With his voting rights on the Curve platform, Du can actively participate in shaping the future of the ecosystem. This move highlights the importance of collaboration and collective support in the crypto industry and demonstrates the potential for individuals and organizations to contribute to the stability and growth of decentralized finance.

![Best Crypto Copy Trading Platforms in [currentyear] (Free & Profitable) 12 Best Crypto Copy Trading Platforms](https://coinwire.com/wp-content/uploads/2023/06/best-crypto-copy-trading-platform-1024x683.jpg)

![BingX vs KuCoin [currentyear]: Features, Fees, and Security 15 Bingx Vs Kucoin](https://coinwire.com/wp-content/uploads/2024/05/bingx-vs-kucoin-1024x683.jpg)